Return on assets of existing equipment formula. Calculation and value of the indicator of capital productivity, calculation formula. Profitability of fixed production assets

For industrial enterprises, the most important factor in the analysis of financial and economic activity is the assessment of the return on investment. The organization's fixed assets are non-current assets, i.e., the funds invested in their purchase will be returned in stages, over several production cycles. Accordingly, the more efficiently they are used, the faster the company returns the invested own or borrowed financial resources. Founders, credit institutions, owners, when assessing the activities of an enterprise, consider indicators characterizing fixed assets. These include return on assets, return on investment, capital-labor ratio and capital intensity.

Characteristics of the return on assets ratio

To calculate the return on assets ratio, a single formula is used, the calculated values of the mathematical components can be adjusted depending on the purposes of calculating the indicator. The main rule for a correct analysis of the return on investment is to track the dynamics of the obtained value. For comparison, a base value can be used, taken as a single positive level for a particular enterprise, or the indicators of the current calendar period are compared with the previous one. Also, a prerequisite for the objectivity of the obtained coefficient are the units of measurement used in the calculation; they should not change in comparable periods (most often it is a thousand rubles). The procedure for calculating the indicator "capital productivity" - the formula for calculating this coefficient - implies that it refers to the values characterizing the turnover of non-current assets. Similarly, the renewal rate is calculated for inventory, receivables, IBE, and other types of assets involved in the production process.

Factors affecting return on assets

The value of the coefficient, which indicates the level of OPF turnover, is significantly influenced by a number of factors:

- The volume of products sold in a certain period (in some cases, the indicator of manufactured, manufactured products is taken into account).

- Performance of the main active part of the equipment.

- Decreased downtime, shorter shifts, days.

- The level of technical perfection of equipment and machines.

- OPF structure.

- Equipment load level.

- Increasing labor productivity and non-current assets.

Formula for calculating return on assets

The coefficient is calculated as the ratio of the released, manufactured (sold) products of the enterprise to the value of the OPF, as a result, an indicator is obtained that indicates how many products are produced (sold) per unit of funds invested in the OF. Let's look at the generalized calculation of the "capital productivity" indicator. The calculation formula is as follows: Fo = Vpr / Sof, where Fo is the total return on assets; Vpr - manufactured products for the selected period; Sof - the cost of fixed production assets. This calculation option is used to obtain a generalized indicator, which must be calculated for all production units, otherwise it will be necessary to specify the elements of the numerator and denominator.

Denominator adjustment

The capital productivity formula in the denominator contains such a value as the cost of fixed assets. To obtain a correct indicator, the values of the numerator and denominator must reflect the actual calculated data. The cost of fixed assets can be calculated as follows: OSav \u003d OSn + OSk / 2, i.e. the book value of the OPF at the beginning of the period is added to the data at the end of the period, then the resulting value is divided by 2 (to obtain the arithmetic mean). You can expand and specify this number by including in the calculation the cost of fixed assets acquired over the period, retired as a result of sale or complete depreciation. The same indicator changes in case of revaluation of funds. Many analysts prefer to use the value of the residual value of fixed assets - it can be defined as the difference between the book price at a certain point (account 01 in the balance sheet) and the amount of fixed asset depreciation (balance sheet account 02) accrued for the entire period of operation.

When taking into account the structure of the OPF, only active (participating in the production process) fixed assets, i.e. machines, machines, equipment, depending on the specialization of the enterprise, are taken into the formula for calculating the return on assets. From the total cost, the funds of the enterprise located on the reservation, leased, modernized and not operated during the analyzed period are taken away. As part of fixed assets, it is necessary to take into account leased or leased units of equipment. They can be reflected on off-balance accounts, so their value does not fall on account 01, which affects the receipt of incorrect data when analyzing such an indicator as capital productivity. The formula, or rather its denominator, must be increased by the value of the leased property.

Numerator adjustment

The volume of products manufactured in the analyzed period is necessarily adjusted for the amount of taxes, i.e. VAT and paid excises are deducted from the total volume of goods sold. Sold products in sum terms are indexed to the level of inflation in order to obtain comparable indicators. It is possible to use the average contractual prices for products sold to calculate the return on assets.

To calculate the return on assets ratio (the general formula was discussed above), the volume of products produced for a certain period can be structured by departments, by types of goods. In this case, output indicators should be correlated with the cost of fixed assets employed in the production of a particular type of product.

