Calculation of compensation for unused vacation. Is compensation paid for unused leave upon dismissal

According to the provisions of article 115 of the Labor Code Russian Federation the employer must provide the employee with a basic annual paid leave of 28 calendar days. Certain categories of workers are granted extended basic leave (i.e., more than 28 days). The Labor Code also provides for cases when the replacement of unused vacation days is prohibited. Let's consider this issue in more detail.

According to the provisions of the normative acts that establish the norms labor law, unused vacation days can be replaced with monetary compensation in the following cases:

at the request of the employee - a part of the annual paid leave exceeding 28 calendar days ();

persons employed in harmful and hazardous working conditions (Article 117 of the Labor Code of the Russian Federation);

workers with irregular working hours (Article 119 of the Labor Code of the Russian Federation);

employees working in the Far North and equivalent areas ();

athletes and coaches (Art. 348.10 of the Labor Code of the Russian Federation);

persons working in representative offices of the Russian Federation abroad (Article 339 of the Labor Code of the Russian Federation);

honey. employees (Article 350 of the Labor Code of the Russian Federation);

employees for whom such leave is guaranteed by federal laws (part 1 of article 116 of the Labor Code of the Russian Federation).

The following persons are entitled to extended leave:

groups of persons defined by federal laws (part 2 of article 115 of the Labor Code of the Russian Federation).

It is worth remembering that for certain categories of employees, the replacement of annual paid compensation with monetary compensation is not allowed. These workers include:

persons under the age of 18 (part 3 of article 126);

pregnant women (part 3 of article 126 of the Labor Code of the Russian Federation);

customs officers (clause 2 of article 35 of Law No. 114-FZ);

police officers (part 3 of article 45 of the Regulations approved by the Decree of the RF Armed Forces dated December 23, 1992 N 4202-1 "On approval of the Regulations on service in the internal affairs bodies of the Russian Federation and the text of the Oath of an employee of the internal affairs bodies of the Russian Federation").

employees of drug control bodies (clause 105 of the Regulation approved by the Decree of the President of the Russian Federation of 05.06.2003 N 613 "On law enforcement service in the bodies for control over the circulation of narcotic drugs and psychotropic substances");

persons employed in work with harmful and / or dangerous working conditions. Exceptions are payments of monetary compensation for unused leave upon dismissal, as well as for a part of the annual additional paid leave exceeding its minimum duration - seven calendar days (part 3 of article 126 and part 2, 4 of article 117 of the Labor Code of the Russian Federation);

workers exposed to radiation from the Chernobyl disaster.

Note: In accordance with Part 2 of Art. 122 of the Labor Code of the Russian Federation, the right to use leave for the first year of work arises from the employee after 6 months of his continuous work. By agreement of the parties, paid leave may be granted to an employee even before the expiration of 6 months.

An employee is entitled to additional leave for work in harmful conditions if he actually worked in such conditions for at least 11 months in a working year (paragraph 2, clause 8 of Instruction N 273 / P-20). If he has worked less than this period, then additional leave is provided to him in proportion to the time worked in such conditions (clause 9 of Instruction N 273 / P-20, Letter of Rostrud dated 18.03.2008 N 657-6-0);

Additional leave for work in irregular working hours does not depend on the length of time worked in the working year under conditions of irregular working hours (Letter of Rostrud dated 05.24.2012 N PG / 3841-6-1);

Registration of monetary compensation for vacation

To pay monetary compensation for vacation, the employer must perform the following sequence of actions:

receive a written statement from the employee;

issue an order;

enter information on the replacement of part of the vacation in the employee's personal card and the vacation schedule.

Note: Study leave is not related to annual paid leave, but is considered an additional targeted leave associated with training (Art. 173-176 of the Labor Code of the Russian Federation). Therefore, the employer does not have the right to replace the employee's study leave with monetary compensation (Letter of the Federal Tax Service for Moscow dated December 27, 2006 N 20-12 / 115069).

Payment of monetary compensation for unused leave upon dismissal

In accordance with Part 1 of Art. 127 of the Labor Code of the Russian Federation upon dismissal, the employee is paid monetary compensation for all unused vacation days. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day.

Upon dismissal, monetary compensation in full size are received by employees who have worked for the employer for at least 11 months, or employees who have worked for more than 5.5 months and dismissed on one of the following grounds:

liquidation of an enterprise;

staff reduction;

transfer to another job at the suggestion of labor authorities;

admission to active military service;

reorganization or temporary suspension of work;

business trip in the prescribed manner to universities, technical schools (or training courses specified educational institutions);

unsuitability for work.

In other cases, compensation is paid in proportion to the hours worked.

Note. In accordance with Art. 291, 295 of the Labor Code of the Russian Federation for employees hired for up to 2 months, or employed at seasonal work, monetary compensation upon dismissal is paid at the rate of two working days per month of work.

