Key discount rate. What is the difference between the key rate and the refinancing rate? What will the increase in the key rate lead to?

All banking institutions interact with consumers and partners through lending and providing the opportunity to open deposits. These services differ in the size of the lending rate (hereinafter referred to as the key coefficient), which fluctuates depending on the key rate set by the Central Bank of the Russian Federation. But the cooperation of banks with their partners, including the Central Bank, is characterized by the size of the refinancing rate.

Let's consider these concepts in more detail.

What is a key rate?

This indicator determines the percentage of the Central Bank, under which the regulator provides a commercial loan to banks. It also acts as the upper percentage limit that determines the amount of deposits. That is, the Central Bank of Russia changes the size of the key coefficient to stabilize pricing in the state and stimulate money circulation within the country.

The key coefficient is responsible for the formation of interest on consumer loans, affects, reducing its growth rate. And it establishes the amount of the penalty in case of non-fulfillment by the person of the credit obligations specified in the agreement with the bank.

By means of the base coefficient, the Central Bank influences:

- Bank liquidity, regulating it;

- Turnover of the money supply - reducing or increasing the size;

- Economic growth rate;

- Inflation scale, both currency and market;

- The term of the interest rate is seven days, the time for which the Central Bank provides a commercial loan to a banking institution.

What is the refinancing rate?

Bank lending (refinancing) is the annual percentage that a financial institution is obliged to return for received borrowed funds from the Central Bank. By setting the size of the refinancing rate, the Central Bank of the Russian Federation affects the interest rates for interbank transactions, increasing or decreasing the percentage on the loan. Thus, it is more profitable for the bank to repay the loan, which affects the decrease in the debt indicator.

Functions of the refinancing indicator:

- Sets the upper limit of interest rates on liquidity transactions.

- It is used when calculating the deduction of taxes and fees by the Central Bank.

- It is used to calculate the amount of fines, penalties, forfeits in case of refusal to fulfill credit obligations.

What is the difference?

The key rate and refinancing have different functions in the economy. The key is the main tool of the state's economy. It determines the monetary policy of the country, sets the level of inflationary processes and the amount of interest rates on consumer loans, and is responsible for the rate of economic growth.

Below the limits of the key indicator, the bank does not have the right to give a loan. Otherwise, a fine will be charged.

The refinancing rate performs fiscal functions. Its main tasks are to regulate the amount of tax deductions, fines, penalties for refusing to fulfill an employment contract, and to determine interest on loans.

Changes

With a decrease in the refinancing rate, the cost of a loan as a percentage decreases. That is, the percentage that is charged according to the terms of the contract will be much lower. In commensurate with this, there will be an increase in the purchasing power of citizens. But along with this, a change in the refinancing rate will provoke a depreciation of money, which will lead to an inflationary growth of the currency.

An upward change in the key position will result in an increase in interest on loans. That is, the number of loans will decrease due to the high interest rate, the market price of money will increase, and inflation will decrease.

Fluctuating rates affect the material well-being of each person. With an increase in the percentage of refinancing, a resident of the country will increase the purchasing power, but the price of money will decrease. When the key% jumps up, the price of money and the exchange rate of foreign currencies rise, and the purchasing power of the citizens of the state falls commensurately with this. Therefore, the regulator, represented by the Central Bank, decided to equalize the key rate and the refinancing percentage in the readings.

Today, these two indicators are the same, at the level of 7.75%.

Quick application form

Fill out the application now and get money in 30 minutes

Each organization, regardless of legal status and organizational form, is required to have a current account. The legislation does not require this from individual entrepreneurs, but it is very difficult to conduct commercial activities without it. All banking...

27.09.2014 14:40:29

Certificate of supporting documents (SPD)

Along with the certificate of foreign exchange transactions (CVO), the instruction of the Central Bank of the Russian Federation No. 138-I established the use of a certificate of supporting documents (SPD) as one of the forms of accounting for foreign exchange transactions. It spells out the procedure for submitting the SOP, defines cases ...

