Payments upon dismissal of your own free will. Reduction payments

The final settlement with the employee upon his dismissal implies the payment of funds that are due to the latter for the entire time of his labor activity... In this case, it is necessary to take into account the grounds for terminating the contract. After all, the salary of a citizen and other necessary payments will depend on this basis. In such a situation, the manager should not forget that full settlement with the resigning person should be made on the day when the employee last performs his activities in this organization. Otherwise, the boss simply cannot avoid problems with the law.

Foundations

The final settlement upon dismissal is made in all cases of termination of the employment contract. But only on the grounds on which the relationship between the employee and his boss is terminated, the amount of money that the person will receive in the end will depend. According to the provisions of Article 140 Labor Code, the manager must pay all the funds due to the citizen on the last day of his work. And if it is impossible to carry out this procedure at the specified time, you need to do it the next day when the employee filed a claim to settle with him. Otherwise, the management may be in big trouble if the person applies for the protection of violated rights in court.

It can be terminated both at the request of the employer and at the initiative of the citizen himself, as well as for reasons beyond their control. In addition, the desire to terminate a labor agreement is often mutual. In the latter case, the final settlement under the contract can be carried out not only on the final day of the person's work, but also after this moment.

Types of payments

Regardless of the reasons for terminating the employment contract, a final settlement is required. Mandatory payments include:

- employee's salary;

- compensation for vacations that have not been used;

- severance pay upon termination of the relationship between the parties to the contract under clause 2, part 1

TO additional species monetary support can be attributed: dismissal benefit by agreement of the two parties, as well as other types of material compensation established by the collective agreement.

Issue and withholding procedure

It is clear that all the money owed must be paid to the employee. At the same time, some of them can sometimes be withheld. In this particular case, we are talking about vacation pay when an employee is fired for the rest that he used, but the period of labor activity was not fully worked out, and the citizen decided to terminate relations with this organization and wrote a letter of resignation.

But there is one more important nuance... The employer will not be withheld from the salary of a person upon dismissal of the money for the used leave only if he leaves the job in connection with the reduction of staff or the liquidation of the organization. In this case, the employee will also be entitled to severance pay in the amount of the average income for two months, and if he did not get a job, then for the third month. The final settlement upon dismissal of a citizen occurs on the last day of his labor activity. And he is paid: salary, compensation for unspent leave, severance pay, if any.

Calculation of vacation pay

The company from which the employee leaves, in mandatory must pay him compensation for the leave that has not been used for the entire period of employment. In the event that a person has not been in it for several years, respectively, the amount of payments is made for all this time. If a citizen terminates labor relations with an organization on his own initiative, and the period of work is not completely completed by him, then in this case deductions are made from his salary for the vacation used. In this case, the accounting department will have to calculate the exact number of days or months of the person's work.

The amount of vacation pay upon dismissal is calculated as follows:

- The number of days of annual paid leave is taken, for example, 28. After that, it is divided by the number of months in a year, that is, by 12. Then the resulting number (2.33) is multiplied by the number of months worked in the working period, for example 4.

- If 2.33 is multiplied by 4, you get 9.32 unused vacation days. Then this number is multiplied by the daily earnings, for example, 900 rubles. It turns out 8388 rubles. This is the money that a person is entitled to as compensation for unused vacation... Personal income tax will be withheld from the same amount - 13%.

The final settlement with the employee should not be delayed by the boss. It must be done on time, regardless of on which of the grounds specified in the Labor Code a citizen is dismissed.

Counting rules upon termination of an employment contract

All payments due to the employee, the latter must receive on the final day of his employment in this enterprise. In the event that the manager did not make the final settlement at the specified time, he will incur administrative responsibility. At the same time, the citizen should receive not only compensatory payments, but also the salary itself during the work.

For each day of delay in payments, the manager pays a fine in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. In addition, if the amount of the final settlement upon payment of the severance pay is more amount three times the employee's earnings, then personal income tax in the amount of 13% will have to be paid from this monetary allowance. The tax is also withheld on vacation pay.

Self-care

Final settlement upon dismissal by on their own must be done with a person on the last day of his employment, which includes:

- salary for the entire time of work;

- compensation for vacations or vacations, if a person has worked without annual rest for several years in a row.

It should also be noted here important fact... If the vacation was used by a citizen, but the period of work was not fully completed, accordingly, upon termination of the contract, at the request of the latter, the employer has the right to withhold previously paid funds from his money.

When it is impossible to make deductions for unearned vacation

In a number of cases, which are stipulated by law, leave leave is not withheld upon dismissal. This category includes the following situations:

- Liquidation of the employer's organization.

- Staff reduction.

