Tax when inheriting an apartment by will, without a will and in other cases. Tax on inheritance of an apartment under a will, without a will and in other cases Tax under a will on an apartment

Until scientists have unraveled the mystery of "eternal life", people have faced and will face heavy losses of their relatives and people close to them. Along with this, a natural question arises about the nuances of inheritance by will and without it.

Inheritance tax in Russia in 2016: do I need to pay?

If we talk about the Tax Code of Russia today, then the answer to the question: “Is inheritance taxed” is twofold. On the one hand, the law on inheritance taxation was canceled, but indirect, acting as a duty, is present.

If not a resident of the country enters into the inheritance, but a citizen of the countries participating in the Chisinau Convention (Article 47 of 2002), these include: Kazakhstan, Azerbaijan, Belarus, Armenia, Georgia, etc., he pays according to the laws of Russia.

Direct or indirect: how to calculate?

The duty rates are as follows:

- For heirs of the first stage (children, parents, spouses) - 0.3%;

- Second and third priority (close relatives and other heirs who did not fall into the first group) - 0.6%.

The calculation is based on the total cost, in this case it does not matter what kind of inheritance plan (property (house, land, car, etc.) or another type). Calculation rates are relevant for any type of inheritance.

For example, let's take data from other states.

The following principle applies in Ukraine:

- Heirs of the first stage, disabled people of the 1st group, orphans, etc. are exempted from paying income tax.

- 2-5 queues - are required to pay a tax of 5% of its value.

- All heirs of a non-resident of this country are required to pay 15%.

Part 3 of Federal Law No. 156 "Civil Code of the Russian Federation" dated November 26, 2001 (hereinafter - the Civil Code of the Russian Federation) defines the basic rules and principles of succession. There are two ways to inherit after the death of a relative: by will or by law. In the first case, the hereditary mass is fully or partially distributed according to the will of the deceased. In the second, property is inherited depending on the degree of closeness of kinship with the deceased, since the testator did not make a will during his lifetime.

Is inheritance taxable?

Relatives are often interested in whether it is necessary to pay inheritance tax from close relatives, and what is its amount. In July 2005, Federal Law No. 78 amended the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), according to which this tax was abolished. The edit was fixed by paragraph 18 of Art. 217 of the Tax Code, and from that moment the following types of inherited property were excluded from the tax base:

- for real estate;

- to the ground;

- for transport;

- to bank deposits.

Paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, cases were also defined when tax on inherited property is levied from successors:

- remuneration to authors of scientific, literary works;

- payment for writing works of art;

- patents for inventions and industrial designs (models).

Such an inheritance is classified by law as part of the personal income tax base (personal income tax) and is taxed at the rate in force at the time of entry into the inheritance. In 2019, personal income tax is 13%.

Is there a tax on testamentary inheritance?

The owner of the property can dispose of the acquired values in advance, dividing them among relatives, leaving everything to one person, strangers or organizations. Then the bequeather enters into the rights of inheritance according to the will.

The main requirements for the execution of the document - the presence of certification by a notary; when staying in another state - the consulate of the Russian Federation. In exceptional cases, it can be certified by another person: the head physician of the city hospital, the director of the nursing home, the captain of the ship, the head of the Arctic station, the commander of the military unit, the head of the place of detention, and subsequently certified by a notary at the place of residence of the owner of the valuables.

Property received under a will is not taxed. This is stipulated in Art. 217 of the Tax Code of the Russian Federation. The law states that if the heir received income in cash or property, no tax is paid. The exception is income in the form of permanent payments for copyrights or a patent for an invention that has been inherited.

What is the inheritance tax rate?

Tax on property inherited without a will is not levied, but its component is a mandatory payment - a state duty or fee. Unlike a tax, it is of a one-time nature and is paid not free of charge, but for the performance of a legally significant action. Thus, under the tax when entering into inheritance rights, it is precisely the state duty that is meant.

The amount of tax without a will

The state fee consists of two parts:

- for the performance of notarial acts - paid by the successor when contacting a notary and drawing up primary documents regarding the opening of inheritance proceedings;

- for the issuance of a certificate of succession.

The amount of the state duty is calculated individually and depends on several factors: which line of heirs the relative belongs to, what is the value of the property.

According to Art. 333.24 of the Tax Code of the Russian Federation in 2019, the amount of the notary fee (GP for inheritance proceedings) is:

- certification of a perfect will - 100 rubles;

- opening and announcement of a closed will - 300 rubles;

- measures for the inventory and protection of the hereditary mass (property) - 600 rubles.