01.12.2014 08:49:55

Remote banking service (RBS)

The main direction of development of the modern banking sector is the introduction and development of remote banking systems based on electronic banking (e-Banking) technologies used throughout the world. Through differentiation from...

14.05.2014 14:15:18

Instructions: filling out the transaction passport

Relations with foreign partners are controlled by the Russian state through banking institutions through the provision of transaction passports by domestic entrepreneurs under concluded (previously drawn up) contracts or agreements ...

27.11.2015 17:26:14

How to check the participation of the bank in the CER, its registration in the DIA?

Since January 2004, Russia has launched a mechanism for insuring bank deposits of the population, designed to protect the savings of citizens in bank accounts and deposits in the country. For this, a special system of compulsory insurance was developed ...

22.10.2015 15:00:32

Blocking of current account by tax authorities

Violation of tax laws may cause the suspension of debit transactions on the company's current account. On what grounds is blocking an account legal, what articles of the Tax Code apply? The Concept Of The Reasons For The Intro...

08.11.2015 23:17:35

Arrest and blocking of bank accounts: who has the right?

The norms of Russian legislation provide for the possibility of imposing arrest and blocking of bank accounts for a number of reasons. “Who and for what reason has the right to arrest or block an account?” - a question that worries many. And rules...

02.12.2015 18:26:59

How do I accept credit card payments on the site?

By organizing bank card payments on the website of an online store, many companies manage to increase their efficiency. Let's try to figure out what you need to accept on the site for payment of bank cards of buyers.

Greetings! Practice shows that during a crisis, the demand for the services of financial consultants is growing. And yet - the number of search queries on financial topics jumps sharply. Users of Google and Yandex are beginning to actively ask for the interest on the bill, and shale oil.

In a crisis, every adult Russian with Internet access becomes an expert in the field of international economics. 🙂 And by the way, I don’t see anything wrong with that! Indeed, in complex terms and phenomena, you need to navigate at least at the level of a “teapot”.

Therefore, today I decided to talk about such an obscure thing as the discount rate. So, is a high discount rate good or bad?

The discount rate is the percentage at which the Central Bank of the Russian Federation (in Ukraine - the NBU) issues loans to banks and other credit institutions. Its second name is the refinancing rate.

It is considered one of the main instruments of the country's monetary policy. Many other indicators are tied to the discount rate. For example, the size of penalties and fines. If you have bank loans, then the contract will definitely contain a clause like “double the discount rate in the form of a penalty is charged for late payment”.

A lot of factors affect the refinancing rate:

- Inflation expectations

- Slowdown or acceleration of GDP growth

- The state of the monetary market

- Macroeconomic and budgetary processes

- Trends in the economic development of the country and others

Important point! There must be good reasons for raising or lowering the discount rate!

What does the discount rate affect?

The lower the refinancing rate, the more stable the country's economy. In the US, the Eurozone and Japan, the discount rate does not exceed 0.5-1%.

The question arises: “Why raise the refinancing rate at all?” The answer is simple: the discount rate is a consequence, not a cause, of the current state of the economy.

Let's take a simple example from life. When it's cold outside, we dress warmer. When the hot summer comes, we undress to a minimum. It would never occur to anyone to go outside in winter in shorts and a T-shirt to raise the air temperature by a couple of degrees.

So the refinancing rate is revised up or down, taking into account the current situation in the economy. Especially if the situation is difficult...

What affects the size of the discount rate? For example, the rate of inflation.

The simplest circuit looks like this. When incomes are fixed or falling, the prices of goods and services rise. The Central Bank raises the refinancing rate. Now Central Bank loans are more expensive for commercial banks. In response, banks are forced to raise interest rates on loans for their borrowers: individuals and legal entities.

The demand for expensive loans is falling along with the purchasing power of the population. After some time, the level of demand for goods and services also decreases. And the rise in prices for them automatically slows down or stops.