- Termination of an employment contract when a citizen cannot fulfill obligations due to illness.

- Army conscription.

- With a complete loss of the former working ability.

- Restoration in the previous position by a court decision.

- Termination of an employment contract upon the occurrence of circumstances that do not depend on the parties.

In any of the above cases of dismissal of a person, the boss must make a final settlement with him on the last day of his labor activity and pay all the money due under the law. Otherwise, the person has every right to defend his interests in the prosecutor's office and the judiciary.

its calculation and size

In a situation where the employer is the initiator of the termination of labor relations, the citizen has the right in some cases to receive compensatory benefits. It is also called a weekend. In this case, the amount of this payment can be in the amount of two-week or monthly earnings. Monetary allowance in the amount of the employee's salary for two weeks can be in the following cases:

- If the state of health of a person does not allow him to continue working in this organization. Or when he refuses to move to another position, and the boss has nothing more to offer him.

- With the complete loss of a citizen's ability to work.

- If the terms of the employment contract change.

- When a person is called up for military or alternative service.

In the amount of monthly earnings, the allowance is paid:

- upon termination of an employment contract due to redundancy;

- in case of liquidation of the organization.

Other circumstances may also be established when such an allowance is issued to an employee. Nevertheless, the payment of the final settlement upon dismissal, including compensatory benefits, must be made on the last day of the person's employment. In addition, when calculating this type of compensation, it is necessary to take into account the payment of taxes if the amount of monetary allowance exceeds the employee's salary three times. Otherwise, personal income tax is not paid.

Final calculation example

An employee who ends his employment relationship with a particular organization has the right to receive money earned and other compensation, if the grounds for dismissal allow this. Consider the following example.

Employee Ivanov leaves the enterprise of his own free will. Naturally, in this case, he does not receive severance pay and the preservation of the average earnings for the third month before the date of employment. But he is entitled to the payment of the money earned for all the time and compensation for the vacation. The final calculation of the employee in this situation will be made according to the T-61 form. filled in upon termination of employment.

Ivanov wrote a statement in April and resigned on the 19th. Accordingly, he should be counted and given remuneration for work from 1 to 18 inclusive. If his average salary is 20,000 / 22 working days (this is the number of them in April), the end result is the amount per day - 909.09 rubles. It is multiplied by the number of days worked in the month of dismissal - 18. As a result, the sum is 16363.22 - Ivanov's salary for April. In addition, the organization first pays tax on this money, and then the accountants issue the final payment to the citizen.

Since the person leaves in April, and he has a vacation according to the schedule only in June, and he did not use it, he is entitled to compensation. The calculation takes place in the following order:

Ivanov worked this year for 3 months and 18 days. But the calculation will go for 4 full. Rounding to the tenth and hundredth part is not done, so the amount is calculated from 28 vacation days / 12 months in a year = 2.33 days. Then 2.33 * 4 (months worked) = 9.32 days. And only then 9.32 * 909.9 (daily earnings) = 8480.26 (vacation compensation).

Thus, the final settlement is made from all assigned to the employee amounts. But in this case, it is only a salary and a cash payment for a vacation, because Ivanov is quitting on his own initiative. If he was reduced or dismissed in connection with liquidation, he would also receive severance pay, which is also paid with all monetary funds (on the basis of Article 140 of the Labor Code of the Russian Federation).

Arbitrage practice

Nowadays, many former employees go to court for the protection of their rights, which, as they believe, were violated by the manager upon dismissal. Especially if the question concerns cash payments that were not timely and in the right size handed over to the employee. In practice, there are even such cases when employers, making settlements with a citizen, made deductions from his income for the vacation that was previously used. And this eventually led to litigation and complaints.

Let's give a colorful example from practice. The employee was fired from the staff reduction organization. The boss paid him completely, but when paying the money, he made a deduction for the vacation, which had already been used by the citizen in June. In addition, the employer violated the dismissal procedure for redundancy in the sense that he did not offer the available vacancies to the employee. But at the same time, he accepted other persons for vacant positions, which is forbidden to do when carrying out measures for dismissal on such grounds. After counting his earned money and discovering violations of labor laws, the former employee applied to the judicial authority with an application for reinstatement at work and payment for the forced absence from work, which occurred due to the fault of his boss.

Having considered all the materials of the case, the court concluded that the employer carried out the layoff procedure without observing the norms of the labor code. In addition, he made a completely wrong calculation with the employee. The final calculation upon dismissal (2016) he simply did not succeed. He grossly violated the norms of the labor code, in connection with which the citizen was reinstated at work in his position, and the employer paid him moral damage and compensation for the used leave, which he had previously unlawfully withheld. That is why, when calculating with employees, managers need to be especially careful and not allow violations on their part, so that later they do not prove their case in the judiciary.