Important! According to Art. 333.24 of the Tax Code of the Russian Federation for all notaries a single cost of services is established.

If, in order to perform notarial acts, the notary is forced to travel to the territory of the client, then, according to Article 333.25, the amount of GP payable must be increased by 1.5 times.

For obtaining a certificate of inheritance is reviewed annually.

If the inheritance was received without a will, that is, according to the law, the percentage of SOEs in 2019 is equal to:

- For close relatives (sons or daughters, surviving husband or wife, parents), brothers and sisters (relatives and half-breeds) - 0.3% of the value of the property, a maximum of 100 thousand rubles.

- For other relatives - 0.6% of the value of the property, a maximum of 1 million rubles.

Will tax amount

The amount of the state duty upon receipt of an inheritance under a will does not differ from the amount that is obligatory to be paid upon inheritance under the law. Notary services (fixed amount) and a percentage of the value of property are subject to payment: for heirs of the 1st, 2nd stages - 0.3% of the value of the property, but within 100 thousand rubles, for other stages - 0.6% within 1 million rub.

If there are several successors, then the state duty must be paid by each of them. The details for payment are given by the notary. Payment is made in cash at the bank's cash desk or by bank transfer before notarial acts are performed.

Inheritance tax of close relatives must be paid within 6 months from the date of opening of the inheritance proceedings. In case of violation of the terms of payment for a good reason, it is necessary to apply to the court with an application for restoration and an indication of the reasons for the delay.

Real Estate Inheritance Taxes

If real estate is subject to inheritance, the beneficiary will bear additional costs associated with the registration of real estate. The amount of the fee is specified in Art. 333.33 of the Tax Code of the Russian Federation.

In general cases, the amount charged from individuals for registering the right to real estate is 2 thousand rubles, from legal entities - 22 thousand rubles. However, there are exceptions:

- when registering the right of ownership to an inherited land plot intended for the construction of housing or outbuildings, maintaining a summer cottage, the payment will be 350 rubles;

- when registering the right to a part of agricultural land, the amount of the fee is 100 rubles;

- if the hereditary real estate is part of a mutual investment fund, registration of property rights to it will cost 22 thousand rubles;

- registration of the right to a share of the common part of real estate in an apartment building will amount to 200 rubles;

- if state registration of a mortgage is required, the fee for individuals will be 1,000 rubles, for legal entities - 4,000 rubles;

- if it is necessary to change the content of the agreement on shared construction in connection with the change of the party to the agreement, the amount of payment will be 350 rubles.

Tax on inheritance of a house or apartment

Property tax, obligatory for payment by the heir to an apartment or house, is a local fee (Article 399 of the Tax Code of the Russian Federation). It is levied on the owners of any premises and structures. The common property of an apartment building is not subject to taxation: storerooms, attics, ventilation shafts, adjacent plot or buildings, etc.

Tax rates are set by municipal authorities (Article 406 of the Tax Code of the Russian Federation).

The taxation base is the cadastral value of an apartment minus the cost of 20 m2 of its area, and for a house - minus 50 m2 of its area.

Tax on inheritance of land

If a land plot is inherited, the payment of tax is mandatory.

The payers are not only the owners of the land, but also persons whose land is in constant use, except for tenants and people using the land free of charge.

The land is not taxed:

- seized or restricted in circulation;

- owned by forestry;

- which is the common property fund of an apartment building.

Land tax is paid once a year.

The tax base is determined based on the data recorded in the state cadastre and documents on the right to real estate.

Tax rates vary depending on the nature of the use of the land plot or the category of land (Article 394 of the Tax Code of the Russian Federation).

Tax on the sale of real estate received by inheritance

Often, the beneficiary, when receiving real estate by inheritance, wants to sell it. Income tax is levied only under certain circumstances. It depends on how long the person has been the owner of the property.

From January 1, 2016, the sale of property that has been owned for less than 5 years is subject to tax. An exception is real estate, the ownership of which arose before January 1, 2016, received by inheritance, as a result of privatization, under a life maintenance or donation agreement. For these categories, the exemption from tax on the sale of property is 3 years.

How to correctly determine the term of ownership of property? According to generally accepted rules, property is recognized as property upon registration of the right to possession and terminates from the date of entry in the state register of information on the transfer of ownership to another person.