Conclusion. An increase in the discount rate leads to a decrease in inflation, but slows down the country's economic growth. And vice versa, a decrease in the refinancing rate “pushes” economic growth, but “accelerates” it.

Short-term effects of the discount rate hike

- Growth of interest rates on loans and deposits

I think you have noticed that after the news about the reduction of the refinancing rate, banks immediately announce a reduction in deposit rates. Some (for example, Sberbank) insure themselves in advance, and adjust rates based on.

The same can be said about loans. The most affordable mortgage for the population was during the period of low discount rates in Russia, and vice versa.

- Increase in fees and fines

Take, for example, a standard mortgage agreement. It contains at least two or three points, not in monetary terms, but linked to the size of the discount rate. Let's say the late payment penalty is calculated as "double the discount rate". Therefore, after its increase, the borrower-debtor will have to pay more.

The size of the refinancing rate is also important for those who regularly pay taxes. The daily penalty for late payment of tax fees is 1/300 of the refinancing rate. The higher the discount rate, the more it will cost the taxpayer each day of delay.

- Rise in the price of loans with floating rates

Some banks issue loans with floating rates. The interest on such loans depends on the discount rate of the Central Bank of the Russian Federation. But as practice shows, "floating" loans in the Russian market are less than one percent.

- Depreciation of the national currency

An increase in the discount rate in combination with a floating exchange rate, as a rule, leads to a devaluation of the national currency. Its face value against other currencies falls.

How is the discount rate different from the key rate?

In Russia, the refinancing rate was introduced in 1992. About how its meaning has changed over the course of 25 years, I will write below. And only in September 2013, the Central Bank simultaneously introduces the second indicator - the key rate.

What is the difference? The main task of the key rate is to control the inflation rate and monitor investment attractiveness. It determines the interest rate of the Central Bank on short-term weekly loans to commercial banks.

The key rate is also “responsible” for the value of deposits that the Central Bank accepts from banks for safekeeping. Unlike the discount rate, the value of the key rate is the middle of the interest rate corridor of the Bank of Russia at weekly REPO auctions.

In 2013, the Central Bank set the key rate at 5.5%. Until the end of 2014, its value was constantly growing and reached 11%.

Until September 2013, the refinancing rate played a major role in the conduct of monetary policy. However, the key rate turned out to be a more effective indicator.

And therefore, on January 1, 2016, the value of the discount rate of the Central Bank was equated to the value of the key rate of the Bank of Russia. Today, the refinancing rate is of secondary importance and performs only auxiliary functions.

So now you don’t have to bother with the question, what does the key rate have to do with the accounting rate? For the second year in a row, they are equal to each other. Suppose the news announced that "the Central Bank left the key rate at 10%." In practice, this means that the discount rate is also 10%. Its value has not been published since January 2016!

Why is the refinancing rate 10%?

Today, the discount rate of the Central Bank is exactly 10%. On February 3, 2017, the Board of Directors of the Central Bank decided to keep the key rate at the same level. Reasons for this decision: economic activity is recovering faster than previously expected.

In the fourth quarter of 2016, the GDP growth rate entered the positive area. Investment activity is recovering, unemployment remains at a low level. Poll data show that business and household sentiment is improving.

Inflation risks

Due to high political and economic uncertainty, there is a risk that inflation will not reach the target level of 4% in 2017. For example, temporary factors will cease to operate and the propensity of households to save will decrease. In this case, a "discount" at a discount rate of 10% will limit inflationary risks.

Inflation dynamics is in line with the forecasts of the Bank of Russia.

Annual inflation continues to decline due to the positive dynamics of the ruble exchange rate and a good harvest in 2016. In December, the rise in prices for all major groups of goods and services slowed down. According to the forecast of the Bank of Russia, by the end of 2017, annual inflation will slow down to 4%.

In the future, the refinancing rate will be reviewed simultaneously with the key rate of the Bank of Russia and by the same amount. I repeat: from January 1, 2016, the value of the discount rate is not published or announced!