All measures to protect the labor rights of the population are regulated at the level of legislation. If an employee is laid off, the employer must make a full calculation from his own budget within a strictly appointed time. Compulsory payments for reductions in 2018 must compensate the employee for all financial losses, the procedure for accruals is regulated by the norms of the Labor Code. In addition to the basic benefits, there are a number of additional periodic allowances that are valid for a certain period after dismissal.

What is layoff on staff reduction

Federal law does not exclude the case of dismissal of employees of the organization on the initiative of the head. Downsizing is an absolute method of optimizing activities in any enterprise. The legislation provides for cases when a mercenary occupying a position to be liquidated, through transfer, has the right to obtain another vacant position in the organization. There is a procedure for the downsizing procedure, which the head must comply with.

It is necessary to notify the employee holding the relevant position no later than 2 months before the scheduled date of dismissal. The employee is notified individually in writing against signature. If he refuses to sign the order, a refusal act of the organization is drawn up with the signatures of the employees. Absence from the workplace for a good reason is no exception to the rule.

Grounds for dismissal

There are various reasons for the reduction in the number of employees: reorganization of the enterprise, internal financial crisis, as a result - temporary or complete absence of the need for a certain staffing unit, liquidation of posts, reduction in the number of jobs. The decision on dismissal is made by the head of the organization independently. For the dismissal of an employee to be legal, the employer must document the current downsizing.

Priority rights of workers

If liquidation occurs staff units, then a certain part of the work collective has preemptive rights to preserve their workplace. Labor legislation based on Art. 179 of the Labor Code of the Russian Federation guarantees that employees with high qualifications and productivity, education level, and professional skills have a better chance of retaining their jobs.

If the qualifications of the employees are approximately the same, the position is more likely to be retained by the following citizens:

- those who are dependent on 2 people or more;

- those who undergo advanced training without interrupting their work;

- those who got an occupational disease, injury, trauma in this job;

- invalids, war veterans.

It is important to provide information to employees subject to dismissal about the need to present required documents confirming eligibility for the benefit. It is worth noting the category of citizens of retirement age. Payments for the reduction of a pensioner in 2018 are no different from the generally accepted ones; they do not have the privilege of preserving a job.

What categories of persons are not subject to dismissal

According to the labor law, there are prohibitions on redundancy. Situations for individuals not subject to dismissal:

- The person is on legal leave or sick leave. If the employer decides to reduce the position occupied by the employee, then the employee will be laid off at the end of the vacation or sick leave.

- Temporary disability postpones the date of dismissal.

- Pregnant women with children age group up to 3 years. Such employees are transferred to a new position or retained for their own until the end of the period maternity leave.

What payments are due when an employee is laid off in 2018

The employer must comply with the strict norms of the Labor Code of the Russian Federation, it is important not only to legally terminate labor relations with hired employees, but also to fully accrue everything due payments upon dismissal due to staff reductions. Basic and mandatory accruals for 2018: severance pay, compensation for unspent vacation, salary - are made by the date of expiry of the cooperation agreement. These payments for the period of subsequent employment help a person during the period of active search for a new job.

Severance pay

The type of cash payment - severance pay upon dismissal, is assigned to an employee in connection with the reduction, as compensation for subsequent lost income. The accrual is equal to the average monthly earnings of the employee. Severance pay upon dismissal due to redundancy, it is retained for the period of further job search, for a period not exceeding two months from the date of redundancy.

Reduction compensation for unused vacation days

The second guaranteed payment in case of reduction is monetary compensation for unused days of paid vacation. If an employee in the same year in which the dismissal occurs, there are "unaccompanied" days of paid leave, this amount must be reimbursed to him in cash. The accrual takes place regardless of the reason for the termination of the contractual obligations of the employer with the employee. The compensation is subject to income tax and is added to the calculation of the severance pay.

Earnings for full-time work before leaving

Upon dismissal due to redundancy, an employee general rule pay wages for the days of the month actually worked. This earnings remains the main one, constitutes the bulk of the compensation. The remaining additional payments are calculated from the amount for this payment. The Labor Code of the Russian Federation, under any conditions of termination of the employment contract, guarantees compensation for this charge. Money is paid in full size on the day of dismissal.

How to calculate payments when an employee is laid off in 2018

When deciding on staff reduction, it is important to correctly calculate all legal payments. When calculating compensation, the amount of earnings for one month is taken into account, calculations are made on the basis of income for one day and the number of days worked, that is, with the exception of numbers when a person was sick or was on vacation. Using the example below, you can easily understand the calculation of payments for the reduction in 2018.

