Application of the USN: norms and their practical implementation. STS taxation Changes on simplified taxation since the year

It is known for certain that under the short abbreviation STS, it is customary to understand the simplified taxation system, which is a special tax payment regime created to minimize the burden on small businesses. Russian entrepreneurs who decide to work on a simplified system automatically save themselves from complying with a number of maintenance requirements. The simplified taxation system was approved by federal bill No. 104-FZ and has been in force since July 24, 2002.

What is USN and who is it suitable for?

Speaking by the letter of the law, the simplified tax collection system is a set of indulgences for businessmen and entrepreneurs working in the segment of small and medium-sized businesses. It goes without saying that it is a priori beneficial for individual entrepreneurs, because it saves entrepreneurs from part of taxes and removes part of the requirements for bookkeeping and submission of reporting documentation.

However, sadly, not every entrepreneur can work on it. The bottom line is that in order to use all the indulgences, an entrepreneur must comply with a number of requirements and meet certain standards.

- The first and most important requirement for an employee of a small or medium-sized business is compliance with profitability, the level of which should not exceed sixty million rubles a year. Thus, entrepreneurs who have worked for a whole year according to this standard are entitled to apply to the tax office for transfer to the simplified tax payment system.

- The next, no less significant requirement for entrepreneurs who want to work on a simplified basis is the requirement for the staff. In accordance with this requirement, the number of employees working in the state of the enterprise should not exceed one hundred people. Accordingly, if the staff of the company is larger, there can be no talk of any transfer.

It should be emphasized that the work of entrepreneurs who have chosen simplified taxation is regulated by a whole chapter of the tax code of the Russian Federation No. 26.2, which applies not only to organizations, but also to companies.

- According to paragraph one of Article 346.14 of the Tax Code of the Russian Federation, the object of taxation under the simplified tax system is the profitability reduced by the amount of expenses. In addition, in accordance, in fact, with Article 346.20 of the Tax Code of the Russian Federation of interest to us, in a situation where income is the object of taxation, tax rates are automatically set and equal to six (6) percent.

- If the objects of taxation are income multiplied by the amount of expenses, the rate reaches a limit equal to fifteen percent.

The main essence of the simplified tax system, as well as its fundamental advantage, is that the process, starting with VAT and ending with property tax, is replaced by the payment of a simultaneous tax.

Advantages and disadvantages of the USN

The simplified taxation system in Russia, which began operating twelve years ago, has a number of undeniable advantages, among which a lightweight form of bookkeeping plays a significant role. Agree, it's important! In addition to the fact that under the simplified system, entrepreneurs pay uniform taxes, it has a whole host of features that are beneficial to every, without any exception, Russian businessman. At the same time, individual entrepreneurs pay an insurance premium under a single system, as well as fees for compulsory social insurance and, of course, land and transport taxes, respectively.

Accounting reports, as I have already emphasized above, are also kept by individual entrepreneurs according to a simplified scheme, which is better to devote separate lines to. However, despite the sea of \u200b\u200bmerits, it has the simplified tax system and minor flaws, which in general, few people pay much attention to. Entrepreneurs who have recently entered the business do not focus their attention on minor disadvantages at all, simply taking them a priori, that is, for granted.

However, the existing shortcomings of the simplified taxation system significantly hinder the possibility of switching to an easy regime for enterprises and factories engaged in the manufacturing sector of the economy of our country. Also, the transition to a simplified form is impossible for firms and companies operating in the middle segment of the market, which significantly complicates their economic cooperation with large factories and concerns. Any entrepreneur can transfer to the simplified taxation scheme or return to the classical regime, to which he is granted all the rights, but only subject to a certain number of conditions. On a voluntary basis, you can switch to doing business on a simplified basis, as I said, with strict observance of a number of legislative requirements. Significant restrictions on the transition to a simplified taxation scheme applicable to Russian entrepreneurs are disclosed in paragraphs 3, 8, 9, 11, 13 and 15 of Article 346.12 of the same Tax Code of the Russian Federation.

What system of taxation of IP to choose?