Why is that?

On September 13, 2013, the Board of Directors of the Bank of Russia improved the system of monetary policy instruments. It was decided that the key rate now plays the main role in the bank's policy. And the refinancing rate is given a secondary role, and its value is given for reference.

How has the discount rate changed in Russia since 1992?

The Central Bank set the refinancing rate for the first time on January 1, 1992. The first discount rate was 20%. However, at such a "decent" level, it did not last long.

Six months later, the policy of the Central Bank changed - the rate had to be raised to 80%. And over the course of two years, its value gradually grew to a record 210% (at the end of 1993). Fortunately, there have never been more such crazy values in the history of Russia!

Until mid-1996, the discount rate fell from 200% to 80%. Until 2000, the refinancing rate "floated" in the range from 20% to 80%.

And only then began a steady reduction in the rate to adequate values. From 25% at the end of 2000, the refinancing rate was gradually reduced to 10% at the beginning of 2008. During the two crisis years, the Central Bank struggled with inflation and briefly raised the key rate to 11-13%.

Well, at the end of 2009, the Russian economy recovered from the consequences of the crisis. And the Central Bank again took a course to reduce the refinancing rate at which banks took loans from the Central Bank. The minimum discount rate of 7.75% was recorded in the second half of 2010. And until the end of 2015, the refinancing rate "floated" in the corridor of 7.75-8.25%.

However, with the advent of another crisis, the rate again had to be adjusted upwards. Since January 1, 2016, the Central Bank has revised its value three times: up to 11%, 10.5% and 10%, respectively.

By the way, the next revision of the key rate is scheduled for March 24, 2017. Subscribe to updates and share links to fresh posts with friends on social networks!

The terms "refinancing rate" and "key rate" are very close in meaning. The indicators of the refinancing rate and the key rate in 2016 became equal. So how are they different anyway?

Key rate and refinancing - differences

The concept of "refinancing rate" became relevant for Russia in 1992. After the collapse of the USSR, the country began to move towards the creation of a new banking system. The refinancing rate appeared in order to determine the interest rate at which the Central Bank (CBR) will issue short-term weekly loans to commercial banks. In addition, such a parameter as the refinancing rate had other functions:

- this is one of the indicators of the development of the country's economy;

- This is the amount by which taxes and fines are calculated.

But in 2013 there were innovations. At the initiative of the Bank of Russia, a new regulator of the economy has appeared - the key rate. The new term "took" the main function of the refinancing rate.

Since 2013, the key rate began to determine the amount of interest at which commercial banks are credited.

And the refinancing rate remains a function of the value by which tax payments, fines and penalties are calculated:

- the calculation of penalties for overdue tax payments is considered as 1/300 of the refinancing rate. The penalty is also calculated if the employer delays wages or other payments provided for by the Labor Code of the Russian Federation.

- It depends on the SR whether you need to pay tax on an open deposit or not. If the interest on the deposit is more than the amount of CP + 5%, then you will have to give part of the money to the tax treasury. If less, you don't have to pay anything.

- If the interest rate is not specified in the loan agreement, then it is equal to the amount of the SR (in force at the time of signing the agreement).

- Many fines also “repel” from the value of the indicator in question.

Summing up, we can say that the difference between the two types of bets is in their different functions. “More important” is the key rate that determines monetary policy. It is an instrument of influence on the country's economy and, in particular, on the level of inflation. The refinancing rate is a passive value that affects only the amount of certain tax charges.

Refinancing rate and key rate in 2019

From the moment the key rate was introduced and almost until the end of 2015, the refinancing rate kept the same indicator - about 8 percent. While the key rate "jumped" from 5 percent to 17 and then to 10.

At present, the words “key rate”, “refinancing” are heard more and more often. At the same time, these concepts are often confused even by professionals, not to mention "mere mortals".