Example. The main payments in case of reduction are calculated as follows: average earnings for one day is 1200 rubles, the actual number of days worked by the employee in the last working month is 25, the average salary for one month will be 30 thousand rubles. This amount of compensation will be accrued. If labor contract additional cash bonuses are provided for a certain amount of work done or the "13th" salary, the allowance also takes these amounts into account.

Formula for calculating severance pay

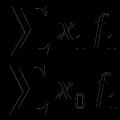

The amount of severance pay in 2018 is calculated using a simple formula: VP = RD * SZ, where VP is the amount of severance pay, RD is the number of normalized working days in the month following the dismissal, SZ is the average daily earnings, which is determined from the formula:

- SZ = GD / 730, where GD is the annual total income for the last two years.

Reduction Payout - Calculation Example

Consider illustrative example calculating the full amount of material compensation upon dismissal of an employee. Mikhail Igorevich Seleznev with two years of work experience at StroyTechMash LLC. In February 2018, Mikhail Igorevich was notified of the staff reduction planned for April 10, 2018. The employee's salary is 25,000 rubles. For the period from April 1 to April 10, the salary of M.I. Seleznev will be (25,000 rubles / 20 (working days)) * 6 working days = 7,500 rubles.

The number of working days for the annual period of work will be 266 days. The employee was not paid bonuses and other additional payments, the annual earnings will be: 25,000 rubles * 12 months = 300,000 rubles. Average daily earnings are determined by the formula: 300,000 rubles / 266 days = 1127.82 rubles. The severance pay for the first month after dismissal will be: 1127.82 rubles * 18 working days = 20300.58 rubles. Additionally, 28 days of vacation are subject to payment: 1127.82 rubles * 28 days = 31,578.96 rubles.

In total, Mikhail Igorevich Seleznev will receive payments from the employer with a reduction in 2018 in the amount of: 7500 + 20300.58 + 31.578.96 = 59379.54 rubles - to be paid. The employer is obliged to immediately calculate the M.I. Seleznev on the date of the last working day, that is, no later than April 10. The full benefit does not exceed three times the average monthly income and is therefore not taxable.

Duration of receiving compensation payment in case of downsizing

Labor legislation regulates the deadline for payments of compensation for redundant citizens in 2018. The employer must transfer the average monthly salary to the former employee for the next two months after dismissal. If, after the specified time period, a person has not got a job on new job, no matter for what reason, the period for payments for him can be extended.

How to extend the compensation period

After the reduction, a person must visit the labor exchange at the place of residence and register. By doing this within two weeks, there is still a chance of extending compensation. If a civil servant in terms of employment of the population does not employ a person for a new job due to a lack of vacancies or for some other reason, he is authorized to make a decision to extend the payment of benefits at the expense of the previous employer while maintaining the average earnings for at least one month.

Additional payments for staff reductions in 2018

Based on Art. 180 of the Labor Code of the Russian Federation, the employer has the legal right to propose to the employee to terminate the employment relationship before the date indicated in the reduction order. If a citizen agrees, he receives an additional monetary compensation in the amount of average earnings, calculated in proportion to the remaining time before the expiration of the notice of dismissal and the amount of severance pay. Compensation for the reduction is not retained for him, since the reason is the mutual agreement of the parties or the employee's own desire.

Video

Firing is a process known to almost every adult who has a job. This procedure has a huge variety of features and nuances. They can be fired by different reasons... Termination of labor relations at the initiative of the employee is more and more common. How is it going this process? And what payments are due in this or that case upon dismissal of their own free will? We will have to answer these questions further. If the employer does not settle accounts with his subordinates, the dismissal will be considered violated. This can lead to a number negative consequences for the former boss.

When can I quit

It is necessary in advance to think about what payments a citizen is entitled to receive upon dismissal of his own free will. But before the calculation, the employee must tell the employer about his intentions. When is it allowed to terminate an employment contract?

Anytime. Each subordinate can quit when he sees fit. This right is regulated by the labor legislation of the Russian Federation. At their own request, it is allowed to quit not only in work time but also on vacation. There are no restrictions on this. Unless the employer must be notified in advance of their intentions.

Testing

Upon dismissal of their own free will, payments to one degree or another are due to everyone who leaves work. They are made after the entry into force of the application of the established form. As already mentioned, it is necessary to inform the employer in advance about the plans to leave the company. According to the law, a citizen will have to work 14 days after submitting an application in the established form for termination of labor relations.

Working off is a mandatory item upon dismissal. However, sometimes you can get rid of it. For example, agree with the employer or go on vacation, while simultaneously submitting a letter of resignation. This or that decision will slightly affect the amount of payments.