When calculating the number of days of unused vacation, the length of service includes:

actual work time;

the time when the employee did not actually work, but in accordance with the labor legislation and other acts containing labor law norms, the collective agreement, agreements, local regulations, the employment contract, the place of work was retained, including the time of annual paid leave, non-working holidays, days off and other days of rest provided to the employee;

time of forced absenteeism in case of illegal dismissal or suspension from work and subsequent reinstatement at the previous job;

the time of unpaid leave provided at the request of the employee, not exceeding 14 calendar days during the working year;

the period of suspension from work of an employee who has not passed a mandatory medical examination through no fault of his own.

The length of service does not include:

the time the employee is absent from work without good reason, including as a result of his suspension from work in the cases provided for;

parental leave until the child reaches the legal age.

Note: In accordance with Art. 121 of the Labor Code of the Russian Federation, vacation time without pay, not exceeding 14 calendar days during the working year, is included in the vacation experience.

The total amount of compensation for unused vacation is paid based on average earnings. In accordance with Art. 139 of the Labor Code of the Russian Federation, the average daily earnings for paying compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.3 (the average monthly number of calendar days).

In practice, it is not uncommon for an employer to pay an employee compensation for unused vacation. In what cases is it allowed to replace vacation with monetary compensation? What are the features of calculating this type of payments? Does the composition of labor costs include monetary compensation for part of the vacation in excess of 28 calendar days? Is monetary compensation for unused vacation days subject to unified social tax? We will try to answer these questions in this article.

Requirements Labor Code

regarding the provision of vacations to employees

Article 122 of the Labor Code of the Russian Federation the obligation of the employer to provide the employee with a paid leave of 28 calendar days ( Art. 115 of the Labor Code of the Russian Federation). The transfer of vacation to the next year is allowed (by agreement of the parties) only in exceptional cases (in particular, when an employee's leave on vacation in the current year may negatively affect the activities of the organization). In this case, the employee must use the days of the postponed vacation no later than 12 months after the end of the working year for which the vacation is granted.

The employer is prohibited from providing the employee with annual paid leave for two consecutive years ( Art. 124 of the Tax Code of the Russian Federation). At the same time, employees under the age of 18, as well as those who are employed in work with harmful and (or) hazardous working conditions, are obliged to provide leave annually.

Thus, the legislation establishes strict restrictions for employers in terms of granting leave to employees. Nevertheless, in practice, workers often accumulate unused vacations in previous years. In this case, the employer retains the obligation to provide the employee with these holidays or pay him monetary compensation for their unused days.

When is it paid

monetary compensation for unused vacation?

Monetary compensation for unused vacation is paid upon dismissal ( Art. 127 of the Labor Code of the Russian Federation), as well as at the written request of the employee for a part of the leave exceeding 28 calendar days ( Art. 126 of the Labor Code of the Russian Federation).

It should also be borne in mind that replacing leave with monetary compensation is not allowed:

pregnant women;

employees under the age of eighteen;

workers employed in hard work and work with harmful and (or) hazardous working conditions.

Calculation of compensation for unused vacation

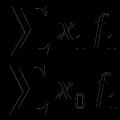

The amount of compensation for unused leave upon dismissal (including for organizations applying summarized accounting of working hours) is calculated as follows:

The calculation of the average daily (hourly) earnings for the payment of compensation for unused vacation is carried out according to the rules established Art. 139 of the Labor Code of the Russian Federation and Regulation on the calculation of average wages, and is calculated for the last three calendar months (if another settlement period not provided for by the collective agreement) by dividing the amount of actually accrued wages by the estimated number of days (actually worked hours) for the calculation period.

On dismissal ...

The most common case when monetary compensation is issued for unused vacation is the dismissal of an employee. Note that upon dismissal, an employee, upon his application, may be provided with all vacations not used by him (both main and additional), except for the case if his dismissal is associated with guilty actions. The day of dismissal of the employee will be the last day of his vacation. In this case, the leave granted to the employee is paid, and, accordingly, compensation for unused leave upon dismissal is not paid.

note: compensation for unused vacation is also paid to employees who leave the organization by way of transfer (on the basis provided for Clause 5 of Art. 77 of the Labor Code of the Russian Federation).

In practice, when determining the number of vacation days an employee is entitled to while working in an organization, certain difficulties arise. The fact is that the Labor Code of the Russian Federation provides for a specific procedure for calculating the days of unused vacation only for employees who have entered into an employment contract for up to two months - by virtue of Art. 291 of the Labor Code of the Russian Federation compensation is paid to them at the rate of two working days per month of work. For other categories of workers, the mechanism of such a calculation is not spelled out in the Labor Code of the Russian Federation.