Very often, newly minted individual entrepreneurs face the difficult question of the choice they make in favor of the regular or simplified taxation system. So which of these systems is more profitable and what are the differences between them?!? These and other questions are answered below. So, when faced with a choice in favor of a standard or simplified tax system, first of all, determine the maximum limit for your annual profit, doing this with a simple business plan. In other words, in your choice, you should be guided by the level of profitability of your company, because it is it that guarantees net profit. If you do not have experience in writing a business plan, use the following scheme for making profitability calculations. Take as a basis the approximate amount of profit received and divide it by income. Remember that when choosing this object of taxation, as income equal to six percent, it is necessary to take into account the amount of payments to employees.

This requirement is explained by the third paragraph of Article No. 346.2, in fact, the Tax Code of the Russian Federation, in accordance, as expected, with which the taxpayer has the opportunity to reduce the amount of calculated taxes by individual indicators. According to the latest changes made to this article, these indicators are: the amount of the insurance premium for compulsory pension insurance and the amount of benefits for lack of working ability. Having thus calculated the profitability, it is possible to easily and naturally determine the most profitable version of the taxation system. Naturally, according to all standards and rules, the most beneficial is the simplified form of taxation, because it uses the formula for calculating the share of the single established tax, which does not change in the amount even under diverse business conditions. But, of course, the best solution to this important issue is to write a detailed business plan.

What changes in the USN in 2015 will occur in Russia?

In accordance with the latest news, next year for private entrepreneurs will be fraught with serious changes in the simplified tax system, which will come into force on the first (1) of January. Significant changes will affect mainly the payment of property tax, which, according to some experts, will cause a lot of noise in the community of individual entrepreneurs. In accordance with the amendments to the federal bill No. 52-FZ of April 2 of this year, Article 346.11 of the Tax Code of the Russian Federation has undergone significant changes. Now private enterprises will have to pay real estate tax, the tax base for which is determined by its cadastral value. For all other real estate objects, private enterprises are exempt from paying taxes. In addition, which in principle is not bad news, the simplified taxation system in Russia will not change in all regions, but only where there is a real estate tax based on cadastral value.

There is a special offer for visitors to our site - you can get a free consultation from a professional lawyer by simply leaving your question in the form below.

The list of these regions includes: Moscow, Moscow region, Kemerovo and Amur regions. Much, of course, will depend on whether the object of taxation is on the list of real estate, the basis for which is the cadastral value. Also, changes in the simplified taxation scheme will affect large real estate used for commercial centers, as well as buildings of administrative status. However, it should be emphasized that according to the new changes, the tax applies to real estate with an area of more than 5 thousand square meters, no less. Based on all these changes, we can draw a very pleasant conclusion. Not every region will be required to pay taxes under the new USN standards in 2015. Moreover, not every real estate object will be taxed. In other words, the segment of small business in Russia that does not fall under the new rules of the simplified tax system in 2015 will remain inviolable.

Many rules for the application of simplified taxation have changed since January 1. Increased income limits that allow you to stay on a special regime. Some companies have an obligation to pay property tax. And everyone who is on the “income minus expenses” facility got the right to write off more expenses. Let's deal with everything in order.

New income limits

For 2015, the deflator coefficient, by which the revenue limits must be indexed for simplification, is 1.147 (Order of the Ministry of Economic Development of Russia dated October 29, 2014 No. 685). Thus, companies whose incomes fit into 68,820,000 rubles can remain on simplified tax during 2015. (60,000,000 rubles × 1.147).

Companies planning to switch to a simplified system from 2016 need to ensure that income for the nine months of 2015 amounted to a maximum of 51,615,000 rubles. (45,000,000 rubles × 1.147). True, the Tax Code of the Russian Federation says that this 45 million limit must be indexed no later than December 31 of the current year by the deflator coefficient set for the next calendar year. From this we can conclude that in order to switch to a simplified system from 2016, a limit of 45 million rubles. must be multiplied by a larger coefficient that officials will set for 2016. But this approach is sure to lead to controversy. After all, the Ministry of Finance believes that it is necessary to apply the deflator that is in force in the current year (letter dated March 24, 2014 No. 03-11-06/2/12708). And in 2015 it is 1.147.