If new employee wants to quit while on probationary period, he will have to notify the employer 3 days before leaving work. Payments will still be due to him.

When is the calculation made

The next important nuance is when a person receives money from the employer, due to him by law. This must be remembered by every subordinate.

Payments after dismissal of their own free will are provided on the day the termination order comes into force. It is impossible to demand funds immediately after submitting an application of the established form. Indeed, throughout the entire working off, the employee can change his mind and pick up the document.

If at the time of termination of labor relations the person was not at the workplace, the calculation is made no later than the next day after the request of the former subordinate for the due money.

List of mandatory payments

What payments upon dismissal of their own free will are due to a citizen in an organization? There are compulsory and optional compensations. Let's start with what is provided to each subordinate.

So, compulsory payments in the event of termination of employment at the initiative of the employee include:

- calculation for the worked time;

- payments for unused vacation.

There are no more mandatory payments. What is meant by each item?

Time worked

Upon dismissal of his own free will, payments for the time worked by a citizen is a mandatory payment. It is laid down for the days in a given month that a person spent in the company, fulfilling his job duties... The calculation is made in the accounting department according to a special certificate.

A citizen is paid a salary in the form of a payment for hours worked in a month. For example, an employee receives a salary of 40,000 rubles. In March, he worked 10 days out of 20 workers, leaving on March 20. Then the employee is entitled to 20 thousand rubles when leaving work.

Vacation

The following payments are due upon dismissal of their own free will to almost all subordinates. Most often they occur. It is about payments for unused vacation. By law, every employee is entitled to a paid annual vacation.

If the citizen did not receive it, but decided to quit, it is possible to demand appropriate compensation from the employer. In this case, the period that a person spent at the workplace without a vacation is rounded up according to the usual mathematical rules. This means that when working for 6 months and 20 days, it can be assumed that the subordinate did not rest for 7 months. If the employee worked for 5 months and 4 days, only 5 months are taken into account.

The calculation is made taking into account the unused vacation days and the citizen's salary. Usually, upon dismissal of one's own free will, payments for rest and for hours worked are made at the same time.

Compensation

We sorted out the obligatory cash. Dismissal of your own free will? What payments are due to some employees?

A number of citizens, under certain circumstances, can count on the payment of the so-called compensation. Its size is set directly by the employer. Usually, compensation is not negotiated with subordinates.

This payment is extremely rare in Russia. Only employees with whom these funds are specified in the contract can claim compensation.

In some cases, severance pay is assigned at a general meeting in the amount agreed upon with subordinates. This money will be issued without fail upon termination of employment.

Dismissal procedure

Now it is clear what payments upon dismissal of their own free will are due to the employee in this or that case. How do you get them? What is the procedure for terminating relations between employers and subordinates?

A citizen who decides to quit must adhere to the following algorithm of actions:

- Write a letter of resignation. Give it to your boss 14 days before the entry into force.

- Work 2 weeks legally. You can go on sick leave or vacation in order not to work out the allotted time.

- After 14 days, the employer issues a dismissal order. The citizen gets acquainted with him and signs. If the employee refused to get acquainted with the document, the chief draws up an act.

- On the last working day, the subordinate collects from the employer work book with a note on the termination of relations, a pay slip and signs the receipt of papers.

- In the accounting department, using the issued leaflet, payments are calculated upon dismissal of their own free will with the issuance of the due funds. It is necessary to sign the receipt of money in a special journal.

That's all. As soon as the subordinate received all his papers and funds, he can be considered dismissed. But that's not all.

Sick leave

If a citizen falls ill within a month from the date of dismissal, he may demand from the former boss a sick leave payment on a certificate of incapacity for work. Only these funds have certain features.

Namely:

- on a certificate of incapacity for work, sick leave can only be obtained by citizens who do not work after dismissal;

- the sheet is presented no later than six months after the termination of work in a particular company;

- the amount of payments is 60% of the salary.

Important: work experience in this situation is not taken into account. Disability certificates issued to close relatives are not paid. This is a normal, legal phenomenon.

Retention

Dismissal took place of your own free will? What payments are due to a citizen in this case? Answer to this question won't give you any more trouble. It should be remembered that each employee receives compensation for vacation and hours worked without fail. But under certain circumstances, the employer can withhold some of the funds. What is it about?

Withholding payments only applies to unused leave. If an employee has booked a vacation in advance, no compensation is due. Moreover, the subordinate must pay 80% of the vacation payment in advance on his own. According to the law, the employer has the right to withhold 20% of the salary.

Therefore, sometimes, upon dismissal of their own free will, payments are issued in incomplete amounts. Withholding is the employer's right. But it is forbidden to withhold funds without reason.