The following calculation option is generally accepted. If the employee has worked in the organization for 12 months, which includes the vacation itself ( Art. 121 of the Labor Code of the Russian Federation), then he is entitled to an annual leave of 28 calendar days. In other words, full compensation is paid to an employee who has worked for the employer for 11 months ( Clause 28 of the Rules on regular and additional vacations, Further - Rules). If the quitting employee has not worked the period that gives the right to full compensation for the unused vacation, compensation is paid in proportion to the days of vacation for the months worked ( clause 29 of the Rules).

When calculating the terms of work that give the right to compensation for leave upon dismissal, surpluses that are less than half a month are excluded from the calculation, and surpluses that are more than half a month are rounded up to a full month ( Clause 35 of the Rules).

Compensation is paid in the amount of the average earnings for 2.33 days (28 days / 12 months) for each month of work.

Example 1.

The employee worked in the organization for 10 months. Upon dismissal, he is entitled to compensation for 23.3 days (2.33 days x 10 months). If he worked for 11 months, he would receive compensation for a full month - 28 calendar days.

Thus, the 11th month of work gives the employee the right to receive compensation for 4.7 days (28 - 23.3).

note: These norms in the payment of compensation worsen the situation of dismissed workers who have worked for less than 11 months, compared to those dismissed after 11 months of work. However, an attempt to challenge the provisions clause 29 of the Rules in the Supreme Court of the Russian Federation was not crowned with success ( Decision of the RF Armed Forces dated 01.12.04 No. GKPI04-1294, Determination of the RF Armed Forces dated February 15, 2005 No. KAS05-14), since, in the opinion of the judges, the principle of proportional calculation of compensation is fully consistent with the analogous principle contained in Art. 291 of the Labor Code of the Russian Federation. The very fact that paragraph 28 of the Rules provides for the right of an employee who has worked for at least 11 months upon dismissal to receive full compensation for unused vacation, in itself cannot indicate the existence of any contradictions between paragraph 29 of the Rules and the provisions of Articles 3, 114 and 127 Labor Code of the Russian Federation.

Some organizations use a different method of calculation, which is reflected in the collective agreement (or regulation on wages). Since the working year is divided into approximately 11 months of work and 1 month of vacation, the employee earns a monthly leave entitlement of 2.55 days (28 days / 11 months). From the point of view of mathematics, this method of calculation is more correct and does not worsen the conditions for the payment of compensation for unused vacation when employees are laid off. However, its application will lead to an increase in labor costs, and this, most likely, will be regarded by the inspection authorities as an understatement of the tax base for income tax. If there are disagreements with the tax authorities, then you will have to defend your position only in court.

Example 2.

I. I. Ivanova went to work on 02.08.03. In 2004, she was in another annual leave from June 1 to June 28 (28 calendar days). In 2005, I. I. Ivanova was not on vacation. In April 2006, she wrote a letter of resignation for on their own(from 24.04.06).

The employee's salary is 10,000 rubles. per month. In addition, she was credited with:

in January 2006 - a bonus based on the results of work for 2005 in the amount of 3,000 rubles. and a monthly bonus for meeting production targets in December 2005 - 500 rubles;

in February - a bonus for the performance of production indicators in January 2006 - 600 rubles;

in March - a bonus for meeting production targets in February 2006 - 700 rubles;

in April - a bonus for performance indicators in March 2006 - 800 rubles. and a performance bonus forIquarter of 2006 in the amount of 2,000 rubles.

The duration of the billing period in the organization is 3 months. The calculation period has been fully worked out.

Recall that upon dismissal of an employee, the calculation of payments due to him (including compensation for unused vacation) is made in a unified form No. T-61 "Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)"... So, let's give a step-by-step calculation of compensation for the unused vacation of I. I. Ivanova.

1) Determine the amount of actually accrued wages for the billing period (January - March 2006). It includes:

the official salary of an employee for three months in the amount of 30,000 rubles. (10,000 rubles x 3 months);

bonus based on the results of work for 2005 in the amount of 750 rubles. (3,000 rubles / 12 months х 3 months);

bonuses for performance indicators in the amount of 1,800 rubles, including: 500 rubles. (since it is charged in the month that falls on the billing period), 600 and 700 rubles.

note: the monthly bonus for performance indicators in March 2006 (800 rubles), as well as the quarterly bonus for the first quarter of 2006 (2,000 rubles) are not taken into account, since they were accrued in a month beyond the estimated period (in April).

Thus, the amount of actually accrued wages in the billing period will be 32,550 rubles. (30,000 + 750 + 1,800).

2) Let's calculate the average daily earnings for the billing period: (32,550 rubles / 3 months / 29.6 days) = 366.55 rubles.

3) Determine the number of vacation days that remained unused. Let us remind you that an employee is granted leave for the time he has worked, and not a calendar year. In other words, the calculation of the period for the right to receive leave begins from the date when the employee started work, and not from the beginning of the calendar year.