The Central Bank, as the regulator of the state's monetary policy, has certain tools for this. One of the main ones is the discount rate. But at present, this concept includes two rates that are different in their functions: key and refinancing. Both have the same value and it is difficult to understand what their difference is, what they are used for.

So, even the Minister of Finance sometimes in his speeches, speaking about the key rate, used the concept of "refinancing rate".

In simple words about two rates

It would seem that both indicators mean the same thing, namely: the percentage at which the Central Bank finances commercial banks.

However, there are some nuances that distinguish one concept from another.

Before going into detail about the difference between the refinancing rate and the key rate, it is advisable to give a simple definition of both of them.

So, lately there has been confusion between the following concepts:

- key rate.

It represents the minimum allowable percentage at which the main bank of the country provides financing to credit institutions for a period of one week. - Refinancing rate.

It basically has only a reference value, to which the legislative acts of the country are attached.

The calculation of fines depends on the value of this indicator. Thus, when drawing up contracts, many counterparties prescribe the need to pay fines and other sanctions as a percentage of the refinancing rate, which before 01/01/2019 was 7.75%.

How is the refinancing rate different from the key

Despite the same size, each bet has its own definition and performs its tasks.

key rate

The key rate reflects the minimum interest rate set by the Central Bank for lending to commercial banks. It is characterized by dynamism and a high frequency of revision (minimum - once a week). A change in its value affects the economy by increasing or decreasing loans issued by commercial banks. An increase in the rate makes loans expensive, which reduces the pressure on the money supply and keeps inflation down.

A striking example of the impact on inflationary processes by changing the key rate was the period from the end of 2014, when the rate reached its maximum of 17%. This was due to a sharp depreciation of the ruble and the threat of a jump in inflation. This rise did not last long, and already in early 2015 the rate began to decline, reaching 11% in August. At that time, the change was justified, the task of curbing inflation was completed. But such sharp jumps have a negative impact on the economy. An increase in the key rate, and, consequently, an increase in the cost of loans, reduces their availability and reduces growth rates. This is especially true for small and medium businesses.

The value of the key rate is of interest not only to businessmen, it directly affects ordinary citizens as well. The higher the value, the more profitable it is to invest in bank deposits. This also affects inflation, people are interested in carrying money to the bank, reducing the free money supply.

It turns out that when determining the value of the key rate, the Central Bank has the task of finding a golden mean, when businesses will be able to receive loans for development at affordable prices, but restrain the growth of free money and, accordingly, inflation.

Refinancing rate

Refinancing rate - this discount rate determines the amount of interest that commercial banks must pay to the Central Bank for the use of money during the year. That is, it also determines the cost of loans for commercial banks, but for a long period, which, when it was introduced, was used to regulate inflationary processes.

Since its introduction, the refinancing rate has sometimes undergone very drastic changes. Initially, its size was 20%, but in the difficult 90s with sharp changes in the ruble exchange rate, the rapid growth of inflation could reach 200% or more. As the economy stabilized, the rate decreased and came to an acceptable value of 8.25% in 2012.

The refinancing rate is also used in fiscal policy to determine the amount of penalties and fines, the calculation of personal income tax when receiving income from deposits that exceed the discount rate plus 5%. The size of the rate becomes decisive in the calculation of fines for non-fulfillment of obligations under contracts.

Learn about the need to replace the "refinancing rate" with the concept of "key rate" in the video.

Key rate dynamics

The refinancing rate appeared in Russia in 1992. At that time, it was its value that determined the cost of borrowed funds. At the same time, it became a benchmark for calculating fines and penalties in the tax system, penalties for overdue payments in the field of public utilities.