Outcomes

Was the dismissal of your own free will? What payments are due to a subordinate? The answer to this question shouldn't be too much trouble. What deadlines do you need to meet? Voluntary dismissal payments are due on the day of termination of employment. Or one day after the person has applied with a statement of calculation.

No more money is required by law to terminate the relationship between a subordinate and an employer. You cannot demand them. But it should be remembered that each boss is obliged to provide payments for both hours worked and unused rest. Anyone can claim these compensation.

In fact, remembering what payments are due upon dismissal of their own free will is easier than it seems. There are not so many payments, they are calculated taking into account the employee's salary and the number of days worked / available rest days.

On the occasion of the birth of a child, young mothers are entitled to several types of state social payments by federal legislation in the field of social support for families with children. In 2017, both lump-sum benefits (,) and (directly from the moment of the child's birth) will continue to be provided:

- in the same size established at the beginning of 2015 - until February 1;

- enlarged after the indexation of the amount of payments to the value of last year's actual inflation (5.4% according to Rosstat data).

The expectant mother should take care of the benefits in advance, the appointment and accrual of which is made in (as well as immediately after childbirth and during the period of caring for the newborn).

Lump sum for the birth of a child

It is paid regardless of whether a woman works, is unemployed, or is registered with the employment service as unemployed. The size of the lump sum payment for the birth of a child from February 1, 2017 will increase and amount to RUB 16,350.33.

Required documents for providing a one-time payment:

- certificate of the birth of a child from the registry office in the form F24 (issued at the time of registration of the child);

- parents' passports and their copies;

- birth certificate of the child and a copy of the document;

- the second parent that this type of benefit was earlier not appointed or paid.

Child care allowance

After a woman is given a lump sum payment at the birth of a child, she is entitled to receive the benefit until she reaches the age of one and a half years. Non-working mothers can have it directly from the month of birth of the child in a fixed minimum size RUB 3,065.69 on the first and RUB 6,131.37 in 2017 - for the second and subsequent children.

For workers, a monthly allowance of up to 1.5 years is calculated in the accounting department of the organization where the woman worked before the maternity leave. At the same time, a new rule has been introduced since 2011 - calendar days that fall on for the following periods:

- Temporary disability;

- Parental leave and maternity leave;

- Exemption from work with the retention of wages, if insurance premiums were not charged on it.

When calculating the amount of childcare allowance, the average earnings are divided by the number of calendar days in two years(730 or 731 days if one of the years falls on a leap year).

When assigning minimum social benefits for a newborn child in a fixed amount, their increased amounts are established for the area in relation to which regional coefficients for wages are applied.

The calculation is done as follows:

- If the woman worked, the benefit will be paid monthly at 40 percent of the average earnings (calculated per month) for the previous two full calendar years. The resulting calculated amount should not be less than RUB 3,065.69 for the first child and RUB 6,131.37- for the second and subsequent children. The accrual and payment of benefits is carried out at the cash desk of the enterprise where the young mother worked, on the day the wages are paid.

At the same time, taking into account the established maximum amount of earnings from which contributions are made to the Social Insurance Fund (670,000 rubles - in 2015, 718,000 - in 2016), the amount of payments in 2017 cannot exceed RUB 23,089.03 per month.

- If a woman did not work before maternity leave, then she is also entitled to a monthly allowance c.

- If a woman is on leave to care for her first child and is about to go on vacation, she is entitled to monthly childcare benefits in the form of the amount of benefits for the first and second (or subsequent) child. Previously, a woman had the opportunity to choose one of the provided payments - for the care of the first or second child (that is, having a larger amount).

The maximum amount of such a “double” benefit cannot exceed 100 percent of the applicant's average earnings in the last two full calendar years, but there cannot be less than the summed minimum amount.

Documents for registration of child benefits

Documents for receiving childcare benefits:

- Parents' passports and their copies;

- Birth (adoption) certificate of the child and its copy;

- Labor books and their copies;

- Birth certificates (adoption) of previous children and their copies;

- Help from the authority public service employment of the population on non-payment of unemployment benefits (for mom);

- Decree on the establishment of guardianship over the child and its copy;

- Certificate from the place of work (study, service) of the other parent stating that he does not receive this type of benefit;

- A photocopy of the personal account number (savings book) in the Sberbank of the Russian Federation;

- Certificate from the place of residence on the composition of the family (on the joint residence of the child with the parents or guardian);

Information about documents for all manuals on the page.

Maternal capital

The right to receive maternity capital is granted once upon the birth of the second or subsequent child in the family. If you have not exercised the right to receive it if you have two children, you can get it for the third and subsequent children.

