What payments are due upon dismissal of their own free will

You work for yourself, you work, and then again - the boss announces a staff reduction. Unfortunately, many have faced such a situation.

Many questions immediately arise that require clarification. For example, what should be the payments to the employee in case of layoff? What is the legal correct way to fire an employee? Is it possible to lay off pensioners, pregnant women?

Your position is no longer needed

One of the first questions that arise when an employee is laid off is: "What payments am I entitled to?" A similar situation occurs both in large companies, and in small ones. According to the law, the reduction must be announced at least two months in advance.

The employee must sign that he was notified on time. If the employee refuses to sign, then a special act is drawn up. If this rule is not observed, then the person can be reinstated in office. As soon as signatures are received, the company is obliged to offer new vacancies that correspond to the specialty of the employee.

When the two-month period comes to an end, the employment contract is terminated and payments to the employee are made in case of a reduction in staff. He is given an allowance in the form of an average salary. It remains for the period of employment (but not more than two months).

Reduction of an employee. Payouts. Labor Code

This topic is regulated by Article 178 Labor Code RF. What she says:

- An employee who has been laid off is paid an allowance. Its amount is equal to the average monthly earnings.

- On the day of dismissal, the company is obliged to pay the entire salary debt to the employee. As well as compensation for unrealized vacation.

- For sixty days after the layoff, the person is paid an average monthly income.

- If he applied to the employment service no later than two weeks from the date of dismissal, but did not find the necessary vacancy, then by the decision of this body, the payment of compensation for the reduction of the employee is extended for another month.

- The issue of money must be made on time, otherwise the dismissed person may challenge his rights in court.

More about amounts

So, what are the payments to the employee when the staff is cut? Firstly, this is financing in the form of an average monthly income. It is paid up to 60 days. Secondly, the allowance, which is issued immediately at the time of dismissal.

Thirdly, the manager is obliged to compensate for all wage arrears, as well as unused vacation. Fourth, in special cases, an employee can be credited with a two-week average income. This applies to the moments when he does not agree to transfer to another service in the cases considered in the legislation. Also, payments to an employee in case of redundancy are made in connection with:

- calling him into the army;

- with the reinstatement of the person who previously held this position (withdrawal from the decree or appeal through the court);

- with the refusal to move to another area;

- with the recognition of him as incapable of work;

- with refusal to work due to changes in the terms of the contract.

Here you need to remember that personal income tax is not withheld from the mandatory amounts. The company is obliged to pay monetary compensation both in the event of the liquidation of the company and in case of violations in the drawing up of an employment contract (if they were not committed through the fault of the employee).

Collective and individual agreements keep payments when the employee is laid off. The timing of the issuance of all due money is limited to the last day on which the employee is still listed in the organization. If there is a delay in payments, then for every day they are accounted for at least 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

Law violation

The fact of illegal dismissal is often found in Everyday life... The employer wants to save his money and can play on ignorance of labor laws. Anyone who was dismissed, having collected evidence of a violation of his rights, can always file a claim with the court. The deadline for submission is thirty calendar days from the date of receipt of a copy of the order of dismissal or issuance of a work book. Good reasons for being late in contacting you may increase the time it takes to accept a claim. Also, the reason for filing a lawsuit is the refusal to pay the percentage of delay due to the worker's compensation.

Conditions for "correct" contraction

If the manager decided to reduce the staff, then a number of rules must be followed:

- The actual layoff of workers. The fact of dismissal is entered into the staffing table of the organization. An order is also issued to approve the new schedule.

- Under Article 179 of the Labor Code, it is necessary to provide in writing a number of other vacancies corresponding to the qualifications of the employee.

- Under article 180 of the Labor Code, the boss must notify the employee no later than two months before dismissal. The employee needs to sign that he was warned on time. Also, the manager approves the plan for communicating information about the reduction. In this case, a newspaper, a bulletin board, a meeting can be used.

- The dismissal should be considered by a selective trade union body. It includes a lawyer, HR director, and a representative of the trade union committee. An order is also issued on the creation of the commission.

- According to the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 2 of March 17, 2004, the responsibility of confirming the legality of dismissal and compliance with its order lies with the head of the organization.

Who shouldn't be fired

Based on Article 261 of the Labor Code, a pregnant woman cannot be reduced. In the case of her work on fixed-term contract the enterprise is obliged to renew the agreement after this period. A woman will only need a medical certificate confirming her position.