Analysis of the return on assets

The coefficient obtained in the calculation of capital productivity is analyzed by comparison with similar data obtained in other periods, or with the level of the planned indicator. The dynamics of the values will show an increase or decrease in the efficiency of the BPF operation. Positive dynamics indicates the proper use of fixed assets, which leads to an increase in production, and, consequently, sales (in the case of a stable level of demand). Lowering the calculated level of the return on assets is not always a negative aspect of the enterprise. Therefore, it is recommended to carefully weigh all the factors affecting its value. For the growth of capital productivity, if it is objectively necessary, several methods are used.

Ways to increase return on assets

In order to increase the capital productivity ratio, it is necessary to increase the efficiency of the operating system at current implementation rates. There are the following ways:

- Reduce equipment downtime by organizing multiple work shifts.

- Stimulation of personnel - a direct dependence of wages on output is introduced.

- Increasing the technical level of personnel - will make it possible to avoid downtime by reducing the number and time of repairs.

- Modernization of equipment, commissioning of more technologically advanced machines.

- Sale of mothballed equipment, write-off of machines with a high level of physical wear or obsolete.

These methods will allow you to gradually increase the economic result from investing financial flows in fixed production assets, without cutting back on

The efficiency of the company is determined by a number of important financial instruments, one of which is the return on assets.

Capital productivity of fixed assets: concept and meaning

In essence, capital productivity is a value that shows the amount of income per 1 ruble of the value of fixed assets directly or indirectly involved in the process of producing products or providing services. This indicator is involved in the analysis of the overall efficiency of the company, and is also used to assess the productivity of using the OS in production.

As a rule, they consider the return on assets in dynamics, comparing several time periods. This makes it possible for an economist to ascertain the completeness of the involvement of fixed assets in the work process, to identify unused facilities, the implementation of which will only improve the state of the company, or to control the processes of commissioning new capacities. Analysis of return on assets reveals the "bottlenecks" of investment and helps to determine an effective strategy for future investments in fixed assets.

Normative values of the indicator have not been established, but its decrease compared to the previous analyzed periods is a negative trend, indicating a decrease in the financial stability of the company as a whole and a drop in the efficiency of using fixed assets in particular. Each industry determines its industry average levels of permissible values of capital productivity and exceeding them by an individual company indicates an increase in competitiveness, and a decrease becomes an indicator of its decrease, although the introduction of new capacities or the reconstruction of existing ones can also lead to a temporary drop in capital productivity.

Return on assets: formula for calculating the balance sheet

To calculate the indicator, key reporting values are necessary - the amount of income received (more often revenue, since it reflects the results of sales, sometimes - profit) and the cost of fixed assets (more often the full cost, but with various analytical actions, there are idle infrastructure facilities or large volumes of work in progress - only directly used). The separation of the funds involved in the work process makes it possible to determine the production return on assets, the value of which is necessary for a basic analysis of production efficiency.

Thus, when calculating the return on assets, they use the indicators of the cost of fixed assets according to the balance sheet (line 1150 of the balance sheet) and revenue from the report on financial results (line 2110 OFR).

Return on assets - balance formula:

F o = p. 2110 / p. 1150

To obtain a more accurate result, experts recommend using the fixed asset cost indicator not at the end of the reporting period, but the average value, for example, the average annual cost, which is calculated by dividing by 2 the amount of fixed assets at the beginning and end of the year.

Profitability, return on assets and capital intensity

Another important indicator of the rational use of assets in a company is the return on assets, i.e. the ratio of book profit to the average annual cost of fixed assets, showing the amount of profit attributable to 1 rub. value of non-current assets. The return on equity is calculated using the formula:

F p \u003d line 2400 OFR / ((line 1100 balance at the beginning of the year + line 1100 balance at the end of the year) / 2).

In economic analysis, there is also an inverse indicator of capital productivity - capital intensity. It shows the cost of OS per 1 rub. manufactured product. Reducing the value of capital intensity is a positive trend in the development of the company, indicating the rational use of production assets. The formula for calculating capital intensity is the ratio of the cost of fixed assets to the income received, i.e. is the inverse of the return on assets formula:

F e = p. 1150 / p. 2110.