Property tax

Organizations on the simplified tax system since 2015 must pay property tax on real estate, the tax base for which is the cadastral value (clause 2 of article 346.11 of the Tax Code of the Russian Federation). The obligation to pay this tax arises from the company if three conditions are simultaneously met. First, the company owns an administrative business or shopping center or premises in it or non-residential premises used for offices and trade. Secondly, in the region where this object is located, the Law on the payment of property tax on the cadastral value of real estate is in force. And thirdly, the company's real estate is listed in a special list approved by the regional authorities (Article 378.2 of the Tax Code of the Russian Federation).

LIFO canceled

Simplified companies can no longer write off goods using the LIFO method when calculating tax. Legislators canceled it in order to bring tax accounting closer to accounting. After all, this method has not been in accounting for a long time. Therefore, companies that evaluated goods in this way in 2014 must choose one of the remaining three (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation as amended by Federal Law No. 81-FZ of April 20, 2014):

According to the cost of the first by the time of acquisition (FIFO);

At an average cost;

At the cost of a unit of goods.

There is no need to recalculate the balances of goods that are listed in the company's records as of January 1. In 2015, they need to be written off according to the new rules, which the company needs to approve in its accounting policy.

Interest on loans is no longer standardized

Companies on the simplified tax system since 2015 with the object “income minus expenses” have the right to fully include interest on loans and borrowings in the tax calculation. They need to be normalized only if the parties to the agreement are interdependent and the transactions (loan agreements) concluded between them are recognized as controlled (clause 2 of article 269 of the Tax Code of the Russian Federation).

On simplified taxation, interest must be included in expenses according to the same rules as when calculating income tax (clause 2 of article 346.16, article 269 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 11, 2013 No. 03-11-11 / 21720 ). Since 2015, for companies on the common system, the rule on rationing interest has been abolished. Accordingly, it is not necessary to apply it to simplified companies. And this also applies to contracts concluded before 2015. Interest accrued under these contracts from January 1 can be included in expenses in full on the date they are paid to the creditor.

Compensation can now be written off

On a simplified taxation system, labor costs can include all the same payments as when calculating income tax (subclause 6, clause 1, clause 2, article 346.16 of the Tax Code of the Russian Federation). From January 1, 2015, the list of labor costs includes severance benefits that an employee receives upon termination of an employment contract by agreement of the parties (clause 9, article 255 of the Tax Code of the Russian Federation). And this means that such payments can be taken into account without risk on a simplified basis. The main thing is that the condition for them should be in the employment contract with the employee or in a separate agreement, including the termination of the employment contract, as well as a local act, for example, a regulation on remuneration.

The Ministry of Finance of Russia has previously allowed the inclusion of compensation in labor costs, provided for by an additional agreement to the employment contract (letter dated July 16, 2014 No. 03-03-06/1/34828). But the tax authorities believed that such payments can be taken into account only if they are of an industrial nature and are related to the regime and working conditions of the employee (letter of the Federal Tax Service of Russia dated July 28, 2014 No. GD-4-3 / 14565).

Important numbers

RUB 68,820,000- an income limit that allows you to work on simplified tax until the end of 2015

RUB 51,615,000- an income limit that allows you to switch to simplified taxation from 2016

VAT declaration for simplifiers

From January 1, 2015, simplified companies that issue VAT invoices must reflect the data of each of them in the VAT return (clause 5.1, article 174 of the Tax Code of the Russian Federation). For this, section 12 is allocated in the new form of the declaration. And you will need to submit it starting from the reporting for the 1st quarter of 2015 no later than April 27th. And in electronic form. Tax authorities have the right to block the account for non-submitted and paper reporting(clause 11, article 76 of the Tax Code of the Russian Federation).

By the way, it will now be quite easy for inspectors to find out that a company issues VAT invoices on a simplified basis, but does not report and transfers it to the budget. Since all invoices (both incoming and outgoing) are now reflected in the declarations, the tax authorities will see the VAT claimed for deduction from the buyer.

Intermediary invoice journal

Under the new rules, intermediaries in special regimes, including on a simplified system, must submit to the inspection a register of invoices in electronic format (clause 5.2 of article 174 of the Tax Code of the Russian Federation). Keeping a journal was required before. And from January 1, there was an obligation to hand it over to the Federal Tax Service. Deadline - no later than the 20th day of the month following the reporting quarter.

The new rule applies to the following intermediaries.

First, on agents and commission agents acting on their own behalf.

Secondly, for developers.