But it can be reduced in the case when it was registered in the organization during the absence of the previous employee, and there is no possibility of transfer to another vacancy. Also, women who have children under three years of age and single mothers with a child under 14 or a disabled child under 18 are not subject to dismissal.

There is one caveat in the field of education. As for the reduction of teaching staff in educational institutions, this action is possible only after the end of the school year.

Useful subtleties

- The calculation of payments in case of redundancy of an employee who is a part-time worker is not performed. The reason for this lies in the existence of a primary place of business.

- A laid-off worker is eligible for early retirement benefits. Moreover, he needs to issue it no earlier than two years before the legal date.

- If an employee has worked in the organization for less than six months, then compensation payments are still made for the unused vacation when the employee is laid off.

- Severance payments are not subject to the unified social tax, pension contributions, personal income tax. As well as insurance premiums to the FSS. Compensation for unrealized vacation days is subject to personal income tax, but not UST.

- If payments to the employee during the reduction are made not at the expense of budgetary funds, then they are taken into account in the composition of expenses going to salaries. Thus, the income tax is reduced (clause 9, article 255 of the Tax Code of the Russian Federation).

- The employer can fire an employee without warning, while all payments must be preserved. An agreement of this kind, however, like all others, must be drawn up in writing. If the worker and the head of the organization have not come to an agreement, then the reduction should take place on a common basis.

Reduction of an employee. What payments are accrued? Calculation example

Let us give next example... The employee began his career on 09/01/07 and was laid off on 04/23/09 (received a notification from his superiors). He quit on 24.06.09. For 12 months, the salary amounted to 126 thousand rubles. Start labor activity in the new organization - 09/05/09. Let's calculate average earnings, the amount of the allowance and compensation for unrealized leave.

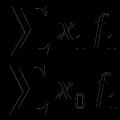

So, what is the procedure for payments when an employee is laid off?

First, let's calculate the benefits owed. To do this, we divide the entire salary by 12 months and by the number of working days. We get an average earnings per day - 357.14 rubles. We multiply this figure by thirty calendar days and get 10714.2 rubles.

Secondly, we will calculate the amount that will be paid over several months. Since the employee in the first of them did not get a new job, the size of the severance pay goes towards the retained average income. In this case, the obligatory payment of average earnings is carried out during the second month. The amount of the benefit will be 11,071.34 rubles (average daily earnings are multiplied by 31 calendar days). For the third month, there will be no payments, since the employee got a job in a new organization.

Thirdly, we will calculate the allowance for unused vacation. Based on the fact that the employee worked for ten months, the compensation will be paid in 23.33 days. We multiply 28 vacation days by the number of months worked (10) and divide by their number in a year (12). Multiplying the resulting figure by the average daily earnings, we get the entire amount of payments - 8,332.08 rubles.

Early dismissal of an employee

Article 180 of the Labor Code says that employees of organizations are notified of the reduction two months before it. In the same article, there is a clause in which it is written that the boss, in agreement with the subordinate, can liquidate the employment contract without waiting for the announced date. All payments for the early layoff of an employee are retained. But he will lose compensation if the basis for termination of the contract is a notice of dismissal by on their own... Thus, in order for the early reduction with all legal payments to occur, the following must be done:

- The manager draws up an offer to the employee to cancel the employment contract before the official termination date.

- The employee writes a written consent to this offer.

Compensation payments for redundancy of an employee are not made if the application states “I ask you to dismiss me of my own free will”. Or there is a letter from the new leader asking for a transfer to another organization. If the application states “I am asking to be dismissed due to the reduction of my position before the expiration of the term”, then the employer's consent will be required.

Going to court

Since it is beneficial for the employer to fire an employee at his own request, the latter may be subject to psychological pressure. And this is a reason for going to court. Compulsion to write a statement will need to be proven. When considering a labor dispute, the court draws attention to the following points:

- What are the reasons for writing the application - the employee's own desire or coercion.

- What are the circumstances of its registration.

- As far as is clear, the appeal is written, the presence of the necessary details in it.

- What are the intentions of the worker.

- What is the procedure for dismissal.

If the court finds the termination of the employment relationship illegal, then the manager is obliged to reformulate the grounds for dismissal, as well as to make all payments to the employee in case of redundancy. It is also possible to restore the former position with monetary compensation for forced absenteeism.

Dismissal of an employee of retirement age

When reducing a retired employee, payments must be made as follows:

- Compensation for unused vacations.