Calculation of the return on assets of an enterprise using an example

Let's calculate the return on assets based on the company's reporting data:

Average annual cost of OS:

For 2016 - 1387 tr. ((1236 + 1538) / 2);

For 2017 - 1494 tr. ((1538 + 1450) / 2);

For 2018 - 1376 tr. ((1450 + 1302) / 2).

Capital productivity of fixed assets:

In 2016 - 2.60 rubles. (3600 / 1387);

In 2017 - 2.54 rubles. (3800 / 1494);

In 2018 - 3.05 rubles. (4200 / 1376).

for 1 rub. The fixed assets of the company received income in 2016 of 2.60 rubles, in 2017 - 2.54 rubles, in 2018 - 3.05 rubles. Fluctuations in the rate of return on assets - a decrease in 2017 and an increase in 2018 compared to 2016 may indicate the introduction of new equipment or the reconstruction of equipment in operation. This is evidenced by an increase in the cost of fixed assets and a slight decrease in the return on funds (up to 2.54 rubles). An increase in the indicator to 3.05 rubles. in 2018 indicates an increase in output, labor productivity or rational use of fixed assets (in a combination of factors or separately).

When a company has unused in production, but socially necessary infrastructure facilities, an economist will have to calculate the return on assets minus the cost of these fixed assets in order to determine the return on assets of the fixed assets used in the production of goods.

Let's supplement the previous calculation with data: the average annual cost of unused fixed assets in 2016 is 320 thousand rubles, in 2017 - 302 thousand rubles, in 2018 - 284 thousand rubles.

The production return on assets will be:

In 2016 - 3.37 rubles. (3600 / (1387 - 320));

In 2017 - 3.19 rubles. (3800 / (1494 - 302));

In 2018 - 3.85 rubles. (4200 / (1376 - 284)).

The trend towards a decrease in the rate of return on assets in 2017 and an increase in 2018 continues, but the amount of income per ruble of fixed assets increased. This indicator reflects the income from fixed assets directly involved in production.

(efficiency of non-current capital) - a coefficient equal to the ratio of the value of manufactured or sold products after deducting VAT and excises to the average annual cost of fixed assets.

It is calculated in the FinEkAnalysis program in the Business Activity Analysis block as return on assets.

Return on assets - what shows

Shows what is the return on each ruble invested in fixed assets, what is the result of this investment.

Return on assets - formula

The general formula for calculating the coefficient:

Calculation formula according to the old balance sheet:

| K f = | p.010 |

| 0.5*(p.120 n + p.120 j) |

where line 010 is the line of the income statement (form No. 2), lines 120 n and line 120 k are the lines of the balance sheet (form No. 1) at the beginning and end of the reporting period.

Calculation formula according to the new balance sheet:

Return on assets - meaning

Return on assets is an indicator that reflects the level and effect of the operation of fixed assets. The value of the indicator depends on industry specifics, the level of inflation and the revaluation of fixed assets.

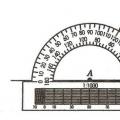

Return on assets - scheme

Was the page helpful?

Synonyms

More found about capital productivity

- Business activity of pharmaceutical industry enterprises: capital productivity rating for 2013 Business activity of pharmaceutical industry enterprises capital productivity rating for 2013 Svetlana Romanova

- Features of the analysis of fixed assets and financial investments on the basis of new reporting forms (explanations to the balance sheet and income statement) Evaluation of the efficiency of the use of fixed assets includes an analysis of capital productivity and profitability indicators, calculation of revenue increments associated with changes in the value of fixed assets, as well as changes in

- Influence of labor intensity on capital intensity. Yield and return on assets, capital-labor ratio Yield and return on assets, capital-labor ratio Artem Nikolsky OOO Research and Production Enterprise Stroytek Yekaterinburg Russia Labor Economics No. 3 2015

- Problems of analysis of fixed assets of an enterprise The next stage in the analysis of fixed assets is their performance indicators 3 Revenue Fixed assets 2012 4,068,014 1,012,164 4.02

- Monitoring and analysis of working capital on the basis of accounting (financial) statements of commercial enterprises It is considered normal when the growth rate of the volume of sold products exceeds the growth in the amount of working capital, indicating an increase in capital productivity and turnover of working capital, i.e. indicators of the efficiency of using funds invested in working capital