Thirdly, for forwarders who include only intermediary remuneration in their income.

The new rule is effective January 1st. Despite this, the Federal Tax Service told us that for the first time, intermediaries would need to hand over the register only after the results of the first quarter. So the deadline is April 20th.

The simplified tax rate directly depends on the object of taxation chosen by the taxpayer. At the same time, specific rates of the simplified tax system are set by the subjects of the Federation. What simplified tax rates are provided for by law, we will consider in the material below.

What are the tax rates for simplistic

The tax rate under the simplified tax system is established by Art. 346.20 of the Tax Code of the Russian Federation and for the general case of applying this system, depending on the object of taxation, it is taken equal to:

- for the object "income" - 6% of the total value of income for the entire tax period;

- for the object "income from which expenses are deducted" - 15%.

For both objects of taxation, it is permissible to apply reduced rates if a decision on this is made in the corresponding region of the Russian Federation. Rates can be differentiated by categories of taxpayers, and in some cases - by type of activity. A taxpayer for whom a differentiated rate applies in the region where he carries out business activities does not need to prove the right to it or notify the tax authority of its application (letter of the Ministry of Finance of Russia dated 10.21.2013 No. 03-11-11 / 43791). The financial department, justifying its answer, indicated that the differentiated rate is not a benefit, therefore, it will not be necessary to confirm the right to it before the fiscal authority.

The generally acceptable value of reduced rates is in the interval:

- for the object “income” - from 1 to 6%, and their application has become possible only since 2016 (clause 1, article 2 of the law “On amendments ...” dated July 13, 2015 No. 232-FZ);

- for the object “income minus expenses” - from 5 to 15%, and for the Republic of Crimea and the city of Sevastopol for the period 2017-2021 it can be even lower (up to 3%).

Some taxpayers may apply a zero rate. These include newly registered individual entrepreneurs operating in the industrial, social or scientific sphere (and since 2016 in the field of personal services to the population), for the first 2 periods of work from the date of state registration as an individual entrepreneur, regardless of the chosen object of taxation.

If, calculated from the rate established in the region, the USN tax turns out to be less than 1% of the income received during the tax period, the taxpayer using the “income minus expenses” object becomes obliged to pay the minimum tax (clause 6 of article 346.18 of the Tax Code of the Russian Federation). Its amount will be equal to 1% of the income received for the period, even if the activity turned out to be unprofitable.

What special tax rates under the simplified tax system are valid in 2015-2021

After the entry into force of the law "On amendments ..." dated December 29, 2014 No. 477-FZ in Art. 346.20 of the Tax Code of the Russian Federation were added paragraphs. 3 and 4. In accordance with them, from the beginning of 2015 until the beginning of 2022, some taxpayers are provided with preferential taxation conditions under the simplified tax system.

In paragraph 3 of Art. 346.20 of the Tax Code of the Russian Federation it is mentioned that for the period 2017-2021 for taxpayers (all or some specific categories) of the Republic of Crimea and the city of Sevastopol, the rate for simplified taxpayers who have chosen the base "income minus expenses" can be reduced to 3% (see changes in paragraph 3 of article 346.20, introduced by law No. 232-FZ of July 13, 2015).

The right to apply the 0% rate from 2015 until the end of 2020 was given to individual entrepreneurs who first started their business not earlier than 2015 (clause 4 of article 346.20 of the Tax Code of the Russian Federation) and leading it in the social, scientific or industrial sphere (and since 2016 year according to the additions made by the law of July 13, 2015 No. 232-FZ, and in the field of personal services).

This benefit is given to an individual entrepreneur for 2 tax periods (years) from the date of registration and is valid if the share of the entrepreneur's income for the tax period for the type of activity for which the 0% rate is applied under the simplified tax system was at least 70%. The law of the region for the application of a zero-rate IP may establish other restrictions.

With a reasonable application of the 0% rate, the IP is not required to pay the minimum tax calculated at the rate of 1% of income on the simplified tax system with the object “income minus expenses”.

Specific types of services that are subject to preferential taxation for such newcomer entrepreneurs are established by the subjects of the Federation in the relevant legislative acts.

Features of the application of rates under the simplified tax system "income" in 2018-2019

When choosing the object of taxation of the simplified tax system "income", the rate, unless otherwise established in the region, will be 6%.