- Benefit.

- Maintaining average earnings for the period of employment for no more than two months. If the organization is located in the Far North, then up to three.

If an employee falls ill while looking for a new job

The employee has the right to submit a sick leave to the manager or to the territorial body of the Social Insurance Fund within thirty days from the date of termination of the employment relationship. Sick leave pay at the rate of 60% of the employee's average income.

Reduction under a fixed-term contract

According to Article 79 of the Labor Code, this type of contract is liquidated at the end of its validity period. The boss must inform the employee within three days and always in writing. Seasonal workers must be notified seven days in advance. They are also entitled to an allowance in the amount of two weeks' average wages. If the contract after the expiration date was reissued as an indefinite one, then the employee is subject to dismissal on a general basis.

Dismissal directly of their own free will The employee will receive a "bare rate" on the work done in the last one month. After that, during the registration of the status of unemployed at the local Employment Center, it will be possible to receive the unemployment benefit due to the former employee, however, less than the "reduced" one, that is, minus ninety days. Dismissal due to changes in the organization of production and labor A person will receive the estimated money in the calculation for the last month, plus to everything, severance pay, issued in the amount of one month's earnings. At the time of registration of the status of unemployed, the employee will be able to receive benefits only thirty days after his reduction (that is, the bosses paid the worker this month as an advance).

Employee benefits for layoffs: legal subtleties

In order to receive the amounts due in the next two (three) calendar months after the dismissal, it is necessary at the end of the month during which the dismissed employee did not find a new job, contact the former employer for a calculation. In this case, the employee must confirm his words with documents (provide a certificate from the Employment Center, demonstrate a work book). Only after that, an employee of the settlement department can start processing payments.

If such documents are not provided, then no compensation is provided. Where are they paid? All payments due to an employee who has been laid off are paid by the employer at the employee's place of previous work.

What payments are due when an employee is laid off?

Even in countries with a stable economic situation, a crisis can arise. And such a situation, of course, will affect all enterprises and, first of all, will affect employees who will be laid off or wish to resign themselves. In order not to end up without work and without money for the first time, every working person should know what the employee is paid when he is laid off.

Every working person should know that an employee is paid when a layoff is made. The day when an employee is officially dismissed is considered his last working day. Regardless of the reason for leaving the enterprise, the former employer is obliged to pay the employee severance pay and monetary compensation for one or more unused vacations, as well as other monetary debts, if any.

The list and procedure for receiving payments when an employee is laid off

You work for yourself, you work, and then again - the boss announces a staff reduction. Unfortunately, many have faced such a situation. Many questions immediately arise that require clarification. For example, what should be the payments to the employee in case of layoff? What is the legal correct way to fire an employee? Is it possible to lay off pensioners, pregnant women? Your position is no longer needed One of the first questions that arise when an employee is laid off is: "What payments am I entitled to?"

A similar situation occurs in both large companies and small ones. According to the law, the reduction must be announced at least two months in advance. The employee must sign that he was notified on time.

If the employee refuses to sign, then a special act is drawn up. If this rule is not observed, then the person can be reinstated in office.

How many salaries are paid when reducing

Dismissal not by agreement of the parties this rule concerns rare highly qualified personnel, which managers plan to subsequently return to the company's staff). If the agreement of the parties was oral (or written, but without special conditions), then the employee will receive the estimated money for the last month worked and will lose severance pay. True, when registering the official status of an unemployed person, he can receive benefits already in the first month after registration.

The most frequent violations by employers registered at this stage The most frequent variant is when the employee is misled, that is, they are simply deceived.

How not to be deceived: what do you have to pay if you are laid off on a layoff?

Attention

That is, either after 3 or after 6 months maximum. Employer's liability for violation If the employee's rights are violated during the layoff, then he must protect them and apply:

- to the labor dispute commission;

- with a claim to court;

- with an application to the labor inspectorate, the prosecutor's office or the investigation department.

Administrative General responsibility of the employer for any "slight" violation labor rights provided for by Art. 5.27 of the Administrative Code. If the employer does not pay the severance pay on time, then according to the inspection of the labor inspectorate or the prosecutor's office, an administrative procedure will be initiated under this article. The maximum penalty is 50 thousand rubles in case of repeated violation of the payment deadline.

In the first case, in most cases, the employer is warned about the need to eliminate violations, i.e. pay off the money. The limitation period for 5.27 of the Administrative Code is 2 months.