The first working year of I. I. Ivanova ended on 01.08.04, the second - 01.08.05. During this time, the employee is entitled to 56 days of vacation (28 days x 2 years).

From August 2, 2005 to April 24, 2006, the third working year lasted, including 7 full months and one incomplete (from 02.04.06 to 24.04.06). Moreover, the latter is equated to a full working month, since it includes more than 15 calendar days. Thus, for the third year of work in the organization, I.I. Ivanova earned a vacation for 8 full months, that is, she was entitled to 19 days of paid vacation (2.33 days x 8 months = 18.64 days).

The total number of vacation days earned by I. I. Ivanova is 75 (56 + 19). Consequently, upon dismissal, she is entitled to compensation for 47 days (75 - 28).

4) So, let's calculate the compensation for unused vacation: 366.55 rubles. x 47 days = 17,227.85 rubles.

note: there are cases when, when calculating compensation, accountants determine the number of days of unused vacation in the last working month in a simplified version. In their opinion, if an employee leaves before the 15th, he does not have the right to vacation days for the last month, if after that date - accordingly, such a right is. However, this approach is incorrect and can lead to errors in calculating compensation payments. Therefore, the calculation should be made according to the established rules: take into account how many days in total the employee worked in the first and last months of work in the organization, and also be sure to calculate the length of service, which gives the right to annual paid basic leave ( Art. 121 of the Labor Code of the Russian Federation).

If the employee continues to work in the organization ...

Article 126 of the Labor Code of the Russian Federation allows the employer ( Attention! This is his right, not an obligation), by agreement with the employee, replace the last part of the vacation that exceeds 28 calendar days with monetary compensation. At the same time, it is impossible to compensate for the main vacation for the current year with money ( Letter of the Ministry of Finance of the Russian Federation of 08.02.06 No. 03-05-02-04 / 13).

Unfortunately, this article does not clearly define the situation and can be read in two ways. On the one hand, it can be assumed that out of the available number of days of unused vacation (for example, the employee has not been on vacation for 3 years, which means that he has accumulated 84 vacation days) he should take 28 days off in any case, and the remaining 56 days (84 - 28) ask to be replaced with monetary compensation.

On the other side, Art. 126 of the Labor Code of the Russian Federation can be regarded as follows. Suppose that the employee is entitled to the main vacation - 28 days and an additional one - of 3 days, which is added to the main vacation. For two years he did not receive them. As a result, 56 days of the main leave must be given to him with days of rest, and only the accumulated additional 6 days can be compensated in cash.

This duality will persist until amendments are made to the Labor Code of the Russian Federation. Accordingly, the explanations given in Letter of the Ministry of Labor dated April 25, 2002 No. 966-10, according to which, due to the uncertainty of the legislative wording, two options for the payment of monetary compensation are possible. The choice is made by agreement of the parties. That is, the employer and the employee must agree on how many days of unused vacations in previous years to replace with monetary compensation.

Calculation of taxes on compensation for unused vacation

Personal income tax

When paying compensation for unused vacation, the employer is obliged to calculate and pay personal income tax from this amount ( clause 3 of Art. 217 of the Tax Code of the Russian Federation). Since compensation for unused leave upon dismissal must be paid to the employee on the day of dismissal ( Art. 140 of the Labor Code of the Russian Federation), then the tax withheld from it must be transferred to the budget when it is actually paid ( paragraph 4 of Art. 226 of the Tax Code of the Russian Federation( clause 6 of Art. 226 of the Tax Code of the Russian Federation).

Monetary compensation instead of a vacation exceeding 28 calendar days, paid at the request of the employee and not related to dismissal, as a rule, is paid along with the salary for the corresponding month ( clause 3 of Art. 226 of the Tax Code of the Russian Federation).

UST, contributions to the FIU and

compulsory social insurance

from industrial accidents

Subparagraph 2 of clause 1 of Art. 238 of the Tax Code of the Russian Federation it was determined that compensation for unused vacation paid to a retiring employee is not subject to UST ( letters of the Ministry of Finance of the Russian Federation dated 17.09.03 No. 04-04-04 / 103, UMNS in Moscow from 29.03.04 No. 28-11 / 21211), as well as contributions to compulsory pension insurance ( clause 2 of Art. 10 of the Federal Law of 15.12.01 No. 167-FZ) and contributions to compulsory social insurance against industrial accidents and occupational diseases ( p. 1 of the List of payments for which insurance premiums are not charged to the FSS of the Russian Federation, Further - Scroll,NS. 3 Rules of accrual, accounting and spending of funds for the implementation of compulsory social insurance against industrial accidents and occupational diseases).