Since 2016, in accordance with the law of July 13, 2015 No. 232-FZ, the rates of the simplified tax system for the object “income”, when the relevant laws are approved by the subject of the Russian Federation, can be reduced and set in the range from 6 to 1%. In order to find out what rate under the simplified tax system "income" is set in the subject of the taxpayer for the current year, he needs to familiarize himself with the relevant current local law.

In the Republic of Crimea and the city of Sevastopol, which have the right to apply special reduced rates, for the object "income" the laws of the regions for the period 2017-2021 set a rate equal to 4% (law of Crimea dated October 26, 2016 No. 293-ZRK / 2016, law of Sevastopol dated 03.02.2015 No. 110-ЗС). In Sevastopol, for taxpayers engaged in crop production, fish farming, education, healthcare, etc., the rate is 3%.

Read more about the special regime of the simplified tax system with the object "income" in the material “STS income in 2018 (6 percent): what you need to know?” .

Features of the application of rates under the simplified tax system "income minus expenses" in 2018-2019

On the simplified tax system, the tax rate for the object “income minus expenses” chosen by the taxpayer, unless otherwise established in the region, is 15%.

Subjects of the Federation may, by their law, establish reduced rates (but not less than 5%) for various groups of taxpayers. In order to find out what rate under the simplified tax system "income minus expenses" is set in the subject of the taxpayer for the current year, he needs to familiarize himself with the relevant current local law.

In the Republic of Crimea and the city of Sevastopol, which have the right to apply special reduced rates, for the object "income minus expenses" the laws of the regions set a rate equal to 10%. In Sevastopol, for certain categories of taxpayers, the tax rate is 5%.

Read more about the special regime of the simplified tax system with the object "income minus expenses" in the article "STS "income minus expenses" in 2017-2018" .

Results

The tax rate under the simplified tax system is determined by the type of object of taxation chosen by the taxpayer. In general, this is 6% for the "income" object and 15% "income minus expenses". Local authorities have the right to reduce rates down to zero for newly registered entrepreneurs.

The article discusses the main changes in the payment of the simplified tax system in 2015.

Exemption from corporate property tax when applying the simplified tax system does not apply to objects whose tax base is determined as their cadastral value.

Organizations applying the simplified tax system are exempt from paying corporate property tax (clause 2, article 346.11 of the Tax Code of the Russian Federation). From January 1, 2015, this exemption does not apply to real estate objects in respect of which the base for corporate property tax is determined as the cadastral value. Recall that in accordance with paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation, this property includes, in particular, administrative, business and shopping centers, non-residential premises intended (used) for accommodating offices, shopping facilities, catering facilities or consumer services, as well as residential buildings and residential premises that are not accounted for in accounting as fixed assets.

Removed LIFO method

The provisions of the Tax Code of the Russian Federation, which provide for the use of the LIFO method to determine the amount of expenses, became invalid as of January 1, 2015. The relevant rules are excluded from paragraphs. 2 p. 2 art. 346.17 of the Tax Code of the Russian Federation.

An entrepreneur applying the simplified tax system is not exempt from the property tax of individuals in relation to individual objects that are used in entrepreneurial activities.

As a general rule, when applying the simplified tax system, individual entrepreneurs are exempted from paying a number of taxes. In particular, in paragraph 3 of Art. 346.11 of the Tax Code of the Russian Federation provides for exemption from property tax for individuals in respect of property used in entrepreneurial activities. Since January 1, 2015, an exception has been established from this rule: this exemption does not apply to objects of taxation on the property of individuals included in the list, which is determined in accordance with paragraph 7 of Art. 378.2 of the Tax Code of the Russian Federation, taking into account those provided for in paragraph 2 of clause 10 of Art. 378.2 of the Tax Code of the Russian Federation features.

As a reminder, we are talking about the following property:

- administrative, business and shopping centers (complexes) and premises in them, as well as non-residential premises intended or actually used to accommodate offices, shopping facilities, public catering facilities and consumer services, the list of which is established by the authorized executive body of the constituent entity of the Russian Federation (clause 1 and 2 paragraph 1, paragraph 7 of article 378.2 of the Tax Code of the Russian Federation);

- real estate objects formed during the year as a result of a division or other action in accordance with the legislation of the Russian Federation with real estate objects included in the said list, if such objects meet the requirements of Art. 378.2 of the Tax Code of the Russian Federation (paragraph 2, paragraph 10 of Article 378.2 of the Tax Code of the Russian Federation).