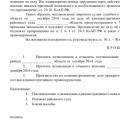

| Period | Meaning |

|---|---|

| September 14, 2012 - December 31, 2015 | 8,25 |

| December 26, 2011 - September 13, 2012 | 8 |

| May 3, 2011 - December 25, 2011 | 8,25 |

| February 28, 2011 - May 2, 2011 | 8 |

| June 1, 2010 - February 27, 2011 | 7,75 |

| April 30, 2010 - May 31, 2010 | 8 |

| March 29, 2010 - April 29, 2010 | 8,25 |

| February 24, 2010 - March 28, 2010 | 8,5 |

| December 28, 2009 - February 23, 2010 | 8,75 |

| November 25, 2009 - December 27, 2009 | 9 |

| October 30, 2009 - November 24, 2009 | 9,5 |

| September 30, 2009 - October 29, 2009 | 10 |

| September 15, 2009 - September 29, 2009 | 10,5 |

| August 10, 2009 - September 14, 2009 | 10,75 |

| July 13, 2009 - August 9, 2009 | 11 |

| June 5, 2009 - July 12, 2009 | 11,5 |

| May 14, 2009 - June 4, 2009 | 12 |

| April 24, 2009 - May 13, 2009 | 12,5 |

| December 1, 2008 - April 23, 2009 | 13 |

| November 12, 2008 - November 30, 2008 | 12 |

| July 14, 2008 - November 11, 2008 | 11 |

| June 10, 2008 - July 13, 2008 | 10,75 |

| April 29, 2008 - June 9, 2008 | 10,5 |

| February 4, 2008 - April 28, 2008 | 10,25 |

| June 19, 2007 - February 3, 2008 | 10 |

| January 29, 2007 - June 18, 2007 | 10,5 |

| October 23, 2006 - January 28, 2007 | 11 |

| June 26, 2006 - October 22, 2006 | 11,5 |

| December 26, 2005 - June 25, 2006 | 12 |

| June 15, 2004 - December 25, 2005 | 13 |

| January 15, 2004 - June 14, 2004 | 14 |

| June 21, 2003 - January 14, 2004 | 16 |

| February 17, 2003 - June 20, 2003 | 18 |

| August 7, 2002 - February 16, 2003 | 21 |

| April 9, 2002 - August 6, 2002 | 23 |

| November 4, 2000 - April 8, 2002 | 25 |

| July 10, 2000 - November 3, 2000 | 28 |

| March 21, 2000 - July 9, 2000 | 33 |

| March 7, 2000 - March 20, 2000 | 38 |

| January 24, 2000 - March 6, 2000 | 45 |

| June 10, 1999 - January 23, 2000 | 55 |

| July 24, 1998 - June 9, 1999 | 60 |

| June 29, 1998 - July 23, 1998 | 80 |

| June 5, 1998 - June 28, 1998 | 60 |

| May 27, 1998 - June 4, 1998 | 150 |

| May 19, 1998 - May 26, 1998 | 50 |

| March 16, 1998 - May 18, 1998 | 30 |

| March 2, 1998 - March 15, 1998 | 36 |

| February 17, 1998 - March 1, 1998 | 39 |

| February 2, 1998 - February 16, 1998 | 42 |

| November 11, 1997 - February 1, 1998 | 28 |

| October 6, 1997 - November 10, 1997 | 21 |

| June 16, 1997 - October 5, 1997 | 24 |

| April 28, 1997 - June 15, 1997 | 36 |

| February 10, 1997 - April 27, 1997 | 42 |

| December 2, 1996 - February 9, 1997 | 48 |

| October 21, 1996 - December 1, 1996 | 60 |

| August 19, 1996 - October 20, 1996 | 80 |

| July 24, 1996 - August 18, 1996 | 110 |

| February 10, 1996 - July 23, 1996 | 120 |

| December 1, 1995 - February 9, 1996 | 160 |

| October 24, 1995 - November 30, 1995 | 170 |

| June 19, 1995 - October 23, 1995 | 180 |

| May 16, 1995 - June 18, 1995 | 195 |

| January 6, 1995 - May 15, 1995 | 200 |

| November 17, 1994 - January 5, 1995 | 180 |

| October 12, 1994 - November 16, 1994 | 170 |

| August 23, 1994 - October 11, 1994 | 130 |

| August 1, 1994 - August 22, 1994 | 150 |

| June 30, 1994 - July 31, 1994 | 155 |

| June 22, 1994 - June 29, 1994 | 170 |

| June 2, 1994 - June 21, 1994 | 185 |

| May 17, 1994 - June 1, 1994 | 200 |

| April 29, 1994 - May 16, 1994 | 205 |