For compensations paid upon written application of employees who continue to work in the organization, different taxation rules have been established. According to the Ministry of Finance, such payments are subject to unified social tax on a general basis ( letters of the Ministry of Finance of the Russian Federation dated 08.02.06 No. 03-05-02-04 / 13,dated 16.01.06 No. 03-03-04 / 1/24,UFNS for Moscow from 15.08.05 No. 21-11 / 57993). In addition, an accountant should not forget about contributions to the FSS.

note: Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 03.14.06 No. 106 clarified that Clause 3 of Article 236 of the Tax Code of the Russian Federation does not give the taxpayer the right to choose which tax (unified social or profit tax) to reduce the tax base for tax by the amount of the corresponding payments. In other words, if the taxpayer has the right to attribute compensation payments for unused vacation to the costs that reduce the taxable base for income tax, then he must charge the UST on them.

Example 3.

In accordance with Art. 119 of the Labor Code of the Russian Federation, the organization provides an employee with irregular working days with an annual additional paid leave, the duration of which is determined by the collective agreement and is 3 calendar days.

At the request of the employee (with the agreement of the administration), the part of the unused vacation exceeding 28 calendar days was replaced by monetary compensation .

Due to the fact that the specified compensation payment is taken into account for the purposes of taxation of profits on the basis of clause 8 of Art. 255 Tax Code, it should be subject to UST.

note: There are cases when local tax authorities insist on imposing UST compensation for unused leave, not related to dismissal, if this payment was not taken into account as expenses for profit tax purposes. It should be noted that the courts this issue take the side of taxpayers (see, for example, Resolutions of the Federal Antimonopoly Service of the UO dated 21.12.05 No. F09-5669 / 05-C2, CO from 15.12.05 No. A64-1991 / 05-10, SZO dated 28.01.05 No. A66-6613 / 2004).

Here is another opinion on this issue. But let us immediately note that it is quite risky and will inevitably lead to disputes with the tax authorities. The essence of this approach is as follows: based on nn. 2 p. 1 art. 238 of the Tax Code of the Russian Federation from the UST taxation all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of the representative bodies of local self-government, related to the implementation of natural person labor duties within the limits established in accordance with the legislation of the Russian Federation. Replacement of part of the annual paid leave with compensation is provided Art. 126 of the Labor Code of the Russian Federation... In tax legislation, the concept of compensation is not established, therefore it should be applied in the same sense in which it is used in the Labor Code of the Russian Federation ( clause 1 of Art. 11 Tax Code of the Russian Federation). Therefore, all the requirements established Art. 238 of the Tax Code of the Russian Federation, and there is no need to accrue UST on the amount of compensation paid according to written statements of employees (regardless of whether such payments are taken into account for profit tax purposes).

Since monetary compensation in return for part of the vacation exceeding 28 calendar days is provided Art. 126 of the Labor Code of the Russian Federation, and the Tax Code does not establish other rules, then by virtue of clause 1 of Art. 11 Tax Code of the Russian Federation The norms of the Labor Code of the Russian Federation are subject to application. Thus, in this case, all the requirements established Art. 238 of the Tax Code of the Russian Federation... Consequently, there is no need to charge UST on the amount of compensation paid at the written request of employees who continue to work in the organization (regardless of whether such payments are taken into account or not taken into account for profit tax purposes). There is also a positive arbitration practice in the considered case (see, for example, rulingsFAS SZO dated 04.02.05 No. A26-8327 / 04-21, from 07.11.05No. A05-7210 / 05-33). A taxpayer who has made a decision to replace a part of leave exceeding 28 calendar days with monetary compensation has the right to take this payment into account in labor costs in accordance with clause 8 of Art. 255 Tax Code... At the same time, the UST does not need to be charged for this payment.

Let's say a few words about contributions for compulsory insurance against industrial accidents: they are not charged for the amount of compensation for unused vacation ( p. 1 of the List).

Income tax

When calculating corporate income tax, the amount of monetary compensation for unused basic leave not related to dismissal, paid in accordance with labor legislation, is taken to reduce the tax base. The basis is clause 8 of Art. 255 Tax Code(cm., letters of the Ministry of Finance of the Russian Federationdated 16.01.06 No. 03-03-04 / 1/24, UFNS for Moscow from 16.08.05 No. 20-08 / 58249). Wherein, if the employer and employees have reached an agreement to pay monetary compensation for all days of unused vacations, then unused vacations are combined, including for those periods when the Labor Code of the Russian Federation was in force, which did not allow such compensation to be carried out, except for the dismissal of an employee.

As for monetary compensation instead of additionally provided under the collective agreement of vacations (that is, on the employer's own initiative), then such expenses are not taken into account for tax purposes. This point of view, in particular, is presented in Letter of the Ministry of Finance of the Russian Federation dated September 18, 2005 No. 03-03-04 / 1/284.