In the case of inheritance of property, when drawing up the relevant documents, the beginning of the counting period of ownership is the moment of death of the testator.

Example. The owner of the apartment died in 2010. The ownership of the property was registered by the heir in 2016. When the apartment was sold in 2019, the heir was exempt from paying income tax, since 7 years had passed since the death of the owner.

The personal income tax rate for the sale of real estate before the expiration of 3 years is 13% if a person lives in Russia for more than 183 days in the year in which the apartment was sold. Otherwise, the tax rate will be 30%.

When selling real estate or part of it, the testator can count on a property deduction, which has some features:

- the deduction applies to property owned for less than 3 years;

- the amount of the deduction cannot be more than 1 million rubles;

- making a deduction is possible only upon submission to the tax authority of a document - a tax return, which reflects the amount received as a result of the sale of real estate;

- the right to a property deduction is granted one-time;

- if the inheritance belongs to several owners, the amount of the deduction is distributed between them proportionally (in case of shared ownership) or by agreement.

Example. The sisters inherited an apartment, which was divided between them in half. After 2 years, the apartment was sold for 2.5 million rubles. By filing a tax return with the specified amount, they claimed the right to a property deduction. Each of the sisters received an income of 1.25 million rubles, and the property deduction amounted to 500 thousand rubles. The amount of tax levied on each of the sisters amounted to 97,500 rubles. (Calculation: (1,250,000 - 500,000) x 0.13).

The declaration of income must be submitted no later than April 30 after the expired tax period in paper form independently, through a notary with a power of attorney, by registered mail or in electronic form with a digital signature.

The beneficiary transfers the amount of the fee to the budget at the place of residence before July 15 of the year following the year of receipt of income.

If the amount of income after the sale of real estate is less than the amount of the deduction, the tax is 0. The filing of a declaration is required.

Penalty for late submission of documents to the tax authorities - from 1000 rubles.

Tax on inheritance of a car

The death of the owner of the car is the reason for opening the inheritance for the vehicle. In this case, all powers of attorney issued to him earlier become invalid. The heir submits documents to receive this property by law or will and acquires the right of ownership, and after the execution of the relevant documents, he has the opportunity to dispose of it.

When contacting a notary, an assessment of the car is made. The amount to be paid for the issuance of a certificate of inheritance of property is determined. It is calculated as a percentage of the cost: 0.3% for successors 1, 2 and 0.6% for other queues, respectively.

Important! The determination of the market value of the car is made on the date of death of the owner of the car.

When inheriting a vehicle, the heir is obliged to pay transport tax. Its rate depends on the technical parameters of the car.

The fee is paid at the location of the vehicle until October 1 of the year following the end of the tax period. As a rule, the owner receives a notification about the need to pay tax.

When selling a car, as in the case of selling real estate, personal income tax will be 13% of the amount of income. The amount of the deduction is 250 thousand rubles.

Who is exempt from tax?

Not all categories of citizens have to pay the state fee. Article 333.35 of the Tax Code of the Russian Federation distinguishes preferential groups of persons who are exempted from paying the GP in part or in full. At the moment, the right to a benefit is given if there is a certificate confirming belonging to:

- disabled people of the first and second groups (50% exemption from the state duty rate on the date of payment);

- participants in hostilities;

- Heroes of the USSR or Heroes of the Russian Federation;

- holders of the Order of Glory.

Also, according to Art. 333.38 of the Tax Code of the Russian Federation, individuals are exempt from tax when issuing a certificate of inheritance:

- Real estate (does not pay a relative who lived with the deceased in the same apartment or house before and after his death).

- Property of victims of political repressions and persons who died in the performance of civic duty or official duties.

- The amount of compensation under insurance contracts, pensions, salaries.

- Underage;

- Declared incompetent.

Inheritance is not a cheap procedure. Especially if, in addition to assets, relatives also accept posthumous debts. Practicing lawyers of the site site know the “weak points” in the law, which will allow:

- save money on an independent property appraisal;

- reduce the amount of state duty for obtaining a notarial certificate;

- resolve any disputes between relatives.

To receive a free consultation, you need to fill out an electronic form.

Useful information on the topic

Sooner or later, every Russian citizen or citizen faces the procedure of inheritance of property and will. When entering into the right of inheritance, a person may have many questions, the main of which is the tax on the share received from the deceased person.

Inheritance tax by law in Russia in 2018

The tax code states that property that is received by will is not subject to any fee, only state duty is paid to the state.