- To the problem of choosing criteria for analyzing the solvency of an organization Indicators of the effectiveness of the use of non-current capital and investment activity 4.1 Efficiency of non-current capital 4.2. Investment activity ratio 5. Indicators of profitability of capital and products 5.1. Profitability

- Features of the analysis of the fixed assets of the organization The indicators of the use of fixed assets include the return on assets of the federal district capital intensity of the financial unit capital return RB, etc. To calculate indicators characterizing the efficiency of the use of fixed

- Profitability analysis of the main activity of a trade organization P 1 0.1180 0.0768 0.0412 65.1 4 fixed and current assets RUB N F E 4.4518 3.5368 0.9150 79.4 5. Speed

- Matrix analysis FC -1500390.7 changes in capital productivity FO 2266026.8 Total change in the volume of proceeds from the activity of VD 1943970 PE FC - reflect

- Vector method for predicting the probability of bankruptcy of an enterprise In this work, 7 authors, based on the methods of analyzing hierarchies and econometrics, out of 36 financial coefficients of the methodology for assessing the viability of an organization 9, selected five financial coefficients of the model current liquidity ratio criterion of capital productivity profitability of the main activity net profit ratio of current assets to the amount of liabilities Number of experts

- Property complexes of industrial enterprises: methods of analysis and ways of improvement objects of the land and property complex

- Capital intensity Capital intensity - the financial coefficient inverse to capital productivity characterizes the cost of production fixed assets attributable to 1 ruble of production Data for its calculation

- Modeling of financial results on the basis of factor analysis Fund - return on assets Df l - financial investments at the end of the year Rf l - profitability of financial investments

- Valuation of shares and value of commercial organizations based on the new financial reporting model Inventory turnover ratio 10.64 10 10 10 10 10 10 0.67 0.53 0.53 0.55 0.55 0.55 0.55 Level of other net operating components assets in thousand rubles 3.885 3.879 3.404 -0.481 87.62 capital intensity thousand rubles 0.257 0.258 0.294 0.037

- Financial security of the company: an analytical aspect

- Evaluation of the effectiveness of the use of financial resources of the organizations of the agricultural sector of the region OAO Raduga Novopokrovsky district thousand rubles 1.39 1.18 1.79 1.45 Turnover of funds in calculations times 25.87 16.77 36.91

Return on assets is an indicator of the company's business activity, which demonstrates the efficiency of using the company's fixed assets. The value of the indicator indicates how many products are produced and services are provided for each ruble of financial resources invested in fixed assets. It is calculated as the ratio of sales (revenue) to the average annual amount of fixed assets. The residual amount of the value of fixed assets is taken into account.

Using this indicator, you can understand the efficiency of using the company's fixed assets.

Standard value:

It is desirable to increase the efficiency of using the company's fixed assets during the study period. There is no such standard value, however, it is worth comparing the value of the indicator with the values of competitors. Different industries are characterized by different indicators of capital productivity. For capital-intensive industries, this figure will be lower, for the service sector - usually higher.

Directions for solving the problem of finding an indicator outside the normative limits

To increase the value of the indicator, it is necessary to ensure 100% workload of the equipment. Another possible solution is to sell part of the unused fixed assets. It is advisable to do this only in the absence of prospects for further business growth.

The growth rate has a limit. If fixed assets are 100% loaded, then it is possible to increase the volume of production and sales only through the purchase of new equipment, and this will lead to some decrease in capital productivity in the short term.

Calculation formula:

Return on assets = Revenue / Average annual residual amount of fixed assets

Calculation example:

JSC "Web-Innovation-plus"

Unit of measurement: thousand rubles

Return on assets (2016) = 2472/ (748/2 + 793/2) = 3.21

Return on assets (2015) = 2019/ (793/2 + 973/2) = 2.29

The efficiency of fixed assets management in the company is growing. In 2015, goods were produced and services were provided in the amount of 2.29 rubles for each ruble of fixed assets used. In 2016, the indicator grows to 3.21 rubles. The reason for this trend is the optimization of the structure of fixed assets - the extra ones were sold. There is also an increase in sales volume.

The main property of laying corners definition

The main property of laying corners definition Finding the whole by its part Finding the whole by its share

Finding the whole by its part Finding the whole by its share Payroll in UPP 8

Payroll in UPP 8