It should be noted that not all experts agree with it. The fact is that the Ministry of Finance, referring to Clause 24 of Art. 270 of the Tax Code of the Russian Federation, equated the cost of paying compensation to the cost of paying for vacations. But in the Tax Code of the Russian Federation, these concepts are separated: the amount of compensation for unused vacation is included in the composition of labor costs based on clause 8 of Art. 255 Tax Code, and vacation pay - according to clause 7 of Art. 255 Tax Code... At least for this reason, an equal sign cannot be put between them. At the same time in Art. 270 of the Tax Code of the Russian Federation it only refers to the cost of paying for additional vacations (and not compensation for unused vacations).

From the foregoing, it can be concluded that the Tax Code of the Russian Federation does not prohibit taking into account, when calculating income tax, the costs of paying compensation instead of additional vacations (regardless of whether such leave is provided by labor legislation or collective and (or) labor contracts). It is clear that such a point of view is unlikely to be accepted by the regulatory authorities, therefore, it is likely that you will have to defend your case in court.

There are categories of workers who, in accordance with the Labor Code and other federal laws, are granted extended basic leave, but they are not considered within the framework of this article.

Regulation on the peculiarities of the procedure for calculating the average wage, approved. Decree of the Government of the Russian Federation of 11.04.03 No. 213.

The collective agreement may establish a different settlement period for the payment of compensation for unused vacation (for example, 6 months, a year), if this does not worsen the situation of employees (Article 139 of the Labor Code of the Russian Federation).

Clause 28 of the Rules on regular and additional vacations, approved. By the People's Commissariat of Labor of the USSR on April 30, 30 (act in the part that does not contradict the Labor Code of the Russian Federation).

Resolution of the State Statistics Committee of the Russian Federation dated 05.01.04 No. 1.

If the employee had quit, for example, on 10.04.06, then compensation for the last part-time work month would not have been due to her, since she had been at the workplace for less than 15 calendar days.

You can't work without vacation, just like you can't work without lunch breaks or weekends.... This is prohibited by both common sense and the law. For each honestly worked year, according to the Labor Code, there are 28 vacation days.

And under harsh working conditions or a specific specialty of the employee, the legislation not only permits, but also obliges the employer to provide additional days off.

But what to do if you didn't manage to take a break from work for some reason? Is there compensation for unused vacation?

TC provides in this case 3 options when unused vacation can be replaced with monetary compensation:

- Receive compensation in cash for unused rest. upon dismissal or retirement, provided that the duration of the vacation does not exceed 28 days.

- Get compensation in cash for, if provided.

- Use a non-"leisure" vacation.

The principle of calculating the amount of monetary compensation is reflected in the 922nd Decree of the Government of Russia (dated December 24, 2007).

The amount of vacation pay and compensation for them directly depends on the amount of official income - salary, bonus for 12 months preceding legal leave or dismissal (retirement).

Example: a woman worked at an enterprise since May 1, 2014, after, in 2016, she was transferred to another organization. For the entire period of work, the woman has never used her vacation and therefore now she is entitled to compensation.

The employee's income for 12 months before the transfer was as follows:

- November 2015 - 10,000 rubles.

- December 2015 - 10,000 rubles.

- January 2016 - 10,000 rubles.

- February 2016 - 10,000 rubles.

- March 2016 - 10,000 rubles.

- April 2016 - 10,000 rubles.

- May 2016 - 10,000 rubles.

- June 2016 - 6316 rubles, the onset of vacation from June 20.

- July 2016 - 0 rubles.

- August 2016 - 0 rubles.

- September 2016 - 0 rubles.

- October 2016 - 0 rubles.

No bonuses were awarded... The total income was 76,316 rubles.

Now you need to decide on the billing period:

- Months fully worked - 7.

- The average number of days in the months worked is 29.3.

- Days worked in June - 19.

- The number of days in June is 30.

It turns out: 7 * 29.3 + 19 * 29.3 / 30 = 205.1 + 18.56 = 223.66 days.

Average daily income is defined as the sum of total income divided by the number of days in the billing period:

Average daily income is defined as the sum of total income divided by the number of days in the billing period:

76,316 / 223.66 = 341.21 rubles.

For the entire period of work from 2014 to 2016, a woman was entitled to 69.4 days of legal rest.

Since, according to the Labor Code, the average daily wage is retained for each vacation day, the compensation will be: 341.21 * 69.4 = 23 679 rubles 97 kopecks.

If the employee was on training, sick leave, business trip, and he was compensated for his expenses, then these amounts cannot be added to income and are not taken into account when calculating payments.

Important! If the vacation was not used in full, or the days of additional days off were not used, then the calculation is based on the actual remaining days.

Taxation

What is vacation pay or compensation for them? This is essentially the same income as wage... Are there any contributions? The organization is taxed on all employee income. ?