How much should I pay from the sale of an apartment?

There is a misconception that an apartment that has been inherited can be sold very easily and quickly. Actually this is a delusion. The procedure for the sale of such property (or its share) has some features:

- you need to make a full entry into your share (you can join after a period of 6 months regulated by law);

- upon receipt of the necessary documents (certificate of the right of inheritance), the right of ownership is formalized;

- when selling an apartment received as a gift, a house, a summer residence or a land plot, you must pay a fee at a rate of 13% of the transaction value.

But if someone wants to sell the apartment after three years from the date of inheritance, then you will not have to pay the money. Only property sold within the first three years after entering into the legal share of the will is taxed.

In Ukraine, this rate is from 5 to 15% even for residents of other countries (non-residents) living in Belarus, Kazakhstan, France, Azerbaijan, Germany. In the US, tax rates are different in each state; in the UK, 40% is charged only on real estate or the amount exceeds 325,000 currency denominations (national banknotes of the country).

What tax is paid: direct or indirect?

Inheritance is subject to an indirect type of tax in the form of a state duty for a will. You also have to pay a notary fee for the services provided by a notary or consultant when re-registering property or valuables.

Inheritance tax by will in Russia in 2018

When real estate and movable property and other valuables are inherited, there is no need to pay a contribution for a person’s share received by will in 2018. They did not cancel the rules and explanations regarding inheritance tax, so they remained the same.

- WWII veterans;

- holders of the Order of Glory;

- heroes of the Russian Federation and the Soviet Union.

If the apartment was inherited by will

If the apartment was received by will, then the heir does not have to pay the inheritance tax, but if you want to sell the property, you will have to pay a rate of 13% (personal income tax). It is very easy to calculate the value of the amount that should be transferred to the state in accordance with the provisions of the Tax Code. This rate can be avoided by waiting three years. Then you don't have to pay taxes.

Exemption from payment: is it real?

Only privileged categories of citizens can exempt themselves from paying taxes. All others must pay an indirect tax - state duty. Payment and its amount may be different and depends on the degree of relationship between the heir and the person who left the will:

- an interest rate of 0.3% of the market value of the inheritance applies to parents, children, blood siblings, and is also taken from spouses (who were legally married). This queue also includes grandchildren and other first-line relatives;

- a rate of 0.6% applies to heirs who were not blood relatives of the heir, cousins and brothers, and other non-close relatives. It is taken from people belonging to the second stage.

Inheritance tax of close relatives in 2018

The right to a share of close relatives quite often gives rise to tax liabilities of individuals, which depend on the norms of the current legislation.

Will there be tax on the death of the owner?

If you received a posthumous payment for a relative, then a direct personal income tax contribution is paid for it, the rate of which is 13 percent. Therefore, the calculation of the contribution is very simple.

In Russia, since January 2006, the testamentary inheritance tax has been abolished.

A similar situation occurred with taxes on other types of inheritance procedures, which are now exempt from paying taxes.

Inheritance tax by will, by law and when inheriting an apartment

Who is exempt from inheritance tax?

After the Federal Law of July 1, 2005 No. 78-FZ was adopted, which made significant changes to the Tax Code of the Russian Federation, testamentary and statutory inheritance tax, and the apartment inheritance tax is not levied on heirs, as was the case in previous years.

If we turn to paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, then specific rules are prescribed there, stating that it is not necessary to pay tax for income received from inherited property. At the legislative level, at the same time, heirs of the degree of kinship or a certain queue are not allocated, making their rights equal.

Who needs to pay tax on inheritance

The legislation contains a small reservation - an exception was made for successors or heirs who receive the following types of income:

- Payment for the author of scientific work;

- The amount of money received by the author of the art object;

- An award that has been awarded to the creator of an industrial design or inventor;

- An award received by the author of a literary work.

The specified parts of the inheritance in accordance with the norms of the current legislation will be taxed. Heirs who are entitled to the income of the testator are required to pay personal income tax in the amount of 13% of the value of the inheritance in order to accept the inheritance if the income is received as a result of:

- Scientific works;

- inventions;

- Creation of works;

- Discoveries.

In addition to the circumstances specified above, the exception applies to inheritance legal relations that arose before 2006. So, an inheritance that was opened before January 1, 2006, if its price is more than 850,000 rubles, should be accepted only when the corresponding tax has been paid.