Reduction payments

Info

If the dismissal occurs of his own free will, he will not be able to receive any compensation due to the reduction. You should not succumb to the persuasion or threats of the employer, you need to observe, first of all, your interests. In case of redundancy, the employee must receive monetary compensation for everything unused vacations.

In addition, the employer is obliged to pay one average monthly earnings, taking into account all payments received during last year... The employee must clarify the provisions of the collective agreement in force at the enterprise, it is quite possible that it stipulates some additional payments in case of layoff. In addition to the monthly severance pay, the employee is also entitled to money that can be received within 2 months after dismissal in the event that he can get another job workplace.

What should be paid in case of reduction

Employees, not knowing their rights well, sometimes do not even realize that in case of redundancy, the employer must pay the dismissed this bonus as well. Even if the reduction occurs in the summer. True, this is only possible if the person has worked in the company for at least a year. Today, the situation on the labor market is such that even employees of the public sector and those who are employed in public service... It is not even necessary to talk about those who work in private commercial enterprises. But in any circumstances, the law is uniform, and it clearly spelled out the mechanism of the procedure for the reduction of jobs and those compensations that are due to the laid-off employee. How the employer should act The fact that it is planned to cut jobs, which also includes the job that is staffing table if you are borrowing, the employer must notify you in advance.

What should be paid when laid off from work

Labor Code of the Russian Federation, you must receive all payments and compensations due to you on the day of dismissal along with the work book. In case of redundancy, you are entitled to: - severance pay in the amount of average monthly earnings, which is calculated taking into account the last 12 months you worked; - within two months after dismissal, you can count on wages provided that during this time you will not get another job; - compensation in cash for all remaining unused vacations, starting from 2002, when the new edition of the Labor Code of the Russian Federation came into force. The economic crisis is the reason that many companies are forced to reorganize and reduce the number of employees working at the enterprise under labor contracts.

What should be paid in case of reduction in Ukraine

For the year worked, the employee is required to pay remuneration. By law, many employers take advantage of the ignorance of their employees and do not pay 13 salaries upon dismissal.

- Vacation. If the employee did not use his due vacation, he has the right to demand compensation from the employer. Payments should be provided upon dismissal even to the employee who wrote an application for postponing vacation to the next year. In accordance with the law, all cash payments must be made on the last working day of the employee. But the timing of the payment of compensation can be agreed with the former employee in words. Note that the employer is obliged to inform you of the dismissal two months in advance (part 2 of article 180 of the Labor Code of the Russian Federation). The employee is obliged to work for this period. But if you find a new job earlier, then the head of the organization may fire you earlier.

What should I be paid in case of reduction

In order to simplify understanding, the text uses the word "abbreviation", which implies (in this article!) Two of the above terms at once. What should be paid if they are laid off on a layoff So, payments on layoffs - who pays the money and how? The payments due during the reduction can be conditionally divided into 2 parts:

- severance pay;

- pay while searching new job.

Let's take a closer look at what the employer must pay in case of redundancy. Calculation on the day of dismissal In accordance with Art. 84.1, 140 and 178 of the Labor Code of the Russian Federation on the last working day, the organization must fully pay off the dismissed: issue all personal documents and pay due according to the law and internal regulations.

Labor Code of the Russian Federation, Article 140.

What should be paid upon dismissal for redundancy

And if on that day he did not work, then he can receive the payments due upon dismissal no later than the day following the day when the employee asked the employer to pay him. 2 List of payments due upon dismissal When an employee terminates an employment contract, he must receive the following payments: salary for the time he worked in a given month; compensation for vacation that the employee did not take off; severance pay - in cases provided by law. Payment of salary upon termination of employment must include all allowances, bonuses and surcharges due. It is worth remembering that an employee, before dismissal, may ask for leave.

In this case, the payments due upon dismissal are made before the vacation. 3 An employee must receive severance pay on dismissal if the reason for the termination of the employment contract was the reduction or liquidation of the company.

Reduction paymentsof the state are called upon to financially support the dismissed employee for the period of his employment. It is not very easy to independently figure out what exactly is due to an employee in such a situation, what the amount of payments is, and also when they are provided. We will discuss these issues in more detail in the presented article.

What payments are provided upon dismissal for the reduction of staff?