IN due to accruals in personal income tax, the employee receives 13% less... This interest will go to the tax office as income tax. The amount of compensation depends on the amount of deductions for insurance premiums and the pension fund. But they are paid from the employer's income and constitute 30% of the accrued employee compensation.

The Tax Code (Art.208,,) tells in more detail about the amounts of withheld amounts, 167th Federal Law and 184th Government Decree.

About breaking the law

Now about the sore point.

The problem faced by many leaving employees is did not pay compensation.

This is a gross violation of the Labor Law. and, on the basis of which the retiring employee carried out his activities and is equivalent to non-payment of wages.

If there is a suspicion that something was not paid in addition, pay attention to the certificate 2-NDFL... Upon dismissal, the accountant is obliged to issue this document. The certificate reflects all income, including vacation pay and compensation for them.

In the absence of charges for unused vacation, proceed as follows:

- Write a complaint to the employer with a demand for compensation for uncleared vacation.

- Apply to the Labor Inspectorate with a statement about the infringement of your rights... This can be done by sending an electronic application, a paper application, or during a personal visit to the inspection. Your appeal will be considered within 30 days. During this period, Employees Labor. The inspectors will make a request to your employer, find out the reason for the non-payment, and inform you in writing about the results of the inspection.

- Apply to the Prosecutor's Office... This appeal can be combined with an appeal to Labor. In the name of the Prosecutor of the place where the employer's organization is registered - i.e. by legal entity the address must write a statement with a complaint about the violation of your rights according to the Labor Code of the Russian Federation by the former director. The prosecutor's office will also conduct an inspection within a month.

- Going to court... Unlike the Labor Inspectorate and the Prosecutor's Office, the court will not be able to bring the employer to justice. But it is quite possible to oblige him to pay everything owed to the employee. The statement of claim also indicates the violated rights and puts forward a requirement to collect compensation from the former bosses for unused vacation. After a decision is made on the basis of a writ of execution, the employer's accounts will be seized and everything that he did not pay in addition will be paid to the employee.

About responsibility

Any delays in payments at the enterprise threaten the management with the need to pay interest.

In a situation with vacation pay and compensation for them, the director bears not only the obligation to pay the principal amount, but also for each day of delay, at least 1/300 of the current refinancing rate.

That is, the employer is financially obligated.

In addition, unscheduled inspections of the tax service and the Prosecutor's Office may be organized in relation to its activities.

Despite the fact that the vacation was invented to make life easier for the working population, not everyone uses it. We hope the information provided in the article will help you get compensation for unused rest.

Useful video

Is it possible to pay compensation for unused vacation? When is it possible? How to arrange it correctly? You will learn about this in the following video:

The Labor Code of the Russian Federation, namely, states that each member of the team has the right to annual leave.

At the same time, he has the opportunity to choose:

- use the rest time as intended;

- refuse vacation in favor of receiving monetary compensation.

Compensation and vacation pay are calculated in a specific manner, which is regulated by Article 139 of the Labor Code. This takes into account the size of the average salary and hours worked.

Thus, compensation for unused leave for leaving is a cash payment that the employee receives in the same amount as if he received them when using the leave. It is legally stipulated that a team member has the right to receive benefits in full.

However, if an employee leaves at will, there will be no other compensation and incentive payments for him.

The law of the Russian Federation provides 2 options for receiving compensation for rest in case of leaving:

- if the employee did not use rest at all;

- if he did not spend some part of his vacation in the current or previous years.

It's important to know. When calculating, the employer is obliged to issue all compensation that is due to the employee, regardless of the limitation period of this debt.

However, if the employee has already used all the rest and received vacation pay, but has not completed the year until the end (or at least 11 working months of the year), the excess amount of these payments will be withheld when calculating. The employer has all legal grounds for this.

It is worth considering. It is not uncommon for the vacation compensation paid upon dismissal to be confused with the compensation for the remainder of the compensation. However, these are not identical concepts. In the latter option, it is necessary to reimburse vacation days that exceed the obligatory 28 days. The rest of the cases are the reimbursement of the main vacation period.

This substitution is not permissible for some types of workers:

- pregnant women;

- minors;

- workers in hazardous or unhealthy work.

Features of vacation payments upon dismissal of their own free will

When making such payments, it is worth considering:

How are they paid?

Vacation compensation is based on the average daily salary for the current calendar year.

Example of an employee statement

If an employee decides to leave of his own free will, he must write a statement. It is compiled in any form. In the document you need to indicate your data, position and reason for leaving.

At the same time, it is not necessary to prescribe a claim for compensation for unspent vacation. These payments are by default laid down by law. However, this wording is necessary if the employee wants to take advantage of the leave before dismissal.