Sale of inherited property

If the heir plans to sell the property received as an inheritance, then he needs to pay 13% personal income tax - this is prescribed in the Federal Law of July 23, 2013 No. 212-FZ.

This condition works only in relation to property, the alienation of which is carried out within 3 years from the date of the death of the testator. Also, the heir who decides to sell the property, within 3 years from the moment the testator died, is entitled to a tax deduction.

How much does a certificate of inheritance cost

A citizen who has received an inheritance must pay a certain amount to pay the state fee for a certificate of inheritance. This document is issued to the heir after the title documents are verified.

What is the amount of the state fee

If we turn to paragraph 22 of Art. 333.24 of the Tax Code of the Russian Federation, it states that the amount of the fee will directly intersect with the degree of kinship.

So, pp. 1 p. 22 Art. 333.24 of the Tax Code prescribes that 0.3% of the property must be paid for obtaining a document, but no more than 100,000 rubles will have to:

- Spouse;

- To the natural children of the testator;

- Parents;

- Children of the testator who were adopted;

- Sisters and brothers.

If you refer to pp. 2 p. 22 Art. 333.24 of the Tax Code of the Russian Federation, it says that all other persons who were not named above will need to pay an amount of 0.6% of the price of the inheritance, but not more than 1,000,000 rubles.

Who is exempt from paying the state fee

In accordance with paragraph 11, 12 of Art. 333.35 of the Tax Code of the Russian Federation, citizens recognized as:

- Full Cavaliers of the Order of Glory;

- Heroes of the Russian Federation;

- Heroes of the Soviet Union;

- WWII participants.

If a citizen inherited a land plot on which a residential building, room, apartment or shares in the listed property is located, then the heir will not have to pay the state duty for the certificate if he lived in the room, house, apartment together with the testator and continues to live there after his death.

How to value estate property

To calculate the amount required to pay the state duty, the heir will need to know how much his share is worth. In order to establish the exact price of the property, the heir will need the services of an independent expert who will determine the market, inventory, cadastral or other value of the inheritance and draw up an appropriate conclusion. Also, this function can be performed by another person authorized to perform such actions.

To establish the value of real estate, with the exception of land plots, BTI specialists are entitled to issue certificates to citizens about the market value of houses and apartments.

If you refer to pp. 8.9 p.1 art. 333.25 of the Tax Code of the Russian Federation, it states that the value of real estate (there is an exception here - these are land plots) can be set by:

- Organizations that carry out accounting of real estate objects at their location;

- Legal entities, appraisers, who have the right to conclude contracts for appraisal.

If it is necessary to evaluate a land plot, then a citizen has the right to apply:

- To state bodies that carry out cadastral registration;

- To legal entities entitled to conclude valuation contracts;

- Appraisers.

In order to evaluate other valuable objects of property that were inherited, the heir should contact independent appraisers (for example, a car), judicial expert institutions of the justice authority or legal entities that are entitled to carry out the assessment. This moment is stipulated in paragraphs. 7, 10 p.1 art. 333.25 of the Tax Code of the Russian Federation.

Appraisal activities can be carried out by individuals and legal entities that are members of self-regulatory organizations of appraisers who have insured their liability.

Inheritance property tax

In accordance with the Law of the Russian Federation dated 09.12.1991 No. 2003-1, objects of property that were received after the completion of the inheritance procedure will be subject to taxation. Owners of property will directly act as payers of property tax.

Real estate objects for which it is necessary to pay tax

The objects of taxation are the following real estate objects owned by the heir:

- Apartments;

- Residential buildings;

- Rooms;

- Country buildings;

- Shares in the ownership of real estate objects;

- Garages;

- Other buildings, premises, structures that belong to the heir.

Who is exempt from inheritance tax

If we turn to paragraph 1 of article 4 of Law No. 2003-1 FZ, then it is written there that citizens belonging to the following categories will be exempted from paying taxes:

- Heroes of the Russian Federation;

- Military personnel;

- Heroes of the Soviet Union;

- Persons who have been recognized as disabled since childhood;

- Persons with an award - the Order of Glory of three degrees;

- Participants in the Second World War, civil war or other military operations;

- Persons with a disability of the 1st or 2nd group;

- Former military personnel who were discharged after reaching a certain age.