In the current unstable economic situation, it is not uncommon for employers to cut their staff. It can be 1-2 employees or dozens, hundreds of people (for example, when an organization is liquidated). The procedure and procedure for calculating payments are the same, regardless of the number of employees who have been laid off. The issues of providing guarantees and compensations to citizens who find themselves at work under the layoff are regulated by Art. 180 h. 3 of the Labor Code of the Russian Federation of 12/30/2001 N 197-FZ.

First of all, it is necessary to note the payments that are due to workers upon dismissal in general order, nobody exempts the employer from these payments. They include:

- salary not yet received in the last month of work;

- compensation for vacation that the employee did not use for any reason.

IMPORTANT! The forthcoming reduction in the staff of the worker must the employer (an order is issued in writing for the enterprise, and all employees are introduced to him against signature) at least 2 months before dismissal. It is assumed that during this period of time, the employee who has been laid off will be able to find a new job for himself.

There are also compensation payments (regulated by Art. 178 Part 3 of the TKRF), which should help a citizen dismissed by layoff to provide for himself while he is looking for a new job. This is:

- severance pay (calculated by the average earnings of a worker);

- payment in the amount of the average salary for the period until the citizen is employed, but not more than 2 months from the date of his reduction.

Terms of payments in case of reduction of an employee

Let's consider in order when payments are made in case of reduction. On the day of the actual termination of the contract with the worker, the total amount of wages and compensation for unused leave are calculated. The payment procedure is saved here as in the case of an ordinary payment upon dismissal of an employee.

In addition, on the day of the reduction, severance pay is paid, since the specified allowance is guaranteed and does not depend on whether the dismissed employee is employed by another employer or not.

After the expiration of 1 month from the date of the reduction of the worker, no payments are made. After two months from the date of the worker's dismissal, if he has not found a job, at his written request, the employer makes a payment in the amount of the average salary of the dismissed. The compensation already paid (severance pay) is included in the payment of such compensation.

Downsizing severance pay

As mentioned above, the severance pay is calculated from the worker's salary (the average value is taken). It cannot be less than the average monthly salary. A collective or, for example, a regular employment contract with an employee may provide for a different amount - towards an increase in severance pay. Then the downsized employee will receive just such an allowance.

Important: the payment of the severance pay does not exempt the employer from paying the bonuses and other incentive payments due to the employee, if they were provided for by the contract.

It should be borne in mind some special cases when payments for reductions are calculated differently, or not paid at all. So, when there is a calculation of the payment for the reduction of a worker who worked for seasonal work, the average salary is taken for a period of 2 weeks, and not 2 months (Art. 296 part 4 of the TKRF). Workers who have entered into a fixed-term employment contract for no more than 2 months do not receive severance pay (Article 292, Part 4 of the TKRF). Part-time employees who have been dismissed due to staff reductions (Article 287, part 4 of the TKRF) are entitled to severance pay on an equal basis with the rest, but are deprived of an allowance in the amount of the average salary at the time of placement with another employer (while maintaining the main place of work ).

The employer and employee can agree on more early date layoffs than 2 months. In this case, in addition to the main compensation payments, in relation to the employee who fell under the layoff, payments are made additionally. Additional compensation is calculated in proportion to the time that the employee has not finished working before the general deadline, also based on the average salary. Other stipulated benefits (holiday and for the period of placement to another employer) are also paid.

Payment of average earnings for the period of placement to a new employer

Situations often arise when a worker has not found a new employer within 2 months after being laid off from a previous job. In this case, as indicated earlier, he is entitled to an allowance in the amount of the average salary for the period of job search (but not more than 2 months), this guarantee is provided by Art. 178 h. 3 TKRF.

However, it happens that a new job was found in the middle of the month, how to calculate the payment? In this case, the payout in case of reduction is calculated in proportion to the time spent on searches. That is, if an employee found a job with a new employer from the 7th, then the average payment will be calculated for 6 days of the month during which he was still looking for work.

There is an exception, and the average monthly payment (by decision of the employment service) can be extended for another 1 month (i.e., for the 3rd), if the following conditions are met:

- the reduced employee was registered with the employment authorities within 2 weeks from the date of dismissal;

- for 3 months the employment agencies did not employ him.

So, we examined what payments are due when an employee is laid off, whether it be a reduction in the number of employees or staff, or the liquidation of an enterprise. The problem of layoffs at work will not be so acute for you if you receive all the due payments in full.

If your boss has warned that a layoff is coming in your firm or enterprise, how much compensation can you expect?