| October 15, 1993 - April 28, 1994 | 210 |

| September 23, 1993 - October 14, 1993 | 180 |

| July 15, 1993 - September 22, 1993 | 170 |

| June 29, 1993 - July 14, 1993 | 140 |

| June 22, 1993 - June 28, 1993 | 120 |

| June 2, 1993 - June 21, 1993 | 110 |

| March 30, 1993 - June 1, 1993 | 100 |

| May 23, 1992 - March 29, 1993 | 80 |

| April 10, 1992 - May 22, 1992 | 50 |

| January 1, 1992 - April 9, 1992 | 20 |

In 2013, a key rate was introduced for a more aggressive way of influencing inflationary processes. The size of the key rate upon introduction was 5.5%, which indicated the state's interest in providing businesses with low-cost loans and increasing investment attractiveness.

| Period | Meaning |

|---|---|

| December 17, 2018 | 7,75 |

| September 17, 2018 - December 16, 2018 | 7,50 |

| March 26, 2018 - September 16, 2018 | 7,25 |

| February 12, 2018 - March 25, 2018 | 7,50 |

| December 18, 2017 - February 11, 2018 | 7,75 |

| October 30, 2017 - December 17, 2017 | 8,25 |

| September 18, 2017 - October 29, 2017 | 8,50 |

| June 19, 2017 - September 17, 2017 | 9,00 |

| May 2, 2017 - June 18, 2017 | 9,25 |

| March 27, 2017 - May 1, 2017 | 9,75 |

| September 19, 2016 - March 26, 2017 | 10,00 |

| June 14, 2016 - September 18, 2016 | 10,50 |

| August 3, 2015 - June 13, 2016 | 11,00 |

| June 16, 2015 - August 2, 2015 | 11,50 |

| May 5, 2015 - June 15, 2015 | 12,50 |

| March 16, 2015 - May 4, 2015 | 14,00 |

| February 2, 2015 - March 15, 2015 | 15,00 |

| December 16, 2014 - February 1, 2015 | 17,00 |

| December 12, 2014 - December 15, 2014 | 10,50 |

| November 5, 2014 - December 11, 2014 | 9,50 |

| July 28, 2014 - November 4, 2014 | 8,00 |

| April 28, 2014 - July 27, 2014 | 7,50 |

| March 3, 2014 - April 27, 2014 | 7,00 |

| September 13, 2013 - March 2, 2014 | 5,50 |

After the introduction of the key refinancing rate, it lost its function as a regulator of the cost of loans, while retaining the role of an indicator for calculations. For a long time, the refinancing rate remained unchanged from 2013 to 2016 at the level of 8.25%. And only from January 1, 2016, the Central Bank of the Russian Federation decided that the refinancing rate is equal to the key one.

Conclusion

To summarize the above, we can determine what exactly is the difference between these two discount rates:

- The key rate acts as an instrument of the Central Bank for the formation of the state's monetary policy.

- The refinancing rate cannot have any influence on the policy pursued by the Central Bank of the Russian Federation.

- The refinancing rate remains as an indicator or reference material used to calculate fines and penalties. Its preservation made it possible not to change the text of many legislative documents, including the Tax Code of the Russian Federation.

Both rates are currently 7.75%.

Learn about the key rate of the Central Bank of the Russian Federation from the video.

In contact with

Mortgage rate cuts Will mortgage rates go down in

Mortgage rate cuts Will mortgage rates go down in Early loan repayment: what every borrower needs to know

Early loan repayment: what every borrower needs to know How to write a supervisory complaint in an administrative case

How to write a supervisory complaint in an administrative case