In relation to the listed objects, from January 1, 2015, by virtue of paragraph 3 of Art. 402 of the Tax Code of the Russian Federation, the base for the property tax of individuals is calculated as their cadastral value using a tax rate in the amount established by the regulatory legal acts of the representative bodies of municipalities (the laws of federal cities) and not exceeding two percent.

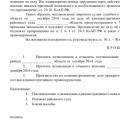

"On Amendments to the Law of St. Petersburg "On the Establishment of a Tax Rate on the Territory of St. Petersburg for Organizations and Individual Entrepreneurs Applying a Simplified Taxation System" (Law of St. Petersburg dated July 2, 2014 No. 379-72).

Establish on the territory of St. Petersburg for organizations and individual entrepreneurs applying the simplified taxation system, if the object of taxation is income reduced by the amount of expenses, a tax rate of 7 percent. This Law of St. Petersburg shall enter into force on January 1, 2015.

On the establishment of deflator coefficients for 2015 (Order of the Ministry of Economic Development of Russia dated October 29, 2014 N 685).

The deflator coefficient used for the purpose of applying the simplified tax system is set at 1.147. This coefficient is used to adjust the amount of the maximum income of the organization received for nine months of the year in which the notification of the transition to the specified regime is submitted.

Accordingly, in 2015 the upper limit of receipts, giving the right to apply the simplified tax system from 2016, will be RUB 51.615 million

In a similar manner, the amount of income for the reporting (tax) period is adjusted, above which the taxpayer loses the right to apply the simplified tax system. In 2015, this amount of income is determined at the level RUB 68.82 million

New declaration form (Order of the Federal Tax Service of Russia dated 04.07.2014 N ММВ-7-3/ [email protected]).

Starting from the 2014 tax period, taxpayers applying the simplified tax system must submit declarations in a new form. This form and the procedure for filling it out, as well as the format for submitting the corresponding declaration in electronic form, are approved by the Federal Tax Service of Russia.

The new declaration form has more sections. This, in particular, is due to the fact that the completion of the sections devoted to the calculation of tax and the calculation of the amount of tax payable depends on the object of taxation chosen by the taxpayer. So, payers using the simplified tax system with the object "income" fill out sections 1.1 and 2.1, and taxpayers with the object "income minus expenses" - sections 1.2 and 2.2. In addition, a new section has appeared, provided only for taxpayers who have received property (including cash), works, services in the framework of charitable activities, targeted revenues, targeted financing.

Regarding new lines, the following should be noted. Sections 1.1 and 1.2 specify that the amounts of advance payments for tax payable and deductible must be indicated by the deadlines of April 25, July 25 and October 25 of the reporting year. And in sections 1.2 and 2.2, in addition to the amount of income received (expenses incurred, as well as losses received in the past and previous periods) for the tax period, the named indicators for the first quarter, six months and nine months should be reflected.

In addition to the amount of calculated tax for the tax period, the amounts of advance tax payments for the reporting periods are given. STS payers who have chosen the object "income" must similarly include in the declaration the amount of insurance premiums, benefits and payments under voluntary personal insurance contracts.

Columns appeared on the title page, which are filled in if the successor submits a declaration for the reorganized company.

In addition, in sections 1.1 and 1.2, instead of the OKATO code, the OKTMO code is entered. The previously valid declaration form for tax paid in connection with the application of the simplified tax system has become invalid.

To pay contributions at a reduced rate for the simplified tax system, only one main type of activity is allowed (Letter of the Ministry of Labor of Russia dated September 18, 2014 N 17-4 / B-442).

Organizations and entrepreneurs using the simplified tax system cannot sum up income from several preferential activities in order to pay insurance premiums at a reduced rate. This conclusion follows from the considered Letter of the Ministry of Labor of Russia.