In addition to the child's mother, this state social benefit can be received by a man if he is the only adoptive parent of the second, third child or subsequent children, and the court decision on adoption entered into force in the period from January 1, 2007 to December 31, 2018 (the program was extended for 2 years).

The size of maternity capital in 2017 due to the lack of annual indexation is still RUB 453,026 Payment is made from the budget of the Pension Fund (PFR) in full or in parts in non-cash form at the request of the holder of a state-recognized certificate.

According to the law of December 29, 2006 No. 256-FZ "On additional measures of state support for families with children" maternity capital funds can be used for the following purposes:

- by non-cash transfer of the specified funds for the purchase of housing on the territory of the Russian Federation;

- Getting an education by a child (children). Family capital can be directed to the education of any of the children in the family (and not just the one whose birth gave the right to maternity capital). Parents have the opportunity to pay with maternity capital for the education of a child in any Russian educational (necessarily accredited) institution.

- Compensation for the cost of purchasing goods and services for the social adaptation of disabled children.

- Formation of the funded part of the mother's labor pension.

In 2016, as an anti-crisis measure, another one-time payment from maternity capital was provided in an amount that parents can spend at their discretion. Possibility of such a measure

In a crisis, enterprises are looking for different ways optimization of activities.

In few places the administration thinks about the intensification of production processes, introduces new technologies in work. It is much easier to reduce costs by reducing people.

The reduction is carried out in strict accordance with the Labor Code of the Russian Federation, and in this case the employee is entitled to a number of payments.

Management often tries to take advantage of the ignorance of the citizen and save on weekend payments. How to get what is due, to resist arbitrariness, we will consider below.

What is staff reduction, what articles of the Labor Code is it regulated

The essence of the reduction is to reduce the number of employees / employees of the enterprise.

The process is carried out according to three schemes:

Legal relationship modern enterprise between employees and the employer are lined up in a contractual manner. Legally, the reduction implies the termination of the employment contract / agreement initiated by the management of the enterprise - paragraph 2 of Article 81 of the Labor Code of the Russian Federation. Also, all aspects of optimization of the staff are provided for by Articles 178-180, related provisions of the law.

The grounds for this procedure

Job loss often leads to litigation between the parties. The claims of the dismissed people also relate to unjustified dismissal.

In this regard, the Constitutional Court of the Russian Federation issued a ruling dated December 18, 2007, by which it released the employers to justify the expediency of reductions. Any employer is free, at its own discretion, to decide on the reduction of the number of workers, if it considers such a step to be economically justified.

Not regulated, but often arising in practice, grounds for downsizing staff / number serve:

Not regulated, but often arising in practice, grounds for downsizing staff / number serve:

- changes in the organizational and legal structure of the organization;

- deterioration of the economic situation of the enterprise;

- changes in employer standards to the professional qualifications of workers.

When considering claims, the courts decide the issue of the legality of the procedure and the order of awarding payments, without making judgments about the need for optimization.

However, in exceptional cases, the employer is forced to substantiate his decision with documentary evidence. For example, in confirmation of the reality of a reduction at a reorganized enterprise, the court may request a new staffing table.

The loss of a job entails an inevitable deterioration in the financial situation. therefore the law introduced restrictions to apply this step to socially vulnerable workers.

Employer has no right to reduce:

- raising children under 14 years of age. If, however, the single mother can continue to work until the dependent reaches the age of majority.

- If the parent is deprived of parenting rights, the person who replaces her - a single father, falls under the protection of the law.

- All women raising children under the age of three.

- The only breadwinner in a family with a disabled child up to 18 years of age.

- Women in.

- Workers who have been injured or injured at work in this enterprise.

- Disabled by military trauma.

- Employees on vacation or receiving medical treatment for temporary incapacity for work.

If a large-scale optimization is planned, when there are several applicants for the vacant positions, Article 179 of the Labor Code on the priority procedure for preserving jobs comes into effect.

A priority get:

A priority get:

- High productivity workers.

- Professionals of the highest category.

If employees are equal, then they are considered family and social status... The advantage is guaranteed:

- family staff with two or more dependents;

- persons - the only able-bodied in the family;

- employees who received occupational diseases during the period of work;

- undergoing qualification retraining in the direction of the employer without interrupting the production process.

When reducing personnel to 18 years of age, the employer must obtain permission from the state labor inspectorate and guardianship authorities (Article 161 of the Labor Code).

Employee rights

The law does not allow dismissing people on layoffs without warning. The employer is obliged to notify candidates about an unpleasant event 2 months in advance in writing.