At the legislative level, the right not to pay tax on buildings, structures, premises is enshrined in paragraph 2 of article 4 of Law No. 2003-1 FZ for the following persons:

- Citizens who were dismissed from military service or called up for military training, who performed international duty in Afghanistan and other countries in whose territory hostilities were carried out;

- pensioners;

- Spouses and parents of civil servants, military personnel who lost their lives during their service;

- Citizens who received land with plots in horticultural and dacha non-profit associations of citizens of a residential building with a living area of up to 50 sq.m. and structures, buildings of economic type, the total area of which does not exceed 50 sq.m.;

- Citizens who received land plots with premises owned by folk craftsmen, artists and cultural figures.

What is the amount of inheritance tax paid

The tax rate is determined in accordance with the legislative acts in force in the regions. The rate depends on the total value of all objects from which the tax must be paid, their type, location, as well as the deflator coefficient. Tax payments will accrue every year from the moment the inheritance was accepted.

In paragraph 5 of Art. 5 of the Law of the Russian Federation of December 9, 1991 No. 2003-1 states that inheritance tax, must be paid from the moment when the testator said goodbye to life. But at the same time, the norms of paragraphs. 3 paragraph 3 of Art. 44 of the Tax Code of the Russian Federation indicate that if the tax is for this property, then the heir must repay them within the value of the property accepted as an inheritance.

If the payer has the right to benefits, then the tax authorities can recalculate on the basis of an application and the package of documents required in this case. And if the amounts paid in excess of the required value are revealed, they can be credited to citizens against future payments or returned to them.

November 1 of the year following the year in which the property tax was charged is recognized as the last day for payment of property tax.

Inherited vehicle tax

When a car acts as an inheritance, the heir will need to pay transport tax for the received car after its registration - this is a direct obligation spelled out at the legislative level. In addition, if the recipient of the inheritance had a transport tax debt, then, accepting the vehicle as an inheritance, he is obliged to pay it off within the limits of the value of the inheritance property. This point is stipulated in paragraph 3 of paragraph 3 of Art. 44 of the Tax Code of the Russian Federation. The tax will be levied on all citizens in respect of whom the registration of vehicles has been carried out.

The calculation of the tax will be carried out by the authorities that are authorized for these actions in accordance with the information provided by the citizen to the registration authority that put the car on state registration.

Here is a list of the property of the heir, which is included in the objects of taxation:

- Airplanes and helicopters;

- Cars;

- Snowmobiles and snowmobiles;

- Motor scooters and motorcycles;

- Motor boats and jet skis;

- Sailboats, yachts, boats, ships;

- Buses and other self-propelled machines and mechanisms on tracks and pneumatics;

- Other air and water types of vehicles.

The list of objects of taxation does not include:

- Vessels for fishing purposes;

- Agricultural machinery;

- Passenger cars, the power of which does not exceed 100 hp, which are intended for disabled citizens and other persons receiving social assistance;

- Boats with a power not exceeding 5 hp

The amount of tax on a motor vehicle depends on the category of the vehicle, its power, the region in which its owner lives. Transport tax in accordance with Part 1 of Art. 363 of the Tax Code of the Russian Federation, is paid no earlier than November 1 of the year following the past tax period.

Tax on land plots received by inheritance

The federal law of November 29, 2004 introduced the land tax. In accordance with it, the heirs who have received the right of ownership of the land allotment must pay land tax every year. The moment of death of the testator will be considered the beginning of the accrual of payments. The amount of tax is directly related to the cadastral value of the land owned by the heir. The cost will be determined based on the results of the state valuation of the land.

Who was exempted from paying tax on inherited land

Persons who belong to the following categories are exempted from the obligation to make payments under the land tax:

- Peoples who use land areas for crafts, farming, for the development and preservation of the traditional way of life;

- Small peoples of Siberia, the North and the Far East.

The tax rate on land for buildings, agricultural plots, vegetable gardens, orchards is 0.3% of the value of the land plot. Other land areas will be taxed at a rate of 1.5%.

In this article, we will consider the features of taxation when inheriting an apartment by individuals / legal entities.

Features of inheritance of an apartment and applicable taxation

Inheritance implies the transfer of property (apartment), rights and related obligations from the testator (individual or legal entity) to the successor (individual). The object of inheritance is property - living space. The right of ownership to it passes to the successor from the deceased owner in accordance with the Civil Code of the Russian Federation. Inheritance of housing, that is, the transfer of property rights, is possible in two ways:

- in law;

- on the basis of a will.