By virtue of clause 8, part 1, part 1.4, 3.4 of Art. 58 of the Law on Insurance Contributions, companies and entrepreneurs who apply the simplified tax system and operate in the industrial and social sectors are entitled to pay insurance premiums at a reduced rate. In paragraph 8 of part 1 of Art. 58 of the Law on Insurance Contributions lists the relevant activities. The procedure for determining the main activity is regulated by Part 1.4 of Art. 58 of the Law on Insurance Contributions.

In the letter under consideration, the Ministry of Labor of Russia clarified that only one type of activity with a share of income from its conduct of at least 70 percent is recognized as the main one. In other words, a payer of contributions carrying out several preferential types of activities, the income from which exceeds the specified value in aggregate, but does not exceed it individually, is not entitled to apply reduced rates of insurance premiums. Note that such a conclusion follows from the literal interpretation of Part 1.4 of Art. 58 of the Law on Insurance Contributions. A similar point of view is contained in the Decree of the Federal Antimonopoly Service of the Volga District dated January 30, 2014 N A65-4392 / 2013 ( By the definition of the Supreme Arbitration Court of the Russian Federation dated May 27, 2014 N VAC-6208/14 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation).

As follows from the Decree of the Federal Antimonopoly Service of the Volga District dated July 14, 2014 N A12-21975 / 2013, the right to use a reduced rate depends on the main type of activity. It can be only one type of activity listed in paragraph 8 of part 1 of Art. 58 of the Law on Insurance Contributions.

Letters from the Federal Tax Service

- The amounts of taxes under the simplified tax system or UTII are reduced by insurance premiums paid in the amount of 1 percent of the amount of income of an individual entrepreneur in excess of 300,000 rubles. Letter of the Federal Tax Service of Russia dated 16.01.2015 N GD-4-3 / [email protected]

- If an organization using the "income-expenditure" simplified taxation system, at the end of the year, received a loss, and switched to OSNO from the new year, then "general" income cannot be reduced by a "simplified" loss. It will be possible to take into account losses only by returning to simplified taxation. Letter of the Ministry of Finance of Russia dated 05.11.2014 N 03-11-06/2/55687

- If the buyer indicated VAT in the PP, then the simplifier does not have to pay VAT on such a sale. Letter of the Ministry of Finance of Russia dated November 18, 2014 N 03-07-14 / 58618

- Individual entrepreneurs using the simplified tax system or UTII, who do not have employees, have the right to reduce the amount of the calculated tax when applying the specified taxation regimes for insurance premiums to the PFR and FFOMS in a fixed amount. Letter of the Federal Tax Service of Russia dated 16.01.2015 N GD-4-3 / [email protected]

- It was reported that taxpayers - individual entrepreneurs who do not have employees, have the right to reduce the amount of the calculated tax for the 1st quarter of 2013 by the amount of insurance premiums paid in this period, as well as by the amount of repaid debt on payment of insurance premiums for the reporting periods of 2012. Letter of the Federal Tax Service of Russia of October 31, 2014 N GD-4-3 / [email protected]

- A commission agent on the simplified tax system who buys goods for a committent is not required to keep books of purchases and sales. Letter of the Ministry of Finance of Russia dated September 30, 2014 N 03-07-14 / 48815

- The costs of a special assessment of working conditions (attestation of workplaces) are not included in the costs taken into account when applying the simplified tax system. Letter of the Federal Tax Service of Russia dated July 30, 2014 N GD-4-3 / 14877

- Simplifiers can take into account land tax in expenses. Letter of the Ministry of Finance of Russia dated September 13, 2013 N 03-04-05 / 37924.

Sole proprietors may apply different taxation systems. The simplified system (STS) remains popular in 2015, despite the changes that have come into force. From this year, you need to pay property tax at the cadastral value.

STS is a simplified taxation system that can be applied to companies with a small turnover and individual entrepreneurs. It was introduced in 2002.

When applying the simplified taxation system in 2015, an individual entrepreneur is exempt from paying:

- Personal income tax on earnings received from entrepreneurial activity (with the exception of dividends);

- tax on the property of individuals, if it is used for business;

As for the absence of VAT, not all counterparties like to work with individual entrepreneurs on a simplified basis. This situation needs to be able to explain intelligibly:

Tax rates in 2015

The amount of tax deductions is calculated according to a simplified algorithm. Depending on the object of taxation, there are 2 types of simplified tax system:

You can choose any option. In a number of regions, reduced rates are applied, in particular in the Crimea and Sevastopol, the tax on "Income" is 3%. Reduced rates for "Income minus expenses" are valid in most regions of the Russian Federation.