Since 2016, in the notice to the employer suggests ways to avoid shortening: for example, work on a shorter schedule. For seasonal workers, labor legislation provides for a different notice period - 7 days (Article 296 of the Labor Code).

At the same time, at least formally, the person being laid off should have a choice: the employer offers employees alternative employment options (Article 180 of the Labor Code). In this case, the vacancy must correspond to the qualifications of the employee, but the level of payment may be lower.

If mass optimization is expected, the administration of the enterprise should notify the employment service, and if there is a trade union association, coordinate all aspects of optimization with representatives of labor interests.

List of payments

The Labor Code established a number of payments for redundant workers.

To the dismissed citizen put:

To the dismissed citizen put:

- Salary for the last month or proportional to the period worked before dismissal (Article 140 of the Labor Code);

- Compensation for unused vacation;

- Severance pay equal to the average monthly earnings;

- Financial support within two months from the date of dismissal in the amount of average earnings.

Important register with the employment service no later than 14 days after "parting" with the enterprise, since according to the decision of the CPC, the payment term "on average" can be increased by another month, if the social service has not been able to employ an unemployed person in two weeks.

The labor exchange will go to the extension of payment for forced rest, even if the person is late with registration. However, the reasons must be force majeure. Usually - by illness or caring for a seriously ill family member.

But if a specialist finds a new place of service before the expiration of a 2-month period, the payment will go according to the actual non-working period.

The procedure for calculating severance pay

Article 139 of the Labor Code and government decree 922 of December 2007 regulate the procedure for calculating payments.

According to their norms, the period for calculating the "average" is taken as a duration of 12 months preceding the date of reduction.

The calculation includes:

- Cash awards, bonuses, bonus payments. Only one of the total amount of additional payments is taken into account in one month. But there is nothing illegal if the unaccounted bonuses are included in the months without premiums.

- Bonuses for seniority, seniority, qualifications, bonus based on the results of work for the year (13th salary);

- Other payments included in the monthly wages.

It is worth remembering that the earnings ratio used for severance payments must not be lower than the federal one at the date of dismissal.

Into account not included:

Into account not included:

- Temporary disability due to illness, being on social leave - for example, a decree;

- When an employee was absent from the service for independent reasons: business trips, internships, training during working hours;

- Strikes and forced downtime of the enterprise when the employee was not able to work;

- The time officially provided by the employer for breastfeeding or caring for a disabled toddler.

When a person who has been laid off has worked in the company for less than a year, the full period of work is taken into account. If you had a chance to work for a very short time, less than a month, the severance pay is calculated based on tariff rate, salary according to the position, other norms of payment established according to the position.

Early layoffs initiated by the employee

The legislator provides the possibility of early termination of the contract in connection with the forthcoming reduction. It is carried out exclusively with the written consent of the candidate for the reduction.

The advantages of this step:

- there is a significant amount of time for advanced training, mastering a new profession and job search;

- a person receives an additional benefit-compensation in addition to standard payments.

Example. Accrual is based on average earnings in proportion to the time remaining before dismissal. Let's say a person receives a warning about staff changes planned at the enterprise in 60 days. After a week's reflection, the employee submits an application for early reduction... Compensation will be credited for 53 days not worked.

Vacation compensation

Order compensation for unused vacation defined by Article 127 of the Labor Code. The amount of the payment depends on the duration of the planned vacation. In this case, compensation for the time spent on vacation is not charged. For example, before the reduction, a person “walked away” part of the time, dividing vacation period into two parts. Here he will be paid only for the remaining time.

Order compensation for unused vacation defined by Article 127 of the Labor Code. The amount of the payment depends on the duration of the planned vacation. In this case, compensation for the time spent on vacation is not charged. For example, before the reduction, a person “walked away” part of the time, dividing vacation period into two parts. Here he will be paid only for the remaining time.

According to Article 81 of the Labor Code, if the redundant has worked for more than 5 months in the current year, vacation pay is calculated in full. In other cases, reimbursement will be calculated according to the hours worked after the fact.

Procedure for registration and receipt

By by and large the accrual of "compensation" is the concern of the enterprise. In particular, the "personnel" prepare the documentary basis, the accounting department calculates everything due.

One-time payments are transferred on the last day of employment.

The severance pay is calculated by the former employer at the end of the billing period of the first, second and third months of registration in the CPA. You will need to provide a work book without another employment record.

For information on what payments are due to employees in case of redundancy, see the following video:

Who and how makes money on import substitution and innovations in agriculture R

Who and how makes money on import substitution and innovations in agriculture R What is the industrial production index, its role and calculation

What is the industrial production index, its role and calculation Calculation of the design population of the city Term in metallurgy

Calculation of the design population of the city Term in metallurgy