Inheritance taxation in Russia is regulated by the Tax Code. Until 2005, when inheriting privatized housing, the heirs in both cases were required to pay property tax under the Russian Tax Code. From 01/01/2016, individuals who, by inheritance, become owners of an apartment, do not pay taxes when registering ownership rights ( Tax Code of the Russian Federation, Art. 217, item 18). The current changes in taxation were introduced in accordance with Federal Law No. 78 from 1.07.2005. Such exemption from tax payments applies to all successors, regardless of their citizenship, degree of kinship, order and mode of inheritance.

At the same time, situations often arise when an apartment (like other property) cannot be inherited. Similar circumstances arise:

- if there are no heirs;

- when the inheritance is not accepted;

- due to the loss of the right of inheritance by the heirs.

Then the real estate becomes the property of the city (municipality) where it is located. Accordingly, the issue of paying property tax disappears by itself.

State duty for a certificate upon inheritance of property (apartment)

When notarial acts are performed by law or by will, for the preparation of documents and certification, successors are required to pay the so-called indirect tax - state duty. Payment is made before receiving a certificate of inheritance of the apartment. Its value depends more on the degree of relationship between the testator and the successor.

According to Russian tax legislation, a category of heirs is established, to which benefits are applied in terms of paying such a state duty. They include:

- participants (veterans) and disabled veterans of the Second World War (including home front workers), as well as military operations in Afghanistan, Chechnya;

- Heroes of Russia, Soviet Union;

- minors (at the time of opening the inheritance);

- heirs with mental disorders;

- persons who are not citizens of Russia, but who have recognized refugee status;

- orphans and children equivalent to them, having parents who are deprived of parental rights;

- families with many children (when there are more than three children in the family, including adopted children).

These citizens do not pay state duty when inheriting housing. Individuals who at the time of the testator's death lived in the inherited apartment and continue to live there are exempted from paying the state duty for a certificate. Disabled people of the first and second groups are also entitled to a 50% discount for all types of notarial acts.

The listed preferential category of heirs and the applied amounts of state duty are established by the edition of the Tax Code of the Russian Federation of 2016, namely: Art. 333.24 regarding the amount of state duty and art. 333.38 - in relation to benefits in the performance of notarial acts.

What else do you need to pay successors when inheriting property?

In addition to the state duty for the title certificate, the successors, when registering the inheritance, bear the costs associated with paying for the services of a notary at fixed rates. Notary fees include payment for the following actions:

- filing an application for opening an inheritance;

- certification of the will or its cancellation;

- implementation of requests, if necessary;

- determination of inheritance shares within the limits of registration of the rights of heirs;

- obtaining a cadastral passport;

- during state registration of property rights of successors to housing;

- for an extract from the register of notarial acts and USRR.

The heirs do not incur any more cash costs when registering hereditary rights to housing.

Tax on the sale of an inherited apartment

Despite the fact that housing received by will is not taxed, subsequently, when it is sold, the new owner in certain cases is required to pay a fee. Tax liabilities arise when the apartment is sold by the heir for the first 5 years after its inheritance (valid for individuals registered in 2016 real estate). If the apartment was owned for up to 3 years, then the tax is paid on the condition that it was accepted as a gift, received through rent, by inheritance and was registered before 2016. The seller of an apartment can use the right to deduct up to 1 million rubles once a year if the housing was owned by him for up to 3 years.

Fees are levied on a general basis for personal income tax, using the established form 3-NDFL. The tax is calculated based on the rate of 13% of the transaction value for Russian citizens and 30% for non-residents. In case of late payment by the tax authorities, a penalty is charged, and in case of non-payment, the regulatory authorities resort to bailiffs for help.

Taxation of gifts and rents to relatives and strangers

Gifts and rental agreements with lifelong (unlimited) maintenance are frequently used methods of transferring apartment housing or its share, which are also indirectly related to inheritance. When donating, an agreement is concluded under which an apartment (house, room) is donated to a relative free of charge. After the death of a citizen, the donation agreement drawn up by him is void. According to article 217 of the Tax Code of the Russian Federation, taxes are not levied on gifts to close relatives. In relation to other relatives, taxation is applied.

In the case of a paid transfer of an apartment (house, share) on the basis of a rent agreement, the actions performed are equated to a purchase and sale. According to the concluded agreement, the housing is transferred into the ownership of the rent payer, who is obliged to pay the rent (an agreed amount of money) to its recipient or money for maintenance. Rent and property acquired on rent may be inherited and bequeathed. If the transferred ownership of a part of the housing is registered to the rent payer, he can inherit the apartment. Tax is not levied on the payer of rent, since the housing received by him is not income. Only a one-time payment is provided under certain conditions. But the recipient of the rent is obliged to report on the income received in the form of rent to the tax authorities.