What compensation do you owe in case of reduction in 2018-2019

In the current situation of general economic fever, it is easy to be out of work on the street. This can happen for several reasons:

- the enterprise is completely liquidated;

- reduce the number of employees at the enterprise;

- inconsistency with the position held;

- and some other reasons.

Reduction of employees

Downsizing is one of the common reasons for layoffs. Contract of employment is torn apart at the initiative of the employer, and the employee is out of work. How much should an employee be paid in case of redundancy, if it happened through the fault of the employer:

- severance pay is paid;

- compensation for unused vacation days;

- other financial debts (salary, bonuses, etc.).

The employee must sign the official paper, according to which he is notified of the day of his dismissal. The employer gives such a notification paper to the employee no later than two months before the final settlement.

The employee receives compensation for vacations and other financial debts in last days work at the enterprise.

Severance pay is paid slightly differently than salary or vacation compensation. For the first 30 days after dismissal, a former employee is required to receive an average monthly salary, in the second month the amount will be calculated differently: the number of working days is multiplied by the average earnings per day.

If during this period you have not found a new job, then an additional payment for the third month is possible. In cases agreed upon separately, and only with confirmation from the Employment Center.

You may have found a job within a period that you should be compensated for. In order not to lose compensation from the former enterprise, agree with the current employer - temporarily do not formalize.

What determines the amount of payments

How to navigate the amount that the company owes you? How much should former employers pay? So, you owe the following cash payments:

- The amount of compensated vacation depends on the amount of accrued vacation pay.

- Additional 13th salary - if it is customary at the enterprise to pay the 13th salary, you are paid, and this is given that you have been working for more than 12 months.

- The severance pay for the first 30 days after being laid off is paid based on the average monthly salary.

- The next amount is paid at the end of the second month after the reduction. The former employee must show a work book, which is proof that he was not hired and supplemented with an application for the payment of average earnings for the period of employment, taking into account the money already paid. In total, the severance pay is equal to two salaries.

If former employee got a job after the deadline due payments, then the money is counted for the days in which he has not yet worked.

If the third month has passed and you have not yet found a suitable place of work, you may be paid extra if:

- you registered with the employment service and did it within 12 days from the date of dismissal;

- during the period while you were registered, the employment service did not find you a job.

If all the conditions have been met, then after the third month, the former employee presents the former employer with a notification from the Employment Center, on the basis of which he is obliged to pay the average monthly earnings, based on the period while he did not work (for redundancy).

What if you get laid off early

Exist different situations in which the employer and the employee agree on early dismissal with staff reduction. In this case, the law provides for the payment of additional compensation for the time that the employee could work and receive wages, until the actual reduction.

Additional compensation is calculated according to the formula: the number of working days from the next after the dismissal until the day that was declared the day of dismissal in the notice of redundancy, multiplied by the average daily earnings.

An employee may receive such additional compensation for the difference between the actual term of dismissal and the term announced in the notice.

Who gets cut

- pregnant women and women in maternity leave up to 3 years old;

- single mothers with a child under 14;

- single mothers with a disabled child under 18;

- fathers or guardians with orphans under the age of 14;

In addition, the employer retains the right to keep specialists at work at his own discretion. In this case, the following categories have an advantage, given equal opportunities:

- professionals with two or more children or dependents;

- employees who are the only breadwinners in the family;

- disabled people and war veterans;

- employees who are constantly improving their qualifications.

All of these points must be documented in a collective employment contract enterprises.

Transfer to another job

In addition to the fact that the employer is obliged to notify about the reduction two months before the dismissal, he is obliged to offer another position. This is a notice of transfer to a vacant position at the appropriate level. If there is no such place, then the employer is obliged to offer the employee a lower vacant position that corresponds to his qualifications, education, work experience and state of health.

Further development of events may be as follows:

- the employee agrees to the proposed position, and the company completes the transfer procedure;

- the employee does not agree, the company issues a written refusal;

- the employee is familiar with the list of vacant positions and refuses them in writing, the company draws up an act on this matter;

If the company cannot provide the employee with the corresponding vacant position, he draws up an act on the impossibility of transfer.

Who and how makes money on import substitution and innovations in agriculture R

Who and how makes money on import substitution and innovations in agriculture R What is the industrial production index, its role and calculation

What is the industrial production index, its role and calculation Calculation of the design population of the city Term in metallurgy

Calculation of the design population of the city Term in metallurgy