How to count?

6%

All IP revenue received in the course of doing business is considered. 6% is subtracted from the result. This is the value of the tax. It can be reduced by the amount of contributions. If there are no employees, then it is allowed to do this up to 100%, otherwise only up to 50%. If there were advance payments during the year, they are deducted from the tax amount.

Do not forget that the individual entrepreneur must pay contributions for himself in any case, regardless of whether the activity was carried out.

15%

Another mathematical action appears: you need to subtract expenses from the revenue and take 15% of this amount. Next, subtract fees and down payments.

You do not need to pay tax, because the amount of contributions is greater than the amount of tax.

USN 6% turned out to be more profitable. 15% will be more interesting with a large amount of expenses.

How to switch to simplified?

You can apply for the simplified tax system in parallel with the application for. If the activity has not yet been carried out, this is allowed to be done no later than 30 days from the date of registration. In this case, the simplification will be applied immediately.

However, if the company was on the OSNO, which is applied by default, then you can switch to the simplified tax system if the revenue for 9 months from the beginning of the year amounted to less than 45 million rubles. and 60 million for the tax period (year). The application must be submitted to the Federal Tax Service (Inspectorate of the Federal Tax Service) before December 31.

Individual entrepreneurs cannot apply the simplified tax system:

- with income for 9 months more than 45 million;

- working with branches and representative offices;

- certain areas of activity (notaries, pawnshops);

- payers of the unified agricultural tax.

If an entrepreneur can no longer apply simplified taxation, he automatically becomes an OSNO payer. No applications are needed.

Innovations in 2015

The main innovations were property tax and cadastral value.

A number of changes to the Tax Code of the Russian Federation were introduced by the Federal Law of April 2, 2014 N 52-FZ.

The most important innovation concerns the regional property tax. Now individual entrepreneurs will pay it if the tax base for property is its cadastral value. Real estate that is not involved in entrepreneurial activities is taken into account.

The list of cadastral real estate in 2015 is valid in the following regions:

- Moscow and Moscow region;

- Kemerovo region;

- Novosibirsk region;

- Primorsky Krai;

- Republic of Bashkortostan;

- Republic of Tatarstan;

- Samara Region.

The list is constantly updated.

For individual entrepreneurs, there are a number of concessions regarding the calculation and preparation of the declaration:

- the tax is calculated by the tax authorities and send a payment order;

- it is not necessary to submit a declaration;

- advances should not be paid;

- at 15% is taken into account in expenses.

You can be exempt from paying by filing a statement that the property is not used in business. The same must be done if the property was not on the list of the region (each region has its own list, you need to check with the tax office). For example, for Novosibirsk, this is Order No. 2886 dated December 25, 2014. You need to search for property by cadastral number.

Payments and documents

According to the results of the activity, a declaration is submitted. This must be done once a year by April 30th. Failure to pay tax threatens with a fine of up to 40% of its amount. Late fees will be charged. During the year, you can make advance payments, which are deducted in the final declaration.

If an individual entrepreneur has worked for a year at a loss, then he does not pay taxes according to the simplified tax system “Income”, but he submits a declaration. With "Income minus expenses" you need to pay a minimum mandatory tax of 1% of revenue. Learn more about reporting in the video:

Advance payments must be made three times a year: by April 25, by July 25, by October 25. The fourth payment is for the year (until April 30).

To pass or not?

Despite the changes made, the simplified taxation system for individual entrepreneurs in 2015 still remains beneficial for three reasons. Firstly, it comes out cheaper than OSNO. Secondly, it is easier to calculate. Third, less paperwork. Therefore, it is worth switching to it, unless, of course, there are other tax regimes that are more beneficial for the entrepreneur.

Addition: It will help you quickly and correctly keep records on the simplified tax system

Mortgage rate cuts Will mortgage rates go down in

Mortgage rate cuts Will mortgage rates go down in Early loan repayment: what every borrower needs to know

Early loan repayment: what every borrower needs to know How to write a supervisory complaint in an administrative case

How to write a supervisory complaint in an administrative case