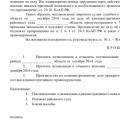

| Method of transfer of the apartment | Taxes collected | Explanations |

| Donation | Personal income tax (PIT) is calculated according to the formula: apartment price (under contract or market) * tax rate; tax rates for calculation: 13% - for citizens of Russia, 30% - for non-residents of the Russian Federation; if the donor is a legal entity, then the tax is calculated and paid by him, and not by an individual independently | The taxable market value may be at least 20% of the price, and the cadastral value - at least 70%; a declaration (form 3-NDFL) is submitted to the tax authorities by April 30, following the year of receipt of housing; |

| Annuity agreement | Calculation of a lump sum payment for personal income tax (if the apartment was owned for less than 3 years) is made taking into account the rate of 13% of the income received; Personal income tax for the recipient of the rent from the monthly income at the end of the year is calculated according to the formula: monthly income under the rent agreement * 12 * 13% | The declaration is submitted before April 30, following the year when the rent agreement was in force with the subsequent payment of personal income tax in the same year until July 15 |

Example #1. Tax calculation when donating an apartment to a non-relative

A citizen of Russia (individual) has drawn up a donation agreement for an apartment worth 9 million rubles. to another individual (also a citizen of Russia) who is not related to him. Since the citizen who accepted the apartment as a gift is not a blood relative of the donor, then, having entered into ownership, he pays a tax. The tax is calculated taking into account the rate of 13%, since the recipient of the apartment is a citizen of Russia. The calculation is carried out according to the formula: the cost of the apartment * the tax rate. It turns out: 9000000 * 13% = 1170000. This is the amount of tax that must be paid.

Example #2. Taxation when selling an apartment that has been owned for more than 3 years.

In 2005, N. V. Petrov purchased an apartment. In 2014 he sold it. Since the purchased apartment was his property for more than 3 years, he is not required by law to pay taxes when selling it. Accordingly, he also does not have to file a declaration for the same reason.

Answers to current questions about inheritance tax

Question #1: Is there any material tax liability for heirs who receive an apartment by inheritance?

No, as such, there are no tax liabilities for payments related to obtaining an apartment due to inheritance from successors. Those who accept the inheritance pay only the state duty for the certificate and pay for the services of a notary. Upon entry into the inheritance, each of the successors, in accordance with Article 1175 of the Civil Code of the Russian Federation, is liable for the debts of the testator. Already being the owner, the new successor takes measures to preserve the received property (apartment), pays the necessary expenses for its maintenance, pays off debts.

Question #2: How can you avoid liability if there is a debt from the testator, and not pay debts?

This option is possible only if the entire inheritance is abandoned. The announced successor (either the trustee or the guardian) must refuse it, declaring it in writing. It should be understood that the rejection of the inheritance, as well as its acceptance, are irreversible actions.

Question #3: Does a gift agreement mean entry into an inheritance and is it necessary to pay (or not pay) any taxes for this reason?

Gift (gift agreement) - does not mean inheritance by will. Housing is transferred into ownership from the moment the deed of gift is written or from the time indicated in it, and according to the will - after the death of the testator. Accordingly, taxes must be paid those that are provided for when donating. According to the legislation in force in Russia, a will can be challenged, but a donation agreement cannot.

Question #4: From what time is the countdown of the ownership of an apartment to determine the application of taxation when selling it?

For the most part, the date indicated on the certificate of ownership is considered to be the starting date. According to the Civil Code of the Russian Federation, Art. 1114 and 1152, an apartment accepted by inheritance is considered to belong to the successor from the moment the inheritance is opened, regardless of the time of registration of ownership. The time of opening the inheritance is the day of the death of the testator.

Question #5: What measures are applied to non-payers of the established tax upon donation?

Violators are fined at a rate of 20% of personal income tax. In case of late payments, a penalty is charged for each day of delay.

Mortgage rate cuts Will mortgage rates go down in

Mortgage rate cuts Will mortgage rates go down in Early loan repayment: what every borrower needs to know

Early loan repayment: what every borrower needs to know How to write a supervisory complaint in an administrative case

How to write a supervisory complaint in an administrative case