The letter of resignation is structured as follows:

- Hat;

- title;

- the main body of the text;

- date, signature of the employee.

Below is an example of the wording of this document.

Example of a resignation document

The dismissal order must be issued in the T-8 form. It contains the data of the employee, the reason for leaving, the date of dismissal, the signature of the employer and the seal of the company are put.

Below is an example of a document.

So, calculating compensation for unused rest is a multi-stage process that requires knowledge and experience from the accountant.

Useful video

Compensation for unused leave upon dismissal - in more detail in the video below:

In order to carry out the calculation correctly, you must strictly follow all the rules established by Russian legislation. It is important to remember that any deviation from the established norms leads to fines.

Every employee is entitled to 28 calendar days of paid annual leave. He has such a right after six months of work with one employer.

The vacation is provided according to the schedule, which must be approved no later than December 15 of the current year for the next year. The right to use does not depend on the calendar year, but on the working year, that is, from the moment the employee is hired. This is stated in the letter of Rostrud dated 12/18/2012 No. 1519-6-1.

If he was hired on November 15, 2017, then the right to use the full vacation arises in six months, that is, from 05/15/2018. In this case, the employee can "walk" for 28 calendar days, but he will receive "Vacation" in proportion to the hours worked.

The right to full leave and full “vacation pay” will arise only after 11 months of work, that is, from 10/14/2018.

In addition to the main vacation, there is also an additional one. It is provided to some categories of workers. For example:

- workers of the Far North and territories that have a similar status;

- workers working in hazardous working conditions;

- workers with hazardous working conditions;

- other categories of workers listed in Art. 116 of the Labor Code of the Russian Federation.

Both the main and additional leave are paid. The amount of vacation pay depends on the employee's average earnings for Last year... According to Art. 139 of the Labor Code of the Russian Federation, to calculate the average wage, all labor payments to an employee for the last calendar year are taken into account.

An employee has the right to receive compensation for unused vacation only in two cases.:

- upon dismissal for all unused vacation days;

- without dismissal for vacation days exceeding 28 calendar days. This is stated in Art. 127 of the Labor Code of the Russian Federation.

The amount of compensation for unused vacation depends on the number of days and on the employee's average earnings over the last year. The average salary of an employee for the year is calculated as the division of the actual salary for the year by 12 months and by a constant number of 29.3 - this is the average number of days in a month.

For example, an employee has 6 days of unused vacation in 2018. Over the past year, his total salary was 420,000 rubles.

The average daily salary of this employee is (420,000 / 12) / 29.3 = 1,194.5 rubles per day

For 6 days of unused vacation, he will receive 1,194.5 * 6 = 7,167.2 rubles.

Is it possible to receive compensation for the vacation and continue to work An employee can only receive compensation for unused additional vacation. To do this, he must write an application addressed to the employer or a person who is authorized by the employer to sign such applications.

The application is written in free form. If the company has developed a form for applications, then it is necessary to use it. The application must contain the following information:

- In the upper right corner, you must specify information about the employer and the applicant:

- the position of the employer's representative who has the right to sign such statements, and his full name. For example: "To the General Director of LLC" Petarda "KP Silyanov";<\li>

- position and name of the applicant. For example: "From the programmer ME Uvarov";

- Further in the center, you need to write the word "Application";

- Then the "body" of the statement. Here you need to indicate the main text, that is, a request to replace unused vacation days with monetary compensation. Also, here you need to indicate the reason for which additional vacation has arisen, its duration and period. You also need to specify Art. 126 of the Labor Code of the Russian Federation, on the basis of which such a right arises for an employee;

- Then the date of submission of the application and the signature of the employee himself.

Based on the application, the personnel officer issues an order and sends an order to the accounting department to pay compensation. The employee must familiarize himself with the order and put his signature on it.

Payment of compensation is made within 10 days after the acceptance of the application or on the day of payment of the next salary.

Replacing monetary compensation for vacation that does not exceed 28 calendar days is prohibited by law. But some employers are accommodating to workers, and pay them such compensation for those vacations that the workers "did not take off" over the past years.

Since this is prohibited by law, at the very first inspection by the labor inspectorate, the employer, as on entity, a fine will be imposed in accordance with Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation in the amount of 30 thousand rubles, and for general director as an official - the fine will be from 1,000 to 5,000 rubles.

The decision on the payment of compensation is made by the employer. This is his right, not his duty. This is stated in Art. 126 of the Labor Code of the Russian Federation, as well as in the letter of Rostrud dated March 1, 2007 No. 473-6-0.

Who and how makes money on import substitution and innovations in agriculture R

Who and how makes money on import substitution and innovations in agriculture R What is the industrial production index, its role and calculation

What is the industrial production index, its role and calculation Calculation of the design population of the city Term in metallurgy

Calculation of the design population of the city Term